“Heart Like a Truck” is a song recorded by American country music singer Lainey Wilson. It was released in May 2022 as the lead single from her second studio album, Bell Bottom Country.

Lyrically, the song compares her heart to a truck and is about acknowledging that it is okay to experience heartache and to remember to keep on going. In a statement accompanying the song’s release, Wilson explained “This is a song about finding freedom in strength, and not being afraid of your scars and bruises. A truck that has hit a few bumps and earned a few scratches has proved itself and its tenacity… the shiny one on the lot can’t say that.”

The meaning of this song clearly parallels the movement of the markets over the past 1.5 years. The “bumps and scratches” the market experienced in 2022 created generational opportunities that our clients and many of our podcast|videocast listeners have been able to and continue to take advantage of.

The song won Female Video of the Year at the 2023 CMT Music Awards. (source: Wikipedia)

I got a heart like a truck

It’s been drug through the mud

Runs on dreams and gasoline

And that ole highway holds the key

It’s got a lead foot down when it’s leaving…

Following along the theme of “trucks” I joined Seana Smith and Akiko Fujita on Yahoo! Finance this Tuesday. Thanks to Taylor Clothier for having me on the show and Sydney Fried for the support. We delivered our update on Cooper Standard (which discussed new car and TRUCK demand/incentives), BAC, VNO, Small Caps, Rates, Fed, earnings, outlook and more. This is one not to be missed. There are quite a few surprises throughout, but most importantly is that the real money will not be made chasing the indices in 2H:

Watch in HD directly on Yahoo! Finance (Segment 1)

Watch in HD directly on Yahoo! Finance (Segment 2)

Full unedited version here:

Here were a few of my show notes ahead of the segment.

On Thursday night I joined Mariko Oi on the BBC to discuss bank earnings before they started on Friday. Thanks to Joao da Silva for having me on. You can see the level of skepticism that was prevalent going into banks earnings. It proved to be unfounded:

Sentiment

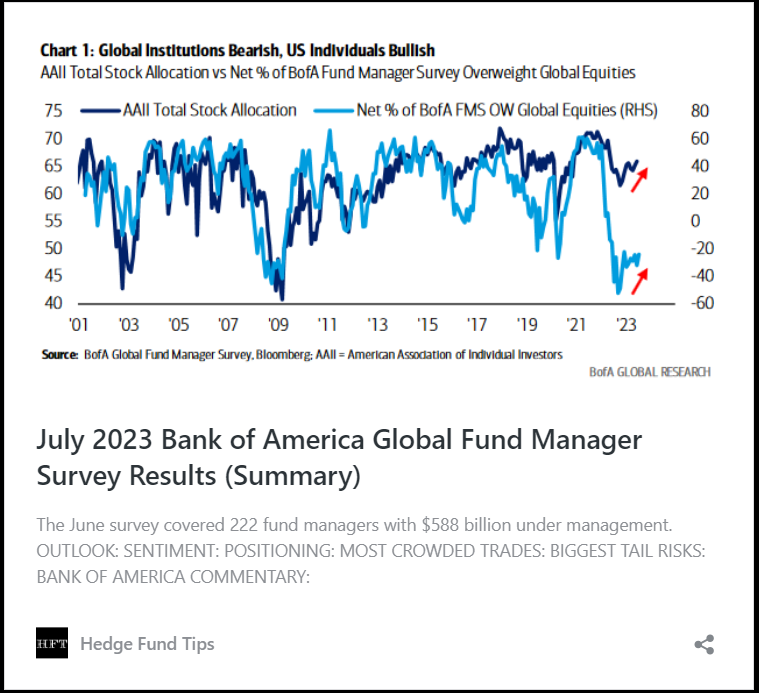

This Tuesday, Bank of America (NYSE:BAC) published its monthly “Fund Manager Survey.” I posted a summary here:

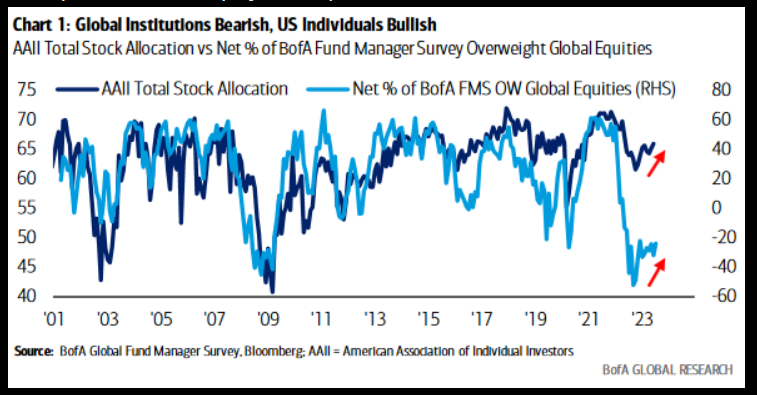

Here were the 5 key points:

1. Similar to COVID lows, “retail” got it right first, Institutions were late to get back into equities and had to play catch up.

