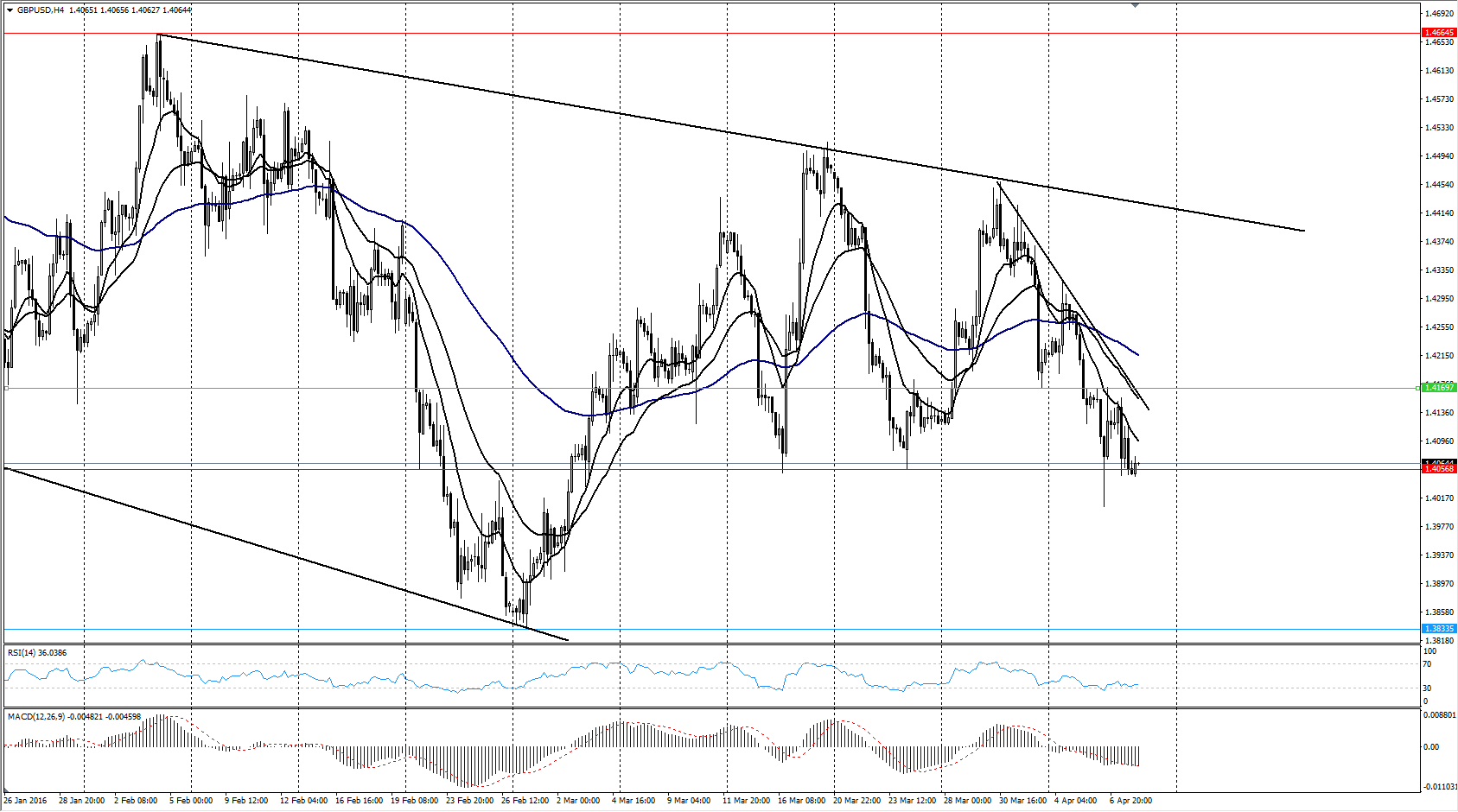

It has been a relatively rocky ride for the venerable cable over the past few weeks as the talk of a Brexit continues to impact the currency. However, despite some of the recent selling, the pair is firmly within the grips of a consolidation pattern that could see some dramatic moves in the week ahead.

Undertaking a technical analysis of the cable’s 4-Hour chart yields some potentially interesting clues for the week ahead. It is readily apparent that the currency pair has largely been trapped within a slightly bearish consolidating channel since the middle of March. Although the pair has reacted sharply to a range of external shocks, including increased talk of a Brexit, price action has remained within a relatively tight range. However, some sharp recent selling has seen the pair trend towards the bottom of the range which could indicate a strong move ahead.

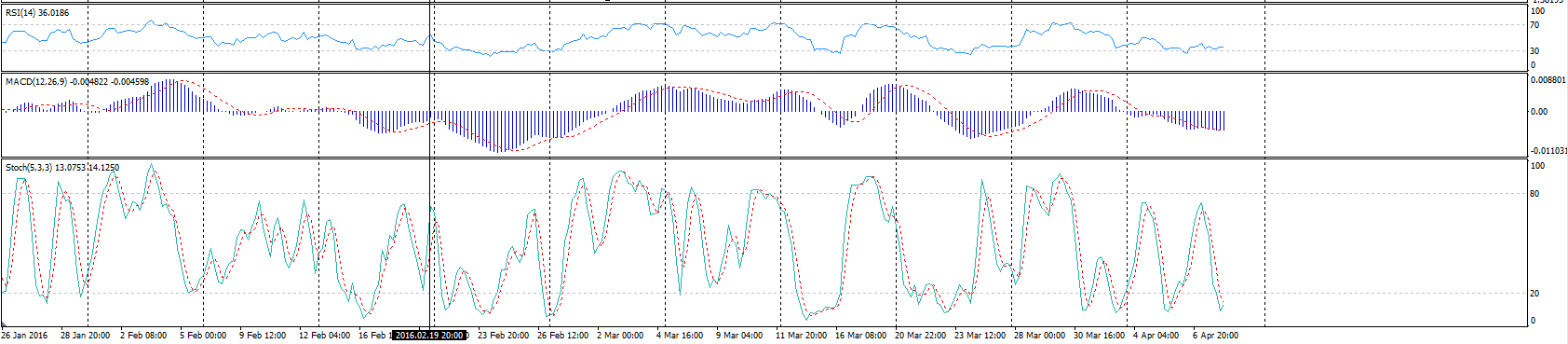

In fact, the technical indicators are showing some interesting signals as the RSI Oscillator remains relatively flat, near oversold territory, despite the recent price declines. Subsequently, there is some divergence between the indicator and price action that could be indicating a reversal of the short term trend. In confluence with RSI, the stochastic oscillator is also deep within oversold territory which lends further credence to the argument for a short term reversal.

Subsequently, there is plenty of scope for the entry of a long position above the key 1.4170 resistance level. Alternatively, a break below the 1.40 handle would indicate a sharp push towards the bottom of the channel is likely. However, be aware of any short side move as the Risk/Reward ratio is not advantageous.

Ultimately, the cable’s forward trend is likely to wait upon the UK Manufacturing Production results before making a strong move. However, given the recent collapse in the pair’s value, the downside might be relatively limited. Subsequently, the most likely scenario is a sideways consolidation at the current level before a challenge of the 1.4170 resistance level.