Today we’re going to look at how we can play the market’s “fear gauge”—known as the VIX, for a 7.5% dividend that’s as steady as they come.

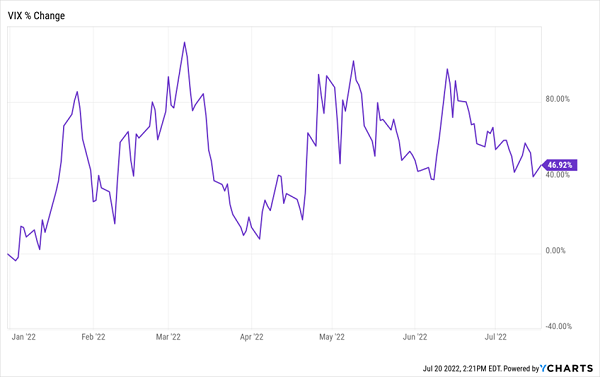

As you can guess, the VIX has been on the rise this year as the Fed-induced market selloff has deepened:

Fear Gauge Rises. A Plus for Our Dividends?

You can’t outright buy the VIX, and even if you could, you wouldn’t get any dividends from it. But there is an asset class that uses the higher volatility the VIX is showing us to generate extra cash, resulting in a higher (and safer) income stream for you: closed-end funds (CEFs) that sell covered-call options.

The Only Options Plan Dividend Investors Should Consider

I know that the idea of selling options sounds dangerous. But selling covered calls is different. If you limit yourself to just covered-call options, you can take advantage of the others’ gambling to make a tidy and consistent income stream for yourself.

Here’s how it works: you buy a stock or a group of stocks and sell a covered-call option against that stock or stocks. This option gives the purchaser the right to buy the stock (or stocks) from you in the future at a fixed price agreed upon beforehand. In exchange for that right, the call-option buyer gives the seller cash—this is known as an option premium.

Here’s where things get good: premiums go up in times of greater volatility, and unexercised options expire worthless. So if you hold 100 shares of a company at $100 each, agree to sell at $120 in exchange for $1 in cash, but the company’s stock price never gets to $120, the option expires worthless—but you keep the 100 shares and the $1 in cash per share.

This is a reliable income-producing strategy that many professional investors have used for decades, and it’s available to everyone through funds like the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX).

SPXX holds well-known S&P 500 firms like Berkshire Hathaway (NYSE:BRKa), Mastercard (NYSE:MA) and McDonald’s (NYSE:MCD), but with a twist: it pays out a 7.5% income stream to investors who buy today. In addition, you’re getting the cash payouts from Nuveen selling call options against that portfolio, a strategy SPXX has successfully used to deliver steady income for 20 years, through the Great Recession and COVID-19.

Now there is a catch with SPXX and funds like it: their option-writing strategy provides stable income and a bit of a volatility hedge, but at the cost of lower returns over the long term, because the fund’s best stocks often get “called away,” causing it to miss out on their biggest gains. This is why we typically only emphasize covered-call funds during times of greater volatility. In a steadily rising market, we prefer to pivot into “pure” stock CEFs.

However, shortly after a bottom, when the market is just starting to recover, covered-call funds tend to closely track or even slightly outperform because of higher volatility, while also providing a much higher income stream.

That’s exactly what happened in 2020, when SPXX edged slightly ahead of the broader index, returning 40% from the trough of the COVID-19 selloff until the end of the year, while paying a dividend more than four times bigger.

This is about as close to a free lunch as a dividend investor can find—and if stocks are near a bottom here, history could be about to repeat. But even if we see higher volatility, SPXX can be a reliable source of upside and dividend income until things (inevitably) settle down, and well into the next rebound, too.

Investors are starting to catch on to this, which is why SPXX trades at a 1% premium to NAV now. But the fund has sported premiums as high as 4.7% in the past year, suggesting further gains ahead.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."