2.Managers INCREASED their cash positions this month. They will be forced to buy up more and more. We are seeing it already.

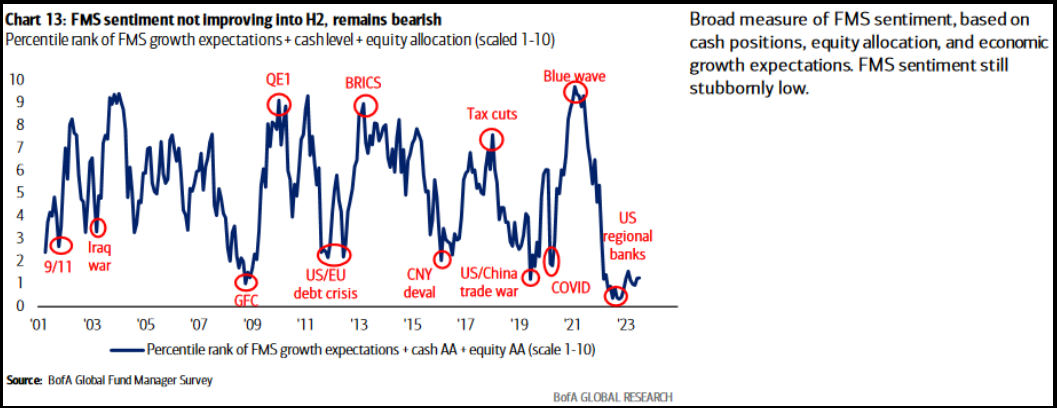

3. Sentiment is at the same pessimistic level you see at market lows (not highs):

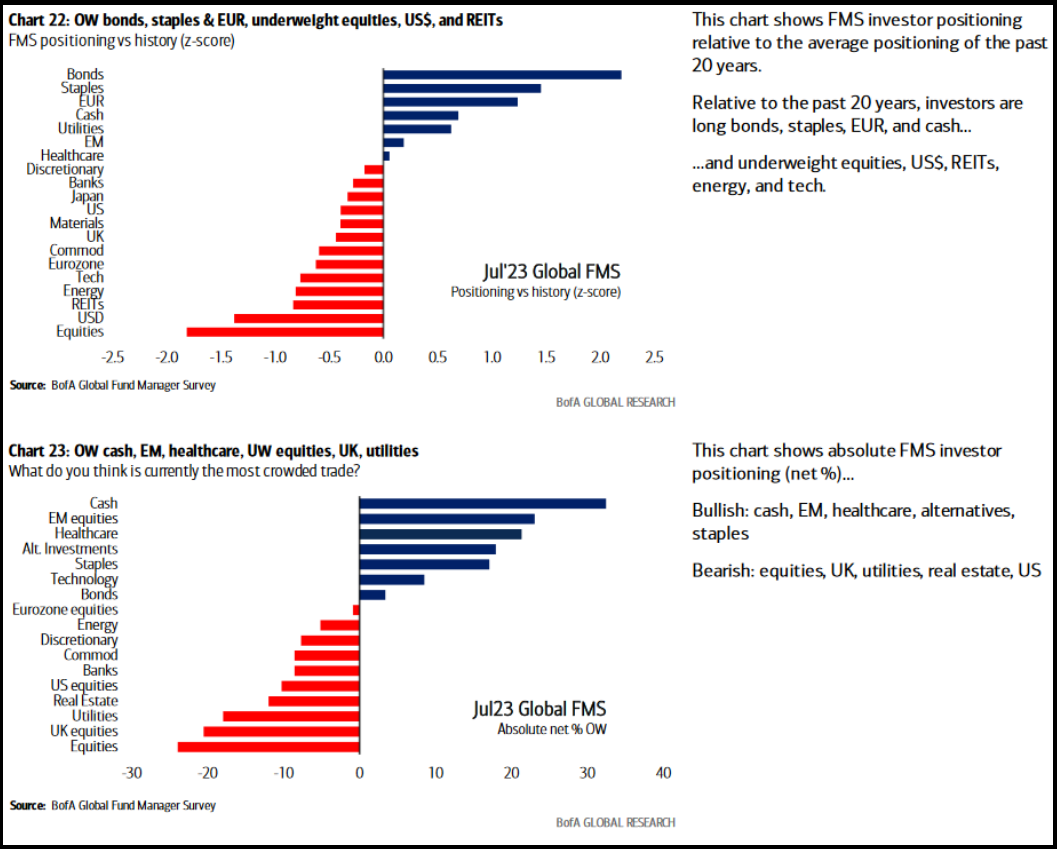

4. Managers still overweight cash and bonds. Underweight equities. You know what to do!

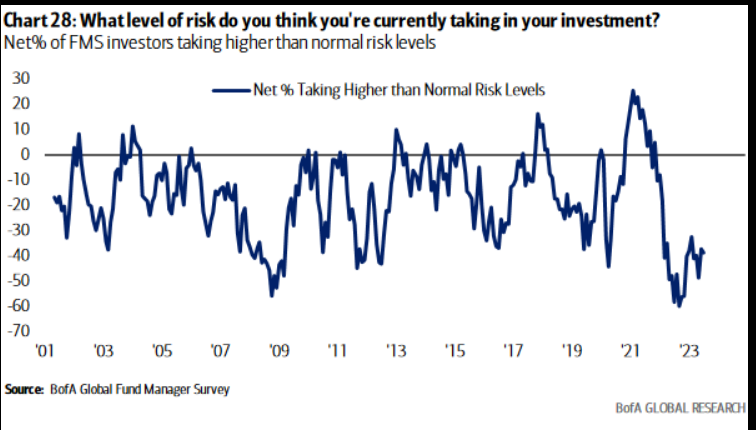

5. Investors taking the least risk since 2009 lows.

Always remember…

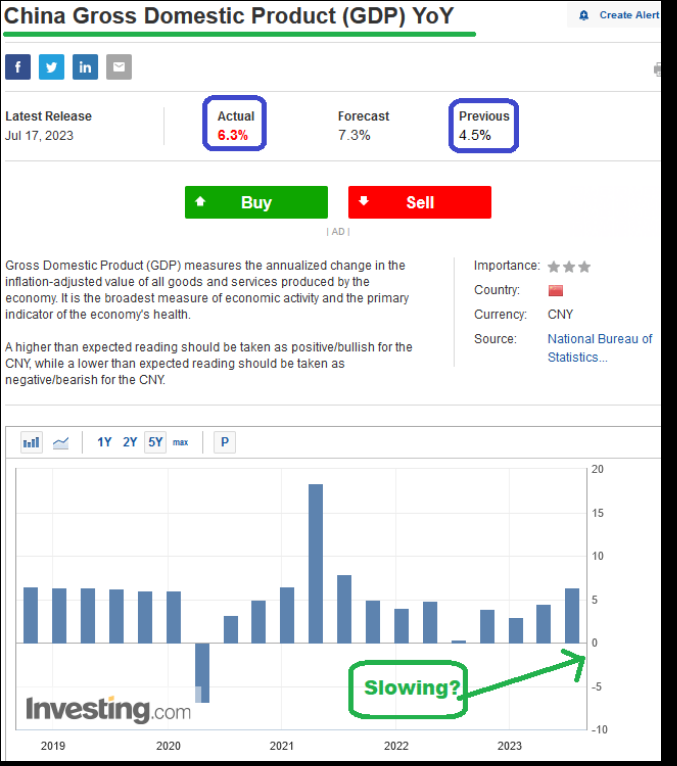

China Updates

Now onto the shorter term view for the General Market:

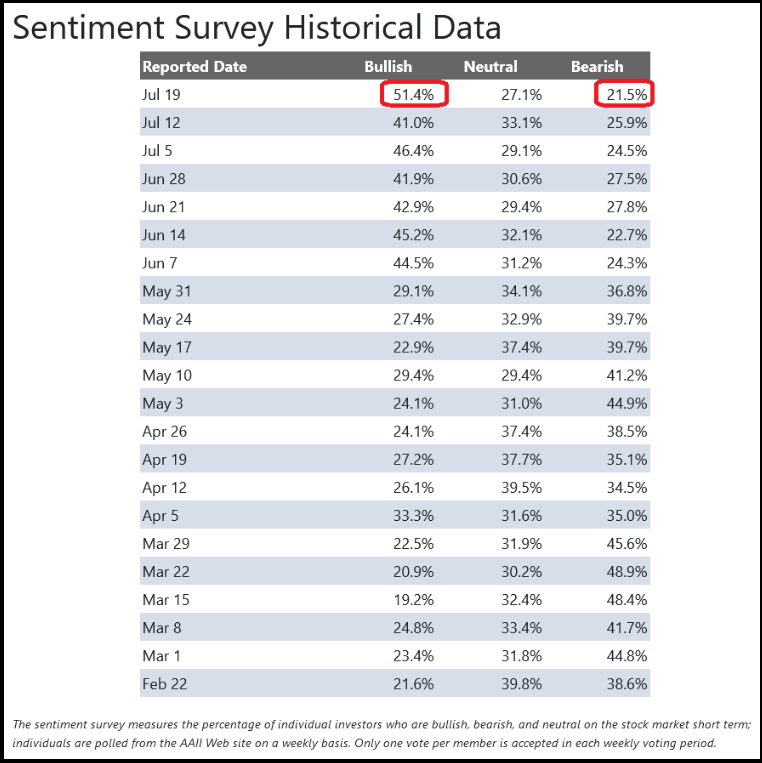

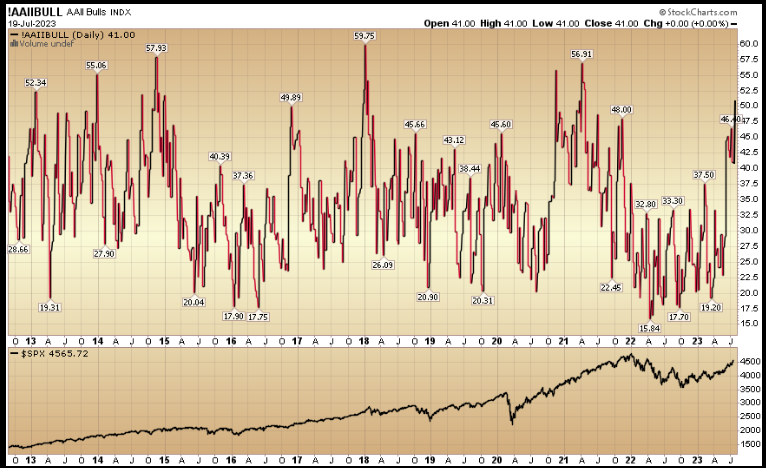

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 51.4% from 41% the previous week. Bearish Percent dropped to 21.5% from 25.9%. The retail investor is very optimistic. This can stay elevated for some time based on positioning coming into these levels, but it would not surprise us to see a little give-back in coming weeks (even if we were to push a bit higher first). Keep in mind, institutional investors are nowhere near fully invested yet, so there will be a persistent bid on any bumpy pullbacks through year-end.

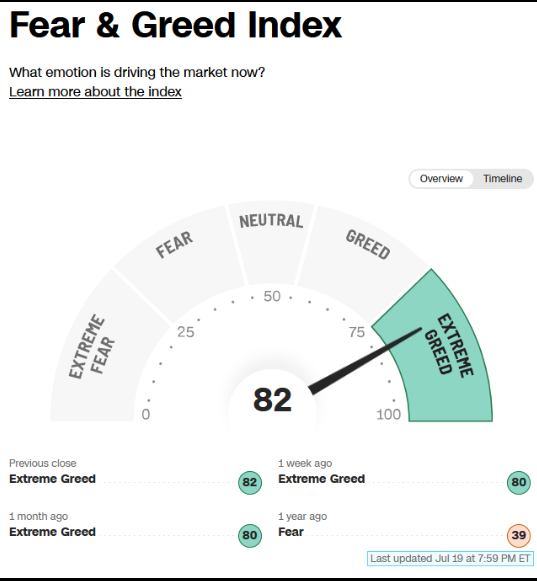

The CNN “Fear and Greed” ticked up from 80 last week to 82 this week. Sentiment is hot and has remained pinned for several weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

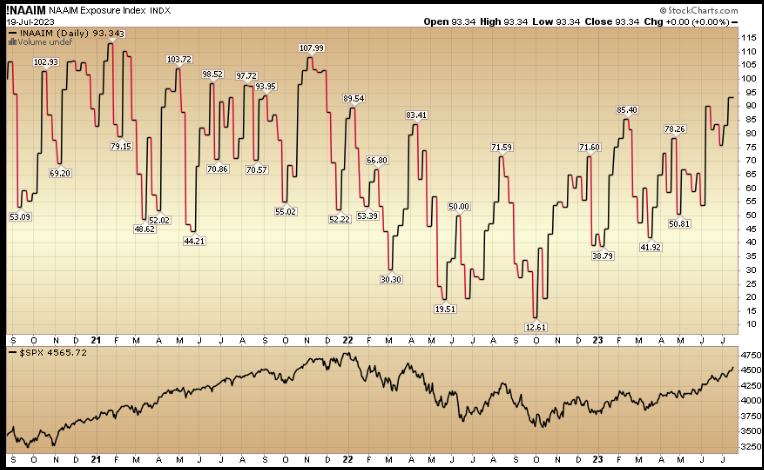

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 93.34% this week from 83.11% equity exposure last week. Managers have been chasing the rally.

This content was originally published on Hedgefundtips.com