After a year of ups and downs, lead prices are finally finding their way up.

Three-month London Metal Exchange lead hit a one-year high last week as prices tested $1,900 per metric ton level.

Neutral Fundamentals

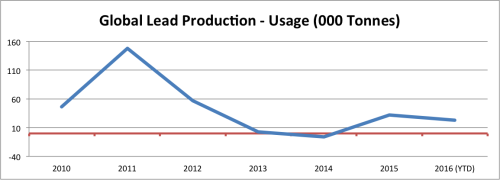

The latest data reported by the International Lead and Zinc Supply Group (ILZSG) indicate the world refined lead metal supply exceeded demand by 23,000 metric tons during the first four months of 2016. Reductions in Australia, China, India and the U.S. led the fall in global lead mine production of 5% compared with the first four months of 2015.

World refined lead metal output decreased by 1.8%, excluding Chinese usage of refined lead metal which rose by 4.2%, mainly because of an 8.8% increase in European demand. Chinese apparent usage, however, fell by 12.1%, and overall global demand decreased by 2.5%. Chinese imports of lead contained in lead concentrates declined by 18.9% compared with the same period in 2015.

These numbers are pretty neutral. The market has not been convinced by the not-so-bullish lead story, but that has now changed. Why?

Broad Metals Complex Continue To Rally

PowerShares DB Base Metals (NYSE:DBB)

Lead prices are being driven by funds’ increasing appetite for industrial metals. This means that even though lead fundamentals don’t look overly bullish, the wind is now blowing at lead’s back. Funds are either seeing a tightening in the fundamentals that we can’t see yet or they are simply buying metals as sentiment in the industrial metals complex has improved. It looks more like the latter.

The latest Chinese economic data also provides some room for optimism, which is also reflected in the bullish performance of China’s stock market. Not only lead, but many industrial metals are climbing into new ground. The bullish move is in the broad metal complex. Despite neutral fundamentals, lead prices could keep rising if this broad move continues.