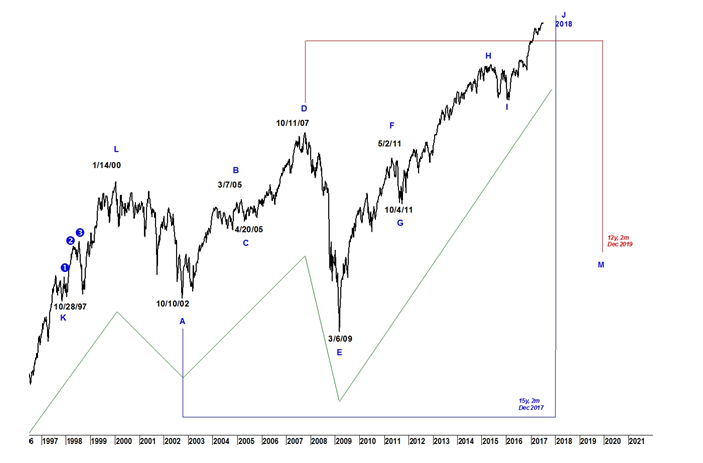

Long-time readers know of Lindsay’s long cycle (points A through M) and that equities should now be in the final basic advance between point I and the secularbull market top at point J.

A basic advance is the equivalent of a cyclical bull market. A basic decline is usually the equivalent of a cyclical bear market but may not always reach the arbitrary 20% sell-off used by the media to define such a decline.

With point A on 10/10/02, point J is expected sometime between October 2017 (15yrs) and September 2018 (15yrs, 11mo). But that is not what this report is about. This report is about our concerns of a possibly serious market correction (in an ongoing bull market) occurring this summer.

Not all long term intervals (15yr and 12yr) are counted from the points (A-M) of the long cycle. Lindsay wrote that counting from any significant low can help to target a market high 15 years later.

The sell-off which terminated on 9/21/01 was sharp enough that we should be able to count to a market high using Lindsay’s 15yr interval. The 2001 low points to a high during the period September 2016 to August 2017. That forecast is bolstered by a 12yr interval counted from 3/7/05 (point B) pointing to a low during the period May-November 2017. We can’t expect a low without a previous high.

The problem with trying to find these inflection points that are not one of the labelled points on the long cycle is that we don’t have the basic advances/declines and their standard time spans to help us. What we do know is that the 15yr interval is running out of time.

We have other reasons for expecting a significant correction in the immediate future. Lindsay warned to expect a “fast selloff followed by 5mo minimum rebound 8 years after an epochal low”. One need not look too hard to determine that the March 2009 low was, indeed, epochal. If Lindsay was correct, July 2017 means that the market is now on borrowed time.

In addition, seasonals argue for a sell-off into September/October.