The leadership at the Federal Reserve has consistently signaled its intention to lift rates this year. It is conditioned on the labor market continuing to absorb the slack, and provided the officials can be "reasonably confident" that the inflation target will be reached on a medium term.

The IMF has argued against this. It has suggested that the Fed wait until next year. Despite the lag time between the implementation of monetary policy and its economic effect, the IMF thinks inflation needs to rise more before a rate hike is appropriate. Temporal inconsistencies do not seem to bother it. If the Fed were to wait, forcing what some officials have suggested would be a steeper increase later, the IMF would likely criticize it for waiting too long.

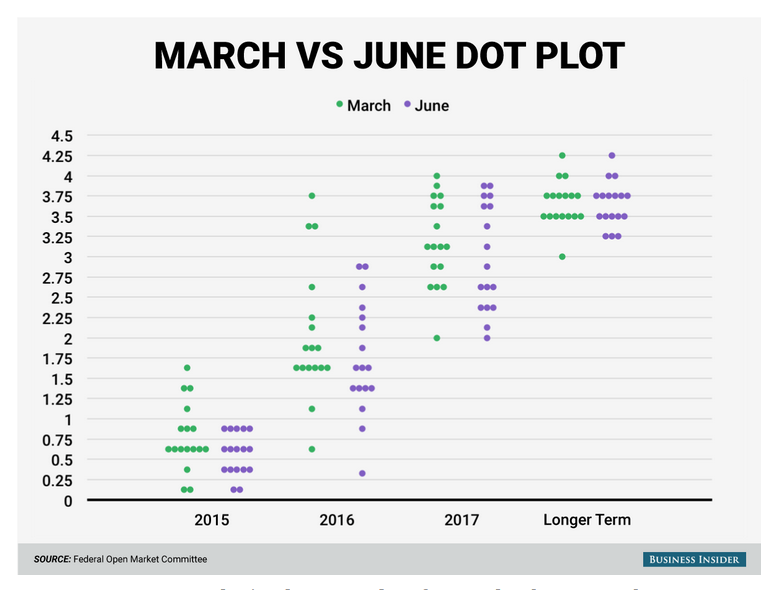

The IMF has come out with more unsolicited advice. A new staff paper suggests the Fed should drop the dot-plots and offer a single staff forecast similar to the ECB. The paper suggests this would improve the effectiveness of monetary policy. This Great Graphic that shows the March and June dot plots was published on Business Insider.

At one of her first press conferences as chair, Yellen played down the signaling of the dot-plots. We have also suggested that there is a high noise to signal ratio in the dot-plots, which many observers still spend a great amount of mental energy in trying to decipher for three months and then begin again with when the new dot plot is published. Many Fed officials recognize the shortcomings of this tool, and a Fed committee is reviewing the central bank's communication.

We have suggested that the Fed consider dropping the dot plots, but increasing the Fed's communication by hold a press conference after every meeting, like the BOJ and ECB do. This will also circumvent the challenge of announcing a policy change without a scheduled press conference. Yellen has said that the Fed always call an impromptu press conference, and while this is factually true, we suspect operationally it would be difficult to achieve. Word of a unscheduled press conference would quickly spread in the markets and be more disruptive then helpful.

Some observers argue that since Yellen has said that it will not be limited to pre-scheduled Fed meetings for changing policy that it has put its credibility on the line, and will have to deliver. We are sympathetic to that view, but not for the first hike. The IMF's recommendation suffers from a similar problem. The IMF's forecasting ability, as we have seen repeatedly (and most tellingly in terms of Greece) leaves much to be desired. Almost by definition, a Fed's staff forecast will likely be no better than the private sector consensus over time. The short-run deviations will not enhance its credibility or what the IMF says is the effectiveness of monetary policy.

Doesn't the IMF have other more pressing issues that to wade into a largely technical and idiosyncratic debate, not about policy but how that policy is communicated? It is difficult to prove or disprove that dot plots weaken the effectiveness of monetary policy. We continue to suggest that investors do best by focusing on the Fed's leadership from which policy emanates (Yellen, Fischer and Dudley). It is true that their dots are not recognizable, but their other communication vehicles indicate that they are committed to raising rates this year.

We argue that telling investors what it plans on doing and then doing it (see the tapering experience as a case study), that makes for effective and credible monetary policy. If the Fed were to listen to the IMF's staff advice, and not raise rates until next year, wouldn't that undermine the Fed's effectiveness in this context? Could it really be repaired by offering a single forecast?