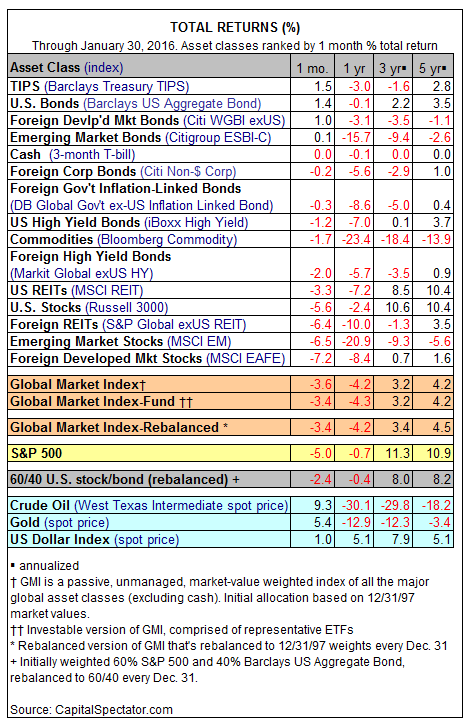

The risk-off trade continued to weigh on the major asset classes in January. The main exception: several slices of high-quality bonds popped last month, led by the 1.5% total return for inflation-indexed US Treasuries. But the bulk of performance data was skewed to the downside in the kick-off month for 2016.

January’s big loser: foreign developed-market stocks (MSCI EAFE), which slumped a hefty 7.2%. US stocks did better, but only in relative terms. The Russell 3000 tumbled 5.6% last month and is now off by more than 2% for the trailing one-year period through the end of January.

Diversification across asset classes is providing a degree of relief relative to an equities-only strategy, but the benefit currently comes in the form of lesser losses these days. The Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, fell 3.6% in January and is lower by 4.2% for the past 12 months.

Over a longer stretch, GMI is still posting positive performance, but the gain has been trimmed to a relatively modest 4.2% for the annualized total return over the past five years through January.

Managing expectations down for GMI—and multi-asset class strategies generally—has been a theme at The Capital Spectator in recent history. Last month’s risk-premia review is merely the latest installment in quantifying the slide in return projections for broadly defined portfolios. It’s all obvious now, but there was plenty of skepticism a year ago, when trailing return numbers still looked impressive.

For instance, in early April 2015 The Capital Spectator published a relatively diminished projection for GMI’s risk premia—just below 4% in annualized terms. The estimate was quite stark at the time when you consider that the actual trailing return for GMI was nearly 8% annualized over the previous three-year period. But the clues continued to mount in the monthly risk premia estimates for anticipating a reversal in the relatively rich performance history for broad diversification. Recent history now corroborates what looked so improbable a year ago by way of the rear-view mirror.

The dominance of weak and negative returns will run its course at some point, but not yet. Momentum of the bearish persuasion still has a head of steam, as several quantitative metrics suggest. The good news: expected return and risk will continue to fluctuate. The critical lesson, of course, is that’s it’s essential to remain vigilant in the art/science of modeling the trend for signs of regime shift. It’s unclear at this stage when that turning point will arrive, but when it does emerge it’s likely to come like a thief in the night.