GBP/USD: Here Comes Brexit Referendum - Liquidity Is Thin, Volatility May Be Huge

- Brexit polling is taking place between 6:00-21:00 GMT today, with the results expected early on Friday.

- The campaign to keep Britain in the European Union got a boost from two opinion polls published late on Wednesday, a few hours before voters begin to cast their votes in a historic EU membership referendum. The news pushed the GBP to its highest level against the USD dollar so far this year on the signs of a last-minute rise in support for staying in the EU. Investors have mostly feared that a so-called Brexit would damage the economy in Britain and possibly beyond.

- A telephone survey by polling firm ComRes, conducted for the Daily Mail newspaper and ITV television showed the "Remain" campaign had a 48% to 42% lead over "Leave". A previous ComRes poll for The Sun newspaper, which was published on June 14, had given a lead of just one point to the "Remain" camp which has been led by Prime Minister David Cameron and the heads of Britain's other major political parties.

- At almost the same time, another poll by YouGov for The Times newspaper showed "In" leading "Out" by 51 to 49%. A previous YouGov poll for The Times had put "Out" ahead. Betting odds moved further in favour of a vote to stay in the EU after the two polls were published. Betfair, a gambling firm, showed the probability of an "In" vote rising to almost 80%.

- The cost of hedging against sharp swings in sterling over the next 24 hours surged on Thursday as the contract rolled over to capture the date of the result for Britain's vote on whether it wants to stay in the European Union or leave. Liquidity is very thin and the volatility of the GBP/USD could be huge. We stay sideways on GBP pairs because of elevated risk ahead of the Brexit referendum result. Our baseline scenario is that the “Remain” vote will prevail.

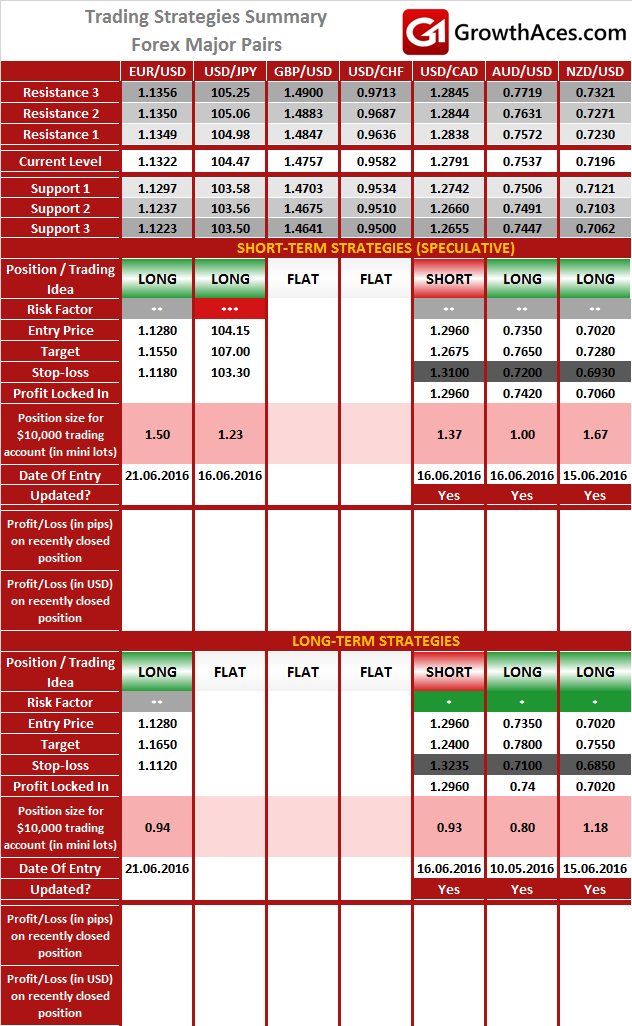

FOREX - MAJOR PAIRS:

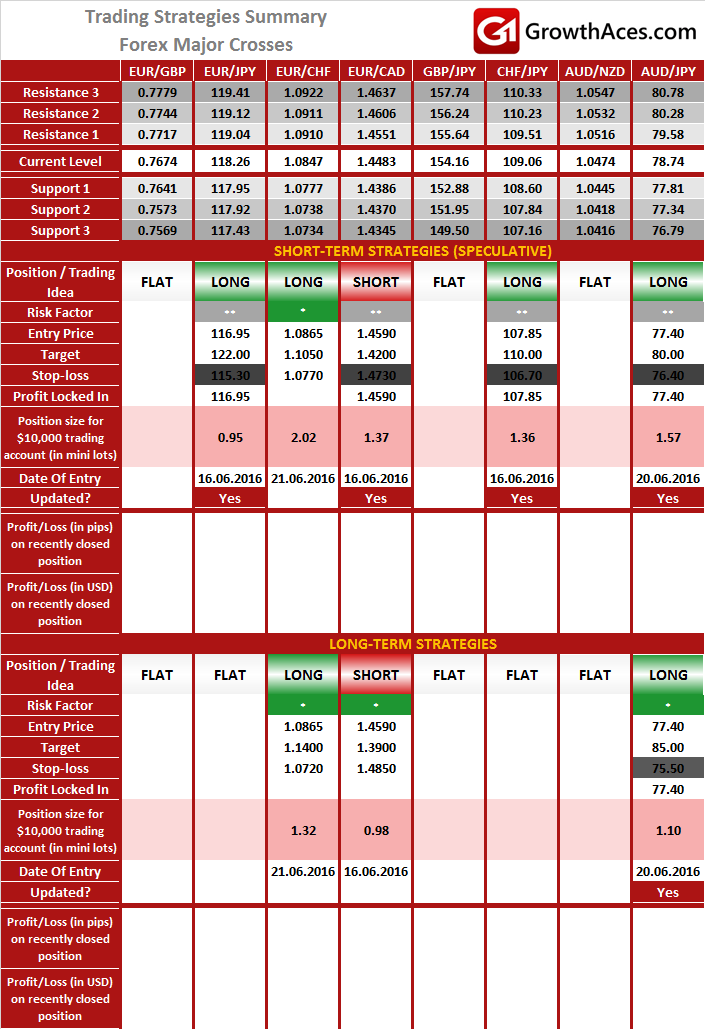

FOREX - MAJOR CROSSES:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Source: Growth Aces - Forex And Precious Metals Trading Signals