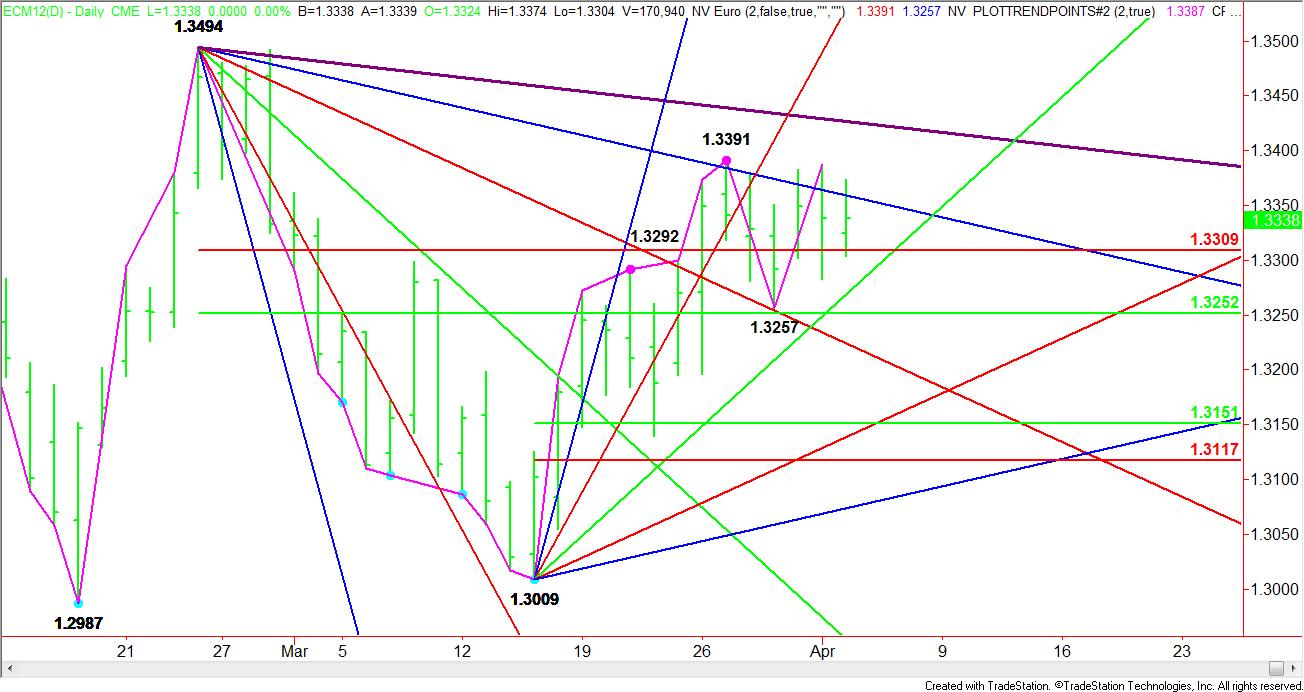

The technical picture of the June euro futures contract is suggesting impending volatility. The tight range being woven between 1.3391 and 1.3257 may be a sign of indecision, but once traders choose a direction, it is likely to move in a big way.

It all may come down to Wednesday’s European Central Bank meeting and the post-meeting commentary by ECB President Draghi. However, even before the meeting, a hard drop in the U.S. dollar may be the catalyst the euro needs to accelerate to the upside. This could be caused by dovish commentary in today’s Fed Minutes.

Currently, the June euro is trading on the bullish side of a key retracement zone so there is a slight bias to the upside. In addition, the main trend on the daily chart is up. According to the daily swing chart, the euro is likely to accelerate to the upside through the March 27 main top at 1.3391; however, the main trend will turn down on a trade through the March 29 main bottom at 1.3257.

The first clue that traders are gearing up for an upside breakout will be a solid close over the downtrending Gann angle at 1.3359. This angle has rejected the euro at least four times over the last six days. If this angle is overcome by strong buyers then the next target will be the downtrending Gann angle at 1.3427.

On the downside, the most important uptrending Gann angle is at 1.3269 today. This angle has held as support since the euro bottomed at 1.3009 on March 15. A convincing break through this angle will mean that sentiment is shifting to the downside and that traders are getting ready to pressure the June euro.

At 13:00 Central Time, the U.S. Federal Reserve will release the minutes from its Open Market Committee meeting on March 13. The minutes could settle the debate as to whether the Fed members are truly behind the assessment that the economy is improving and that there may not be a need for additional stimulus in the form of additional bond-purchases.

Pulling in the reins of additional quantitative easing is likely to have a bullish influence on the U.S. dollar while pressuring the euro. A dovish tone or indications that there is a split among Fed members in gauging the strength of the U.S. economy could mean that additional quantitative easing is still on the table. Since this is akin to printing more money, the dollar could fall, pushing the euro higher.

June euro traders are also watching the activity in Spain this morning ahead of tomorrow’s ECB meeting. Rising debt rates in Spain suggest that investors fear that the nation may not be able to reduce spending enough to ward off a sovereign debt problem. This could trigger another sell-off in the euro because of the fear of contagion.

Euro traders are looking for the central bank to leave interest rates unchanged at 1.0% at its monetary policy meeting on Wednesday. In addition, the recent rise in the euro may be suggesting that the central bank is poised to have a more hawkish tone in its assessment of the eurozone economy.

In summary, the rangebound June euro is poised for a volatile move but the direction is unclear at this time. A breakout over 1.3391 is likely to greenlight a rally while a break through 1.3257 could trigger an acceleration to the downside.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

June Euro Set Up For Volatile Breakout

Published 04/04/2012, 05:45 AM

Updated 05/14/2017, 06:45 AM

June Euro Set Up For Volatile Breakout

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.