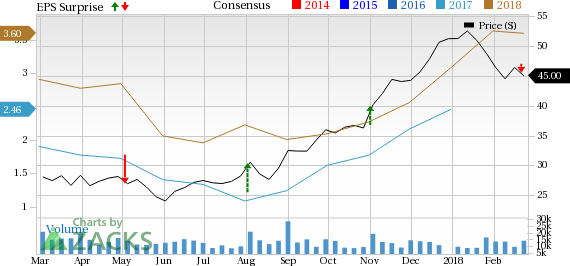

HollyFrontier Corporation (NYSE:HFC) reported fourth-quarter 2017 net income per share (excluding special items) of 70 cents, below the Zacks Consensus Estimate of 82 cents. The weaker than anticipated results can be attributed to lower-than-expected refining margins. Notably, the refining margins in the quarter stood at $12.54 a barrel against the Zacks Consensus Estimate of $13.15 a barrel.

However, the bottom line turned around from the year-ago period’s loss of 6 cents.Robust year-over-year results were driven by higher sales volume and stronger contribution across all segments.

Revenues of $3,992.7 million missed the Zacks Consensus Estimate of $4,310 million. However, the top line surged 35.1% from the fourth-quarter 2016 sales of $2,955.1 million.

Segmental Information

Refining: Net income from the Refining segment, which is the main contributor to HollyFrontier’s earnings, was $282.3 million, surging a whopping 475.5% from the year-ago income of $49 million. The improvement reflects wider gross margins, which jumped 85.2% to $12.54 per barrel.

Total refined product sales volume averaged 482,860 barrels per day (bpd), up 3.5% from 464,160 bpd in the year-ago quarter. Moreover, throughput increased from 497,450 bpd in the prior-year quarter to 466,640 bpd. Capacity utilization was 100.9%, up from 94.5% in fourth-quarter 2016.

Lubricants and Specialty Products: Income from the segment, totaled $29.3 million, up from $20.6 million reported in the year-ago quarter. Product sales averaged 29,670 bpd, significantly above the prior-year level of 11,230 bpd. Throughput came in at 20,990 bpd in the reported quarter.

HEP: This unit includes HollyFrontier’s 36% interest in Holly Energy Partners L.P. (NYSE:HEP) , a publicly-traded master limited partnership that owns, operates, develops and acquires pipelines and other midstream assets.

Segment profitability was $67.6 million, up from $54.9 million in fourth-quarter 2016. Earnings were buoyed by higher segment sales.

Balance Sheet

As of Dec 31, 2017, HollyFrontier had approximately $630.8 million in cash and cash equivalents, and $2,498.9 million in net long-term debt, representing a debt-to-capitalization ratio of 29.8%.

Zacks Rank & Other Key Picks

Headquartered in Texas, HollyFrontier carries a Zacks Rank #2 (Buy).

Meanwhile, investors interested in the same sector may also consider Marathon Petroleum Corp. (NYSE:MPC) and Murphy USA Inc. (NYSE:MUSA) . While Marathon Petroleum sports a Zacks Rank #1 (Strong Buy), Murphy USA carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Marathon Petroleum delivered an average positive earnings surprise of 182.62% in the trailing four quarters.

Murphy USA delivered an average positive earnings surprise of 20.65% in the trailing four quarters.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Murphy USA Inc. (MUSA): Free Stock Analysis Report

HollyFrontier Corporation (HFC): Free Stock Analysis Report

Marathon Petroleum Corporation (MPC): Free Stock Analysis Report

Holly Energy Partners, L.P. (HEP): Free Stock Analysis Report

Original post

Zacks Investment Research