I often talk about how the gold trade is really two separate trades. There’s the 'fear trade' that buys gold out of fear of war or poor government policies. This crowd sees the precious metal as a safe haven during times of crisis, such as when gold rose over the fear of a war in Syria, but eased when a much more limited military action became likely.

However, there were other factors beyond Syria driving gold. It’s called the 'love trade'. This group gives gold as gifts for loved ones during important holidays and festivals.

Big Gains

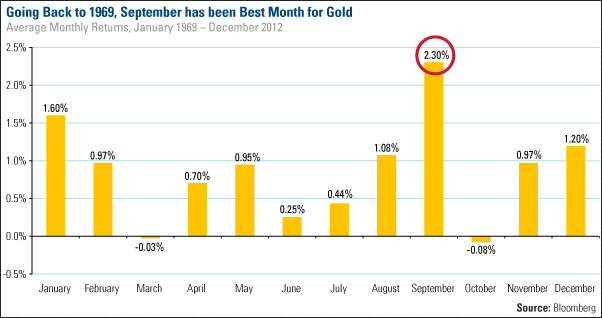

And that's the time of year we're in the midst of right now. Historically, September has been gold’s best month. Looking at more than four decades of monthly returns, the precious metal has seen its biggest increase this month, averaging 2.3 percent.

The India Factor

Indians will be getting ready for their wedding season that begins in October followed by the five-day Hindu festival of lights, Diwali, which is India’s biggest and most important holiday of the year. In December, millions of people will be gathering with loved ones to exchange gifts as they observe Christmas. And finally, millions will celebrate Chinese New Year at the end of January 2014.

In India, there’s also the harvest season to consider, as its crop production relies on rainfall for water.

One positive driver for gold this year is the fact that the country has had a heavy monsoon. The rains that started in June covered most of India at the fastest pace in more than 50 years. About 70 percent of the annual rainfall in India happens from June to September, and a strong monsoon season usually means a bumper crop, which boosts farmers’ incomes.

That could increase gold buying as well, negating the government’s efforts to quell India’s gold-buying habit. Historically, good monsoon seasons have been associated with strong gold demand. “In 2010, the last year that rains were heavily above average, demand soared 37 percent in the fourth quarter after harvests,” says Reuters.

In the rural areas of India, there is little access to banking networks, so gold is used as a store of wealth, says Reuters. And with half the population in India employed in agriculture, it’s no surprise that 60 percent of all the gold demand in the country comes from these rural areas.

India’s rural community has seen a “hefty rise” in income this year, reports Mineweb. But instead of buying gold, Mineweb says Indian farmers may purchase land due to gold in local currency reaching “dizzying heights.”

Particularly over the past few weeks, as the currency faced increasing weakness, gold in rupee spiked. Over the past three years, gold is now up 58 percent compared to gold in the U.S. dollar, which rose nearly 12 percent.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Here's Why You Should Buy Gold In September

Published 09/17/2013, 02:41 PM

Updated 05/14/2017, 06:45 AM

Here's Why You Should Buy Gold In September

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.