In an effort to boost its financial position for investing in growth endeavors, Innovative Industrial Properties (NYSE:IIPR) has announced a public offering of 1.25 million shares of common stock. Moreover, the company expects to grant the underwriters a 30-day option for purchase of up to an additional 187,500 shares of its common stock.

Specifically, Industrial Properties, which is focused on cannabis-centered real estate portfolio, intends to invest the capital reaped through this offering in real estate assets that help the regulated cannabis cultivation and processing industry. The company also plans to support it general corporate needs with the proceeds.

Notably, the legalization of marijuana’s medical use in several states as well as allowing adult consumption in some states have opened up scope for the cannabis industry. Therefore, with more states in the United States giving cannabis the green light, Innovative Industrial Properties has incentive to acquire additional properties.

Recently, the company completed the acquisition of a Michigan property and entered into a long-term, triple-net lease agreement with subsidiary of Ascend Wellness Holdings, LLC (AWH).

Specifically, Innovative Industrial Properties has shelled out $4.8 million (excluding transaction costs) for this property in Lansing, which comprises around 145,000 square feet of industrial space. The subsidiary of Ascend Wellness Holdings will use the property as a licensed medical-use cannabis cultivation and processing facility, following some redevelopment efforts.

Innovative Industrial Properties has also committed to provide up to approximately $15 million as reimbursement for the tenant improvements, resulting in its total investment in the property reaching around $19.8 million.

Moreover, last month, the company announced the acquisition of a property in Harrison, MI, which comprises around 45,000 square feet of industrial space. The company entered into a long-term, triple-net lease agreement with an affiliate of Emerald Growth Partners that will use the property as licensed medical-use cannabis cultivation and processing facility, and committed to provide up to approximately $3.1 million as reimbursement for the tenant improvements, leading to its total investment in the property reaching around $10 million.

In fact, the company’s strategic expansion efforts have resulted in the company owning 23 properties as of Jul 9, 2019, located in Arizona, California, Colorado, Illinois, Maryland, Massachusetts, Michigan, Minnesota, New York, Ohio and Pennsylvania. The properties aggregate around 1.8 million rentable square feet that were fully leased, with a weighted-average remaining lease term of about 15.6 years.

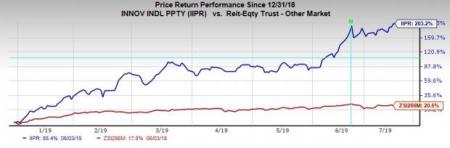

Innovative Industrial Properties currently carries a Zacks Rank #2 (Buy). In the year-to-date period, shares of the company have significantly outperformed the industry. While the stock has surged 203.2%, the industry has gained 20.5% during this period.

Other Key Picks

Some similar-ranked stocks from the real-estate space include Duke Realty Corp. (NYSE:DRE) , Lamar Advertising Company (NASDAQ:LAMR) and PS Business Parks, Inc. (NYSE:PSB) . You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Duke Realty’s Zacks Consensus Estimate for 2019 funds from operations (FFO) per share moved marginally north to $1.42 in a month’s time.

Lamar’s FFO per share estimates for the current year inched up 0.3% to $5.83 over the past two months.

PS Business Parks’ Zacks Consensus Estimate for the ongoing year’s FFO per share moved up 0.6% to $6.71 in the past month.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Lamar Advertising Company (LAMR): Free Stock Analysis Report

Innovative Industrial Properties, Inc. (IIPR): Free Stock Analysis Report

Duke Realty Corporation (DRE): Free Stock Analysis Report

PS Business Parks, Inc. (PSB): Free Stock Analysis Report

Original post

Zacks Investment Research