Forex News and Events

USD/JPY and JPY crosses trade sluggish as Japanese insurers display little enthusiasm in foreign assets in their allocation plans for the second half of the fiscal 2014. Trend and momentum indicators suggest stronger JPY, especially given the low US yields before Wednesday’s CPI reading in US. In the UK, the focus is on the BoE minutes (Wed). We see limited upside potential in GBP-complex given the dovish shift in BoE expectations.

Japanese insurers have limited enthusiasm in foreign assets

USD/JPY legged down to 106.25 in Tokyo, alongside with the slide in Nikkei stocks (-2.03%). The pair broke the Ichimoku tenkan line (106.78) on the downside and is heading towards its ascending Ichimoku cloud cover (104.23/105.39). Given the strong short-term bearish technicals, we see room for deeper downside correction. The rapid JPY depreciation keep the politicians alerted, given the potential negative impacts on small business and household consumption, but the individual investors’ JPY-shorts increased to 817’817 contracts, largest since September 2011. The long-term bias is clearly skewed upwards. However, we do not see the same enthusiasm on the institutional level.

Japanese insurers announced their investment plans for 2H of fiscal 2014. Nippon Life Insurance said to be looking to increase allocation in Japanese and hedged foreign bonds, while the unhedged foreign bonds remain an open-end question. All depends on JPY returns. If Japanese rates stay at the current “extremely low” levels, a shift to foreign bonds will be envisaged according to Nippon Life’s public communication. On the other hand, Sumitomo Life Insurance (Japan’s 4th largest life insurer) plans to keep its Japanese, foreign stock holdings unchanged and sees limited expansion in its foreign bond holdings. Little institutional enthusiasm keeps the interest in fresh JPY-short positions limited. Meiji Yasuda publication is due tomorrow.

GBP gains remain timid pre-BoE minutes

GBP/USD advances to 1.6184 in London today. The upside potential should remain limited before the release of the BoE minutes on Wednesday. Option barriers are touted at 1.6175/1.6200+ for today expiry. Given the recent developments, traders should stand ready for any dovish shift in the BoE view. The fading forward rate agreements on 3m/6m contracts reveal rising bets for a delay in the first BoE rate hike. The MPC SONIA suggests a delay as far as August-September 2015. The minutes will confirm whether the anxieties are funded or not.

The MPC members are expected to have voted 7-2 for keeping the BoE bank rate unchanged at the historical low of 0.50%. Some participants certainly defended the view that the rate hike should start earlier (former expectations favored February 2015) and should rise gradually. Among BoE hawks, Martin Weale, who voted for rate increase in August and September MPC meetings as he finds it appropriate to “anticipate the wage growth”. “The margin of spare capacity is shrinking rapidly” argues Weale “and all logic suggests that that ought to lead to an increase in inflationary pressures”. Others members most likely kept the cautious tone given the slack in the labor market, weak growth in wages and soft inflation dynamics. The dove-hawk balance will be at GBP-traders radar.

Swissquote Sqore Trade Ideas:

Today's Key Issues (time in GMT)

- 2014-10-21T14:00:00 USD Sep Existing Home Sales m/m, exp. 1.0%, last -1.8%

- 2014-10-21T14:00:00 USD Sep Existing Home Sales, exp. 5.10M, last 5.05M

The Risk Today

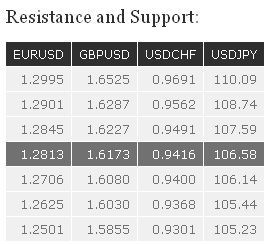

EURUSD EUR/USD continues to be well supported, as can be seen by the succession of higher lows since the one at 1.2501. An hourly resistance can be found at 1.2845 (16/10/2014 high), while another resistance stands at 1.2901. Hourly supports lie at 1.2706 (16/10/2014 low, see also the rising channel) and 1.2625 (15/10/2014 low). In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) has opened the way for a decline towards the strong support at 1.2043 (24/07/2012 low). As a result, the recent strength in EUR/USD is seen as a countertrend move. A key resistance stands at 1.2995 (16/09/2014 high).

GBPUSD GBP/USD has broken the hourly resistance at 1.6127 (13/10/2014 high), signalling an increasing buying interest. Monitor the test of the resistance at 1.6227. Hourly supports lie at 1.6080 (20/10/2014 low) and 1.6030 (17/10/2014 low). Another resistance stands at 1.6287. In the longer term, the collapse in prices after having reached 4-year highs has created a strong resistance at 1.7192, which is unlikely to be broken in the coming months. Despite the recent short-term bearish momentum, we favour a temporary rebound near the support at 1.5855 (12/11/2013 low). A key resistance lies at 1.6525.

USDJPY USD/JPY has weakened near the resistance at 107.59 (see also the 50% retracement), suggesting further consolidation. An hourly support can be found at 106.14 (17/10/2014 low), while a key support stands at 105.23. A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. Despite the recent decline near the major resistance at 110.66 (15/08/2008 high), a gradual move higher is eventually favoured. Another resistance can be found at 114.66 (27/12/2007 high). A key support lies at 105.44 (02/01/2014 high).

USDCHF USD/CHF has failed to break the resistance at 0.9491 (see also the declining channel). The support area between 0.9400 (16/10/2014 low) and 0.9368 is challenged. Another support stands at 0.9301. From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. As a result, the recent weakness is seen as a countertrend move. A key support can be found at 0.9301 (16/09/2014 low). A resistance now lies at 0.9691 (06/10/2014 high).