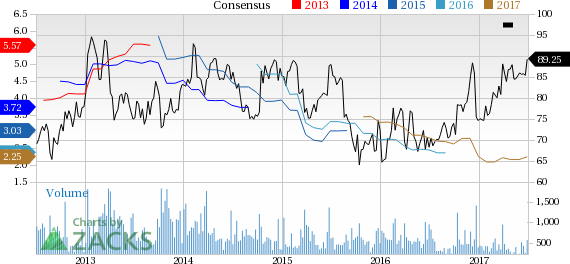

Shares of Lindsay Corporation (NYSE:LNN) scaled a new 52-week high of $92.74 during trading session on Jun 30, following its third-quarter fiscal 2017 results ended May 31, 2017. The company eventually closed the trading session a little lower at $89.25.

This Omaha, NE-based leading designer and manufacturer of self-propelled center pivot and lateral move irrigation systems, has a market cap of roughly $975 million. The average volume of shares traded in the last three months is around 71.57K.

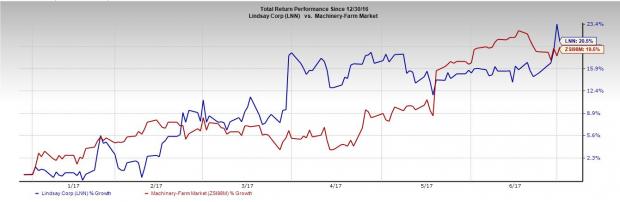

Year to date, Lindsay’s stock has outperformed the Zacks categorized Machinery-Farm industry. While the stock has gained 20.5%, the Zacks sub-industry recorded 19.5% growth.

Positive earnings estimate revisions for 2017 and 2018 as well as earnings growth expectation of 13.50% for the next five years indicate the stock’s potential for further price appreciation.

Growth Drivers

Lindsay reported third-quarter fiscal 2017 (ended May 31, 2017) earnings of $1.02 per share compared with 90 cents per share recorded in the prior-year quarter. Earnings surpassed the Zacks Consensus Estimate of 92 cents, generating a positive earnings surprise of around 10.9%. The company delivered an average positive earnings surprise of 3.29% in the trailing four quarters.

The company’s backlog as of May 31, 2017, was $70.1 million compared with $61.2 million as of May 31, 2016.

Further, it expects that stabilization in the U.S. irrigation equipment market, a consistent recovery in Brazil and increased project activity in developing international markets will drive growth. The company also stated that its irrigation operating margin performance in the U.S. will likely benefit from the strength and growth of technology products. Further, growers’ sentiment in the U.S. has been displaying signs of improvement.

Moreover, Lindsay is poised to gain from improving activity levels in the international irrigation and infrastructure markets. Additionally, population growth, increased food production, efficient water use and infrastructure upgrades are likely to propel long-term growth.

Lindsay Corporation Price and Consensus

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Lindsay Corporation (LNN): Free Stock Analysis Report

Alamo Group, Inc. (ALG): Free Stock Analysis Report

Original post

Zacks Investment Research