In case you haven’t heard, Deutsche Bank (DE:DBKGn) is having a bit of a meltdown right now.

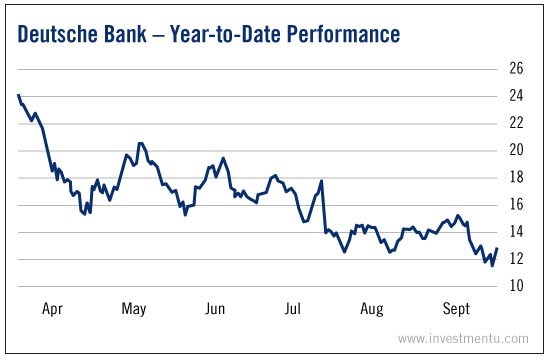

After write-downs, Brexit losses and a Department of Justice lawsuit, Deutsche Bank stock is at multidecade lows. Now, fund managers are pulling collateral out of the bank. And rumor has it that the German government has been discussing bailout scenarios.

Deutsche is twice the size of Goldman Sachs (NYSE:GS). And its stock is down almost 45% this year. That’s lower than its Great Recession bottom. We might be witnessing the death of one of the world’s largest banks.

But on the other hand, if Deutsche Bank stock recovers, this would be the ultimate contrarian buy opportunity. You’d be picking up shares of one of the largest financial institutions on Earth for half off.

So what are the chances that it’ll pull through? It’s difficult to say, but one way we can get some answers is through fundamental analysis.

We wanted to test Deutsche on six core factors and compare it to its peers in the banking industry. So we ran Deutsche Bank stock through the Investment U Fundamental Factor Test. (As a reminder, our checklist looks at six key metrics to diagnose the financial health of a stock.)

- Earnings-per-Share (EPS) Growth: Bad news right out of the gate. The banking industry as a whole is hurting. Negative interest rates have eaten into its income. And that’s reflected in the average earnings-per-share growth rate - a sad -10.17%. Then there’s Deutsche, which has seen EPS drop by 94.7% in the last year. That’s not great.

- Price-to-Earnings (P/E): This is another extremely concerning factor - especially given that Deutsche Bank stock is already at record lows. Price-to-equity ratio is an indicator of under- or over-valuation. Deutsche’s P/E is 32.45, almost three times the financial industry average of 13.09. It looks like the market is somehow still too confident about its chances.

- Debt-to-Equity : Deutsche’s debt burden isn’t too much worse than the average among its competitors... but it’s not better. It has a debt-to-equity ratio of 426.32%, while most other banks have 419.10% leverage. Deutsche really needed a win in this factor, and it didn’t get it. We all remember from 2008 what happens when a big, weakened bank is overleveraged.

- Free Cash Flow per Share Growth : Once again, Deutsche Bank is close to the industry average here... but still noticeably worse. Most big banks have seen free cash flow per share grow by a healthy 108.58%. Deutsche Bank’s growth rate of 96.7% isn’t terrible, but it’s definitely below average.

- Profit Margins : At least it’s not a total shutout. Deutsche is doing considerably better than its competitors in profit margins. The industry average is just 0.25%, while Deutsche is running 16.49% margins. This is likely a result of spinoffs and asset sales to raise funds for the ailing bank.

- Return on Equity : On the last factor, Deutsche Bank isn’t doing much better than it did on the first five. Its competitors have seen a small but respectable annual ROE of 3.55%. Deutsche, on the other hand, has a return of -12.33%.

All in all, fundamental analysis of Deutsche Bank stock shows that this is not a time for optimism. Deutsche is seriously compromised on five of our six fundamental factors. It may soon be joining Bear Stearns and Lehman Brothers on the big, always-bullish trading floor in the sky.

For perspective, Deutsche Bank is doing so badly that it broke our grading engine. The equations we use to calculate growth in different metrics aren’t supposed to process negative numbers. We had to dig through the financial statements ourselves to see just how toast the bank is.

For these reasons, Deutsche Bank stock has earned a grade of F. If you have shares, or you’re thinking about picking some up, then... just... don’t.