The Scotts Miracle-Gro Company (NYSE:SMG) stock looks promising at the moment based on compelling growth prospects for fiscal 2019. The company’s shares have gained around 22% over the past six months.

Scotts Miracle-Gro currently sports a Zacks Rank #1 (Strong Buy) and a VGM Score of B. Our research shows that stocks with a VGM Score of A or B combined with a Zacks Rank #1 or #2 (Buy), offer the best investment opportunities for investors. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let's delve into the factors that make Scotts Miracle-Gro stock an attractive investment option at the moment.

Upbeat View

In July 2019, Scotts Miracle-Gro raised its guidance for fiscal 2019 for the second time.

The company now expects adjusted earnings per share (EPS) in the band of $4.35-$4.50 compared with $4.20-$4.40 expected earlier. Per the company, revised guidance for company-wide sales growth of 16-17% assumes that sales in the Hawthorne unit will increase around 90% year over year to $650 million in fiscal 2019. The U.S. Consumer segment is expected to grow 6-7%.

Acquisitions and Hawthorne to Drive Growth

The company will gain from the synergies of the Sunlight Supply acquisition. The buyout provides it with modern and cost-efficient supply chain in the hydroponic industry that will benefit its retail and end consumers.

Moreover, the integration of Sunlight Supply is on track. The company continues to expect nearly $30 million in synergies from the transaction by the end of fiscal 2019.

Scotts Miracle-Gro is witnessing strong growth in the Hawthorne segment. Sales in the segment surged nearly 138% in the fiscal third quarter, mainly driven by the acquisition of Sunlight Supply. Scotts Miracle-Gro is expected to benefit from long-term prospects and cost-saving opportunities associated with the Hawthorne division.

An Outperformer

Scotts Miracle-Gro has significantly outperformed the industry it belongs to year to date. The company’s shares have rallied 65.7% against the 0.5% decline of the industry. The company has also outpaced the S&P 500’s rise of 7.2% for the same period.

Estimates Moving Up

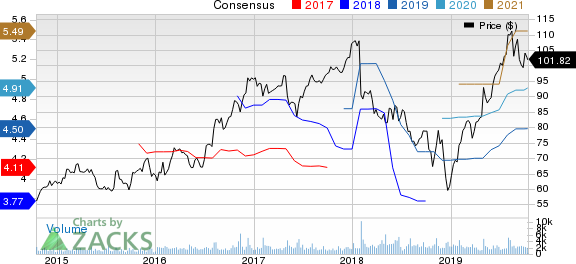

Earnings estimate revisions have the greatest impact on stock prices. Estimates for fiscal 2019 for Scotts Miracle-Gro have moved up 3.9% in the past three months. The Zacks Consensus Estimate for earnings for the fiscal is currently pegged at $4.50 per share, which indicates an expected year-over-year rise of around 21.4%.

Other Key Picks

Some other top-ranked stocks in the basic materials space are Kinross Gold Corporation (NYSE:KGC) , Royal Gold, Inc (NASDAQ:RGLD) and Agnico Eagle Mines Limited (NYSE:AEM) , each sporting a Zacks Rank #1.

Kinross has an expected earnings growth rate of 170% for 2019. The company’s shares have surged 60.7% in the past year.

Royal Gold has a projected earnings growth rate of 82.1% for fiscal 2020. The company’s shares have rallied 58.6% in a year’s time.

Agnico Eagle has an estimated earnings growth rate of 158.6% for the current year. Its shares have moved up 38.5% in the past year.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Royal Gold, Inc. (RGLD): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

The Scotts Miracle-Gro Company (SMG): Free Stock Analysis Report

Original post

Zacks Investment Research