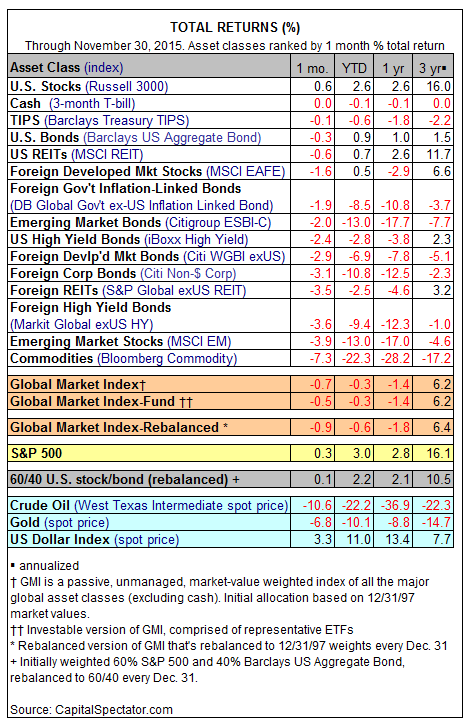

Red ink swept across the major asset classes in November, with one exception: US equities. The Russell 3000 Index edged up 0.6% last month. Otherwise, losses prevailed, delivering a negative counterpoint to October’s generally bullish profile.

As for November, commodities were the big loser… again. The broadly defined Bloomberg Commodity Index fell 7.3% last month—the fifth consecutive monthly loss and the biggest dip since July.

Red ink now dominates the performance profile for most asset classes over longer-term horizons. The bearish aura continued to weigh on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI slipped 0.7% in November. Year to date GMI is fractionally lower, dipping 0.3% so far in 2015.

For the trailing three-year period, however, GMI still posts a respectable 6.2% annualized total return, which is nearly twice the rate for the benchmark’s long-term forecast, based on last month’s risk premia outlook.