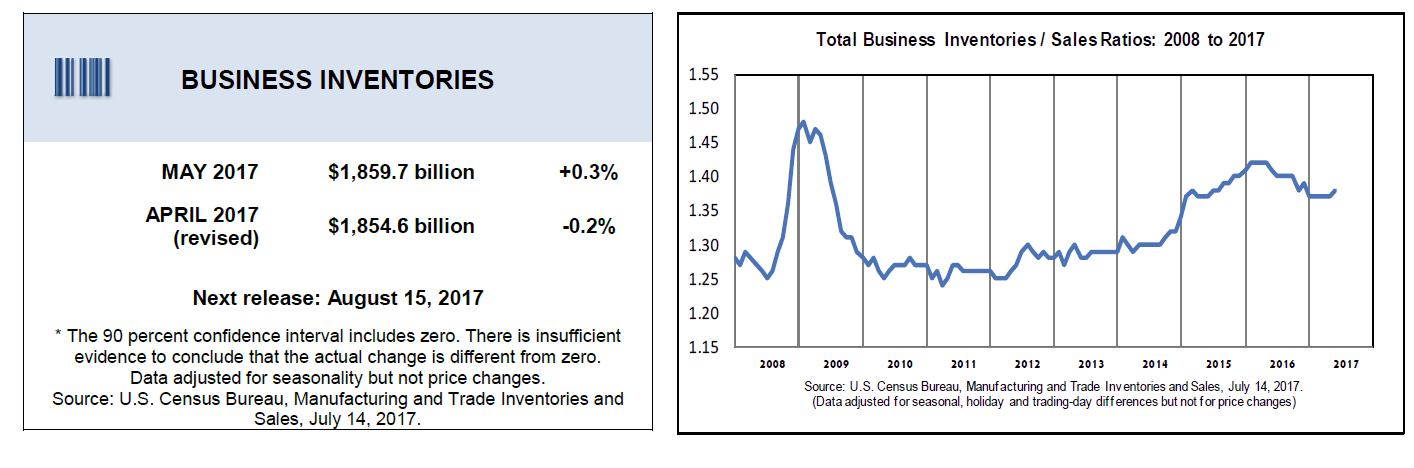

Adding to silly Commerce Department reporting of “auto sales”, today we learn business inventories were up 0.3%, led by autos up 1.1%. The rise in inventories matched the Econoday consensus estimate.

Inventories are looking to be a slight positive for second-quarter GDP as a 0.3 percent build in May offsets a 0.2 percent draw in April. But it’s inventories at auto dealers that are making the difference, jumping 1.1 percent in May and lifting the retail component to a 0.5 percent build. The May build in vehicles matches a May gain for retail sales of vehicles, though sales proved soft in June.

Wholesalers also built inventories in May, up 0.4 percent with manufacturers, however, working down their inventories by 0.1 percent. Total sales in May came in at minus 0.2 percent which pulls up the inventory-to-sales ratio to a less lean 1.38.

Whether May’s overall build points to overhang will depend on how strong June business sales will prove where the outlook for the retail sector, based on this morning’s retail sales report, is not positive.

Business Inventories

Inventories Adding To GDP?

Unlike Econoday, I have no confidence that inventories will add to GDP.

However, I have complete confidence the sales figures from the commerce department earlier today showing retail auto sales were up 0.1% in June, 0.9% in May, and 0.5% in April are total nonsense.

The question at hand is how the BLS values the inventories that are clearly stacking up on the lots of dealers.

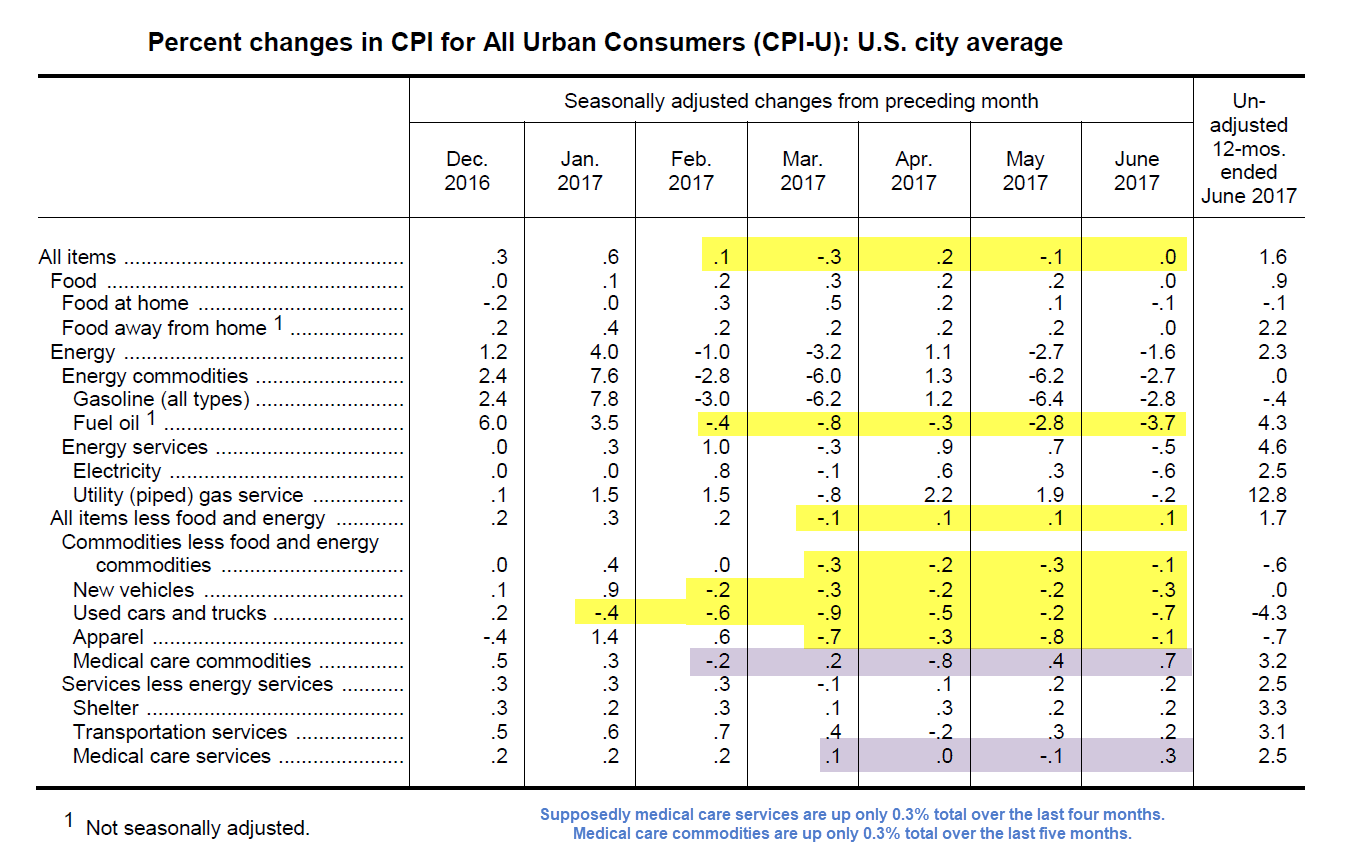

The CPI report from earlier today says new vehicle prices are down five consecutive months and used vehicle prices are down six consecutive months.

Percent Changes by Category

One can make a case for literally anything off this kind of reporting.

Moreover, the decline in CPI (if it applies to the GDP deflator and that is another pot shot) that would tend to boost “real sales” and thus GDP.

I have a bit of time to sort all of this out, but for now, I am around 1.0% GDP growth for the second quarter.

Here are some related posts to consider.

- Retail Sales Unexpectedly Sink 2nd Month: Supposedly Car Sales Rise 3rd Month

- BLS Reports Net Negative Inflation for 5 Months: Anyone Believe That?

- On May 2 (April Numbers) I reported Auto Sales Puke Again: Year-Over-Year Totals: GM -6%, Ford -7.2%, Toyota -4.4%, Fiat-Chrysler -7.0%.

- On June 1 (May Numbers) I reported Motor Vehicle Sales Flat, Hope Turns to Second Half: What About Fleet Sales? Incentives?

- On July 3 (June Numbers) I reported Auto Sales Weak Again, Average Loan Hits Record 5.75 Years: Don’t Worry “Plateau Expected”.