Higher yielding currencies, namely the EUR and AUD, remained bearish during European trading yesterday, as fears that Greece will have to leave the eurozone led to risk aversion in the marketplace. Investors are now worried about what the possible effects of a Greek exit from the eurozone would be for other indebted countries, including Spain and Italy.

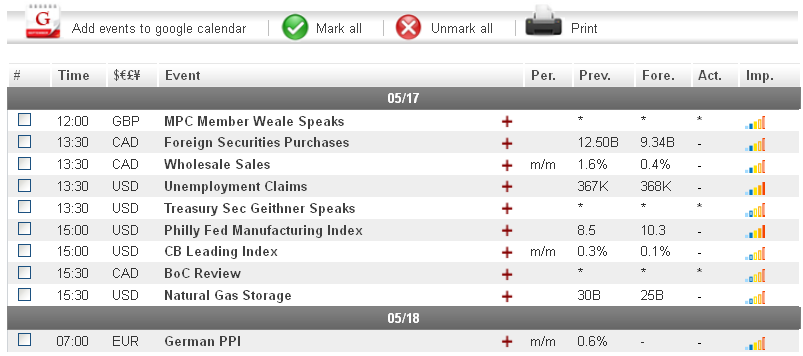

Today, traders will want to note that there is a bank holiday in France, Germany and Switzerland. That being said, news out of the US may lead to market volatility. The Unemployment Claims figure and Philly Fed Manufacturing Index are both forecasted to show US economic growth. If true, the USD could see gains during the afternoon session.

Economic News

USD - Manufacturing Data Could Result In Dollar Gains TodayThe dollar was able to benefit yet again from risk aversion in the marketplace yesterday, as worries about the Greek political situation caused investors to abandon higher yielding assets. The EUR/USD dropped to a fresh four-month low during the morning session, reaching 1.2679 before staging an upward correction. The pair eventually peaked at 1.2758. The greenback also saw gains against the Australian dollar. The AUD/USD fell as low as 0.9868 before moving upward during mid-day trading.

Turning to today, dollar traders will want to pay attention to the US Unemployment Claims figure at 12:30 GMT, followed by the Philly Fed Manufacturing Index at 14:00. Despite a lack of overall growth in the US labor market in recent months, the number of people claiming unemployment insurance in the US has remained relatively steady. Should today's news come in below the forecasted 368K, the greenback could see gains vs. its main rivals. With regards to the manufacturing index, analysts are predicting the news to come in at 10.3, well above last month's figure. If true, the USD/JPY could turn bullish as a result.

EUR - EUR/JPY Drops To 3-Month Low

The possible effects of a Greek exit from the eurozone sent the common currency to fresh lows against several of its main rivals during trading yesterday. In addition to the EUR/USD, which hit a four-month low, the EUR/JPY dropped to its lowest level in three-months. The pair dropped to 101.89 at the beginning of the European session before staging a mild correction and stabilizing at 102.40. The euro had better luck against the British pound, following a warning from the Bank of England Governor that the eurozone crisis could impact growth in the UK. The EUR/GBP advanced close to 60 pips, reaching as high as 0.8006 during the afternoon session.

Turning to today, euro traders will want to continue monitoring any announcements out of the eurozone. Analysts are warning that the currency still has the potential to sink further as long as the prospect for a Greek exit from the eurozone exists. Furthermore, the possible negative effects the current political crisis can have on other eurozone countries, notably Spain and Italy, may result in additional risk aversion in the marketplace, which could cause the euro to fall further.

JPY - JPY Sees Mild Losses Vs. USD

The USD/JPY advanced close to 30 pips during European trading yesterday, reaching as high as 80.54. The dollar was able to benefit from better than expected news out of the US, which placed the currency well above the psychologically significant 80.00 level. The yen also took losses against the Australian dollar. The AUD/JPY was up over 80 pips during mid-day trading, reaching as high as 80.15 before staging a slight downward correction.

Turning to today, JPY traders will want to pay attention to news out of the US, specifically the Philly Fed Manufacturing Index. The index is forecasted to show significant growth in the US manufacturing sector. If the indicator comes in at or above the forecasted 10.3, the yen may fall further against its US counterpart.

Crude Oil - Crude Oil Falls Following US Inventories Report

After moving up for most of the European trading session, crude oil once again turned bearish following a higher than forecasted US Crude Oil Inventories figure. The indicator was taken as a sign that demand for oil in the US continues to fall. While the commodity reached as high as $94.10 a barrel during mid-day trading, it eventually began falling later in the day, reaching as low as $92.73 by the end of European trading.

Turning to today, oil traders will want to continue monitoring developments out of the eurozone. The political uncertainty in Greece has resulted in significant aversion to risk over the last several weeks, which has caused the price of oil to tumble. Any additional negative news today could result in the commodity taking further losses.

Technical News

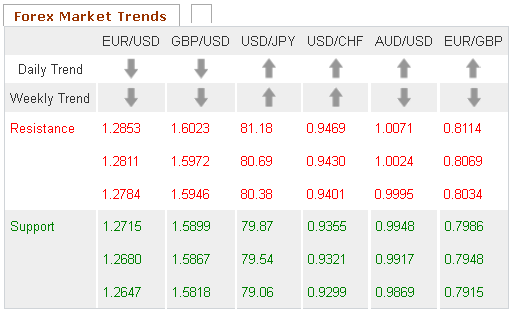

EUR/USDMost long-term technical indicators place this pair in oversold territory, indicating that upward movement could occur in the near future. The Williams Percent Range on the weekly chart is currently at -90, while the daily chart's Slow Stochastic has formed a bullish cross. Traders may want to go long in their positions.

GBP/USD

While the daily chart's Slow Stochastic has formed a bullish cross, most other technical indicators place this pair in neutral territory. This includes the weekly chart's Relative Strength Index and MACD/OsMA. Taking a wait and see approach may be the wise choice for this pair.

USD/JPY

The Williams Percent Range on the daily chart has drifted into overbought territory, indicating that this pair could see downward movement in the near future. Additionally, a bearish cross on the weekly chart's MACD/OsMA has formed. Traders may want to go short in their positions.

USD/CHF

A bearish cross on the daily chart's Slow Stochastic indicates that this pair could see downward movement in the near future. Additionally, the Relative Strength Index on the same chart is currently in the overbought zone. Opening short positions may be the wise choice for this pair.

The Wild Card

AUD/CADThe Williams Percent Range on the daily chart is currently in oversold territory, indicating that upward movement could occur in the near future. Additionally, a bullish cross on the same chart's Slow Stochastic has formed. This may be a good time for forex traders to open long positions ahead of a possible upward correction.