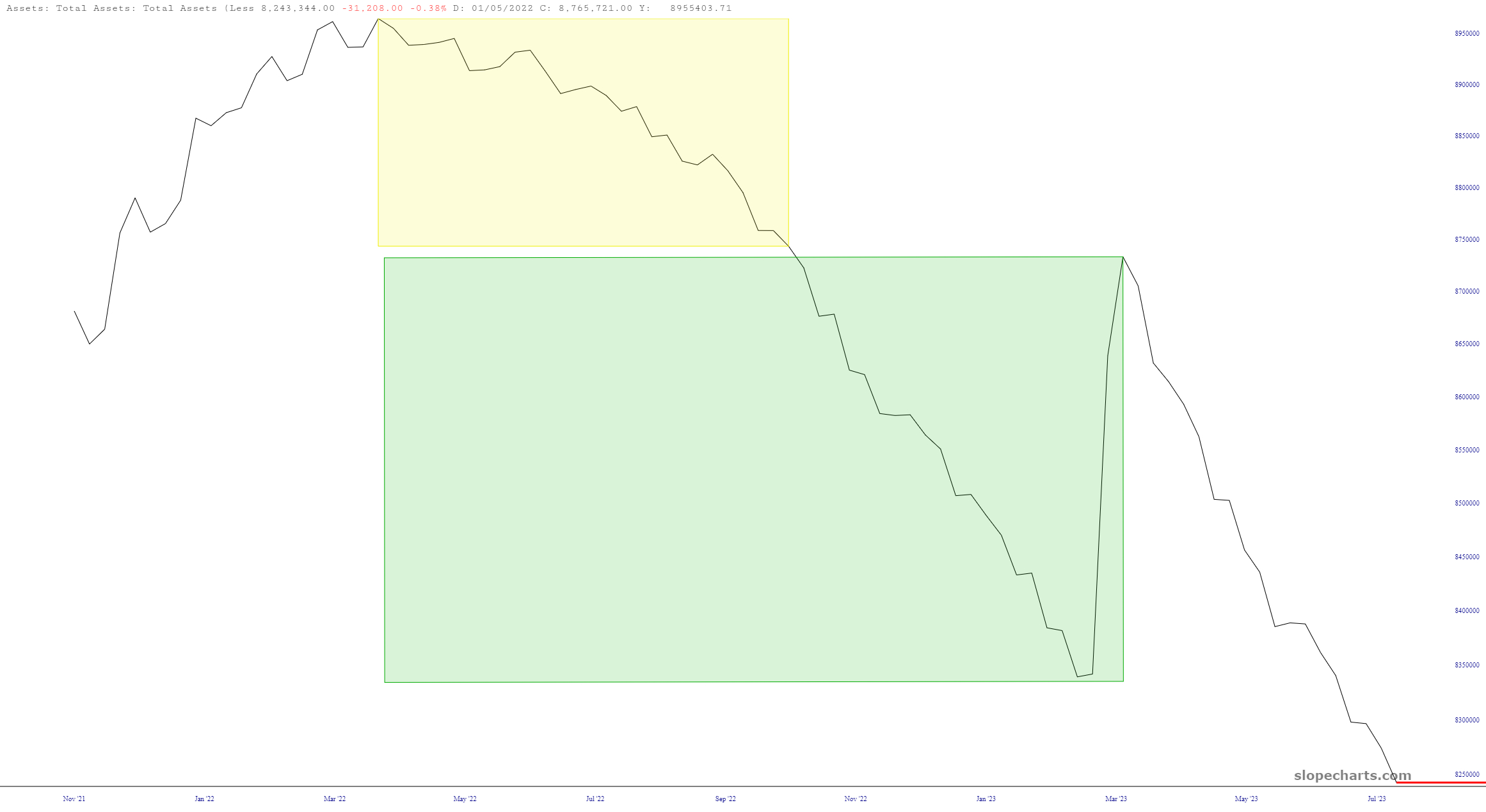

In the first half of March, as we plummeted toward the reality that some of the biggest banks in the country were going to collapse, it would seem to be the picture-perfect kick-off to a huge bear market. Well, nope, nope, and nope. Because instead of providing a reason for a bear market, it instead provided an EXCUSE for the government to trot out more “accommodations” for the banking golf buddies of Yellen and Powell. Thus, even as we observe that quantitative tightening is moving apace.

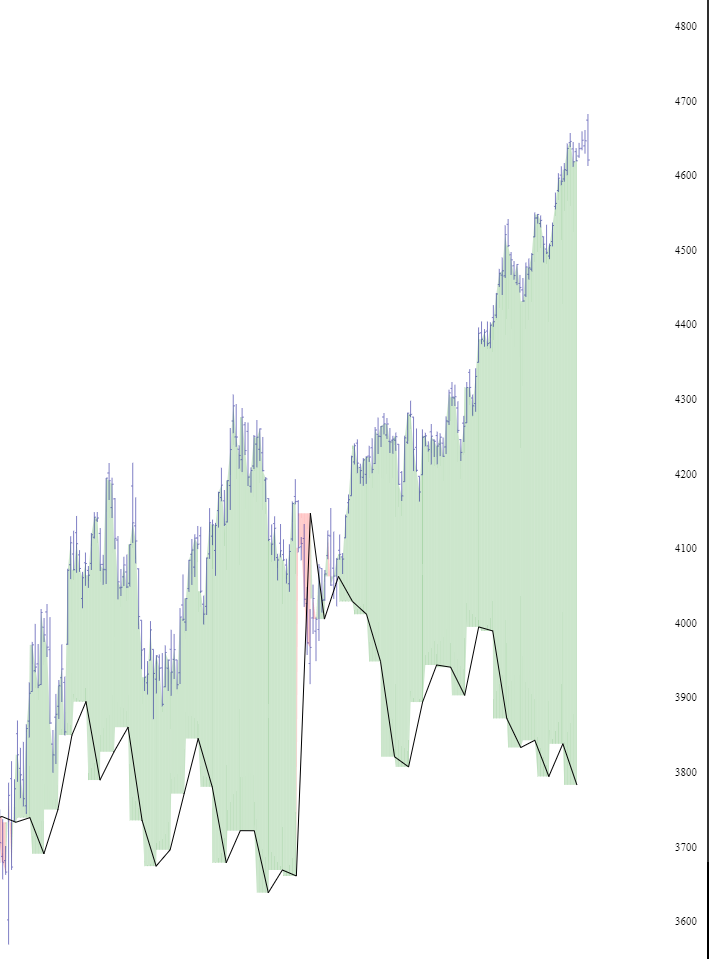

The “Fed Spread” (or should I call it Dead Fed Spread?) has become ludicrously wide, approaching 800 points! I mean, honestly, this is absurd:

