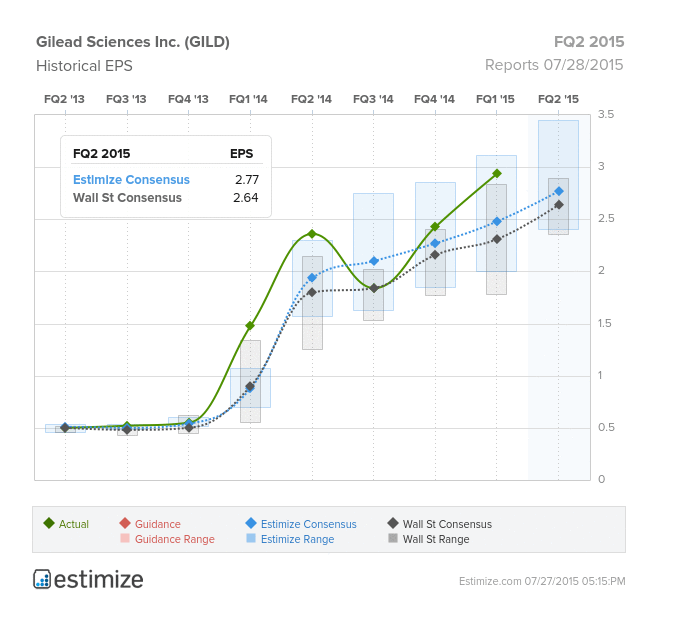

Gilead Sciences (NASDAQ:GILD) reports its FQ2 ’15 results after the closing bell today. Both Estimize and Wall Street are predicting a fall in EPS and revenues QoQ. Estimize are forecasting an EPS figure of $2.77 and a revenue target of $7.540B. Wall Street estimates EPS to come in at $2.64 and revenues to be $7.360B.

The success of Gilead over the past 36 months can be attributed to the company’s strong revenue growth figures which have blown expectations out of the water consistently over the past 2 years. However, this metric has recently experienced a slowdown and is expected to only further decline. As payers begin to balk at the high price tags of Gilead’s Hepatitis C drugs including Sovaldi and Harvoni, sales are expected to be negatively affected.

Despite the potential negatives associated with falling revenue growth, Gilead is in a very strong position in terms of its balance sheet. Gilead has the ability to use its balance sheet to its advantage and potentially acquire desirable businesses in an attempt to bolster growth over the coming years. However, Gilead’s management have informed the market that they will not rush into a transaction and pay too much to acquire another company. In February, Gilead announced to the market that they will start paying a $0.43 quarterly dividend and launch a $15B share buyback program. Importantly, the market has previously rewarded drugmakers engaging in M&A activity.

Companies such as AbbVie (NYSE:ABBV) and Alexion Pharmaceuticals (NASDAQ:ALXN) have both benefited from their M&A strategies and are both trading at considerable premiums since their acquisition announcements. These success stories place more pressure on Gilead’s management to act sooner rather than later with respect to making acquisitions.

Investors will be eager to hear from management with respect to both increasing competition and also their M&A strategy moving forward. Investors have become accustomed to Gilead outperforming analyst expectations, therefore if there is a miss today, the stock could potentially experience a significant pull-back depending on the severity.