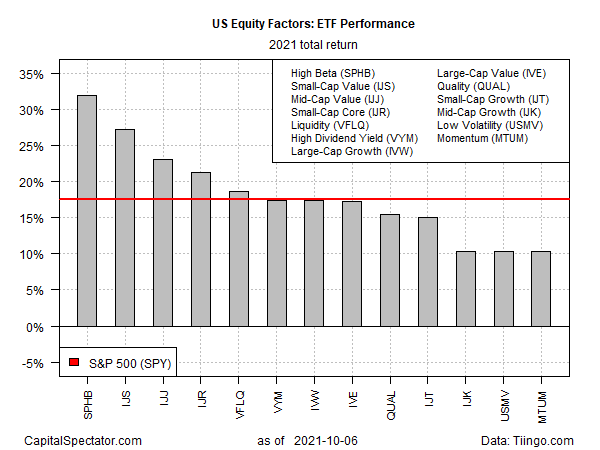

Shares with the highest beta-risk continue to top the US factor race in 2021 by a wide margin, based on a set of exchange traded funds.

Invesco S&P 500® High Beta ETF (NYSE:SPHB) is holding on to a substantial lead via a 32.0% gain so far in 2021 through yesterday’s close (Oct. 6). Although the fund has been treading water for the last several months, no other factor ETF has challenged SPHB’s year-to-date front-runner status.

The nearest competitor to SPHB’s leadership this year is small-cap value: iShares S&P Small-Cap 600 Value ETF (NYSE:IJS) is up 27.2%. That’s a strong gain, but IJS has also been moving sideways in recent months and its impressive performance this year reflects a rally that unfolded in the first half of 2021.

US equity factor results overall are posting gains across the board, but the results vary widely. The weakest performers are essentially tied via a trio of funds targeting mid-cap growth (IJK), low volatility (USMV) and momentum (MTUM) — each is up roughly 10% this year.

US stocks generally, based on SPDR S&P 500 (SPY), are posting middling results vs. the factor-ETF field. Year to date, SPY has rallied 17.5%.

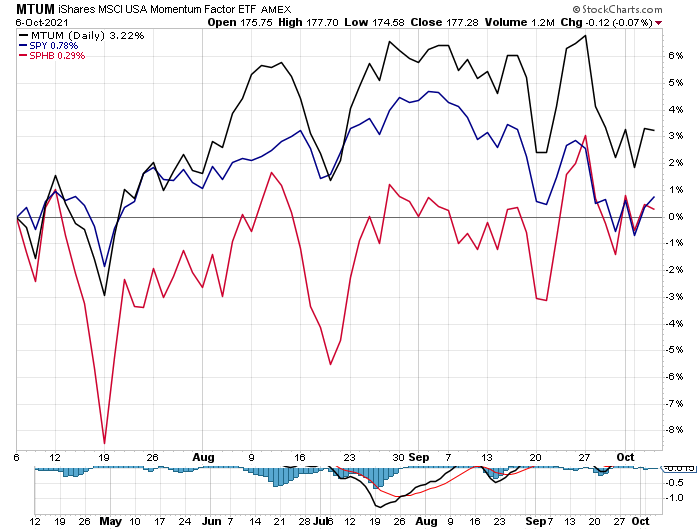

In CapitalSpectator.com’s previous update on factor funds in mid-August, there were hints that momentum was set to challenge high-beta’s leadership in the second half of the year. But momentum’s upside bias faded as stocks overall became stuck in a trading range. Momentum has modestly outperformed high-beta and the broad market over the past three months, but the leadership is thin and, for now, still unconvincing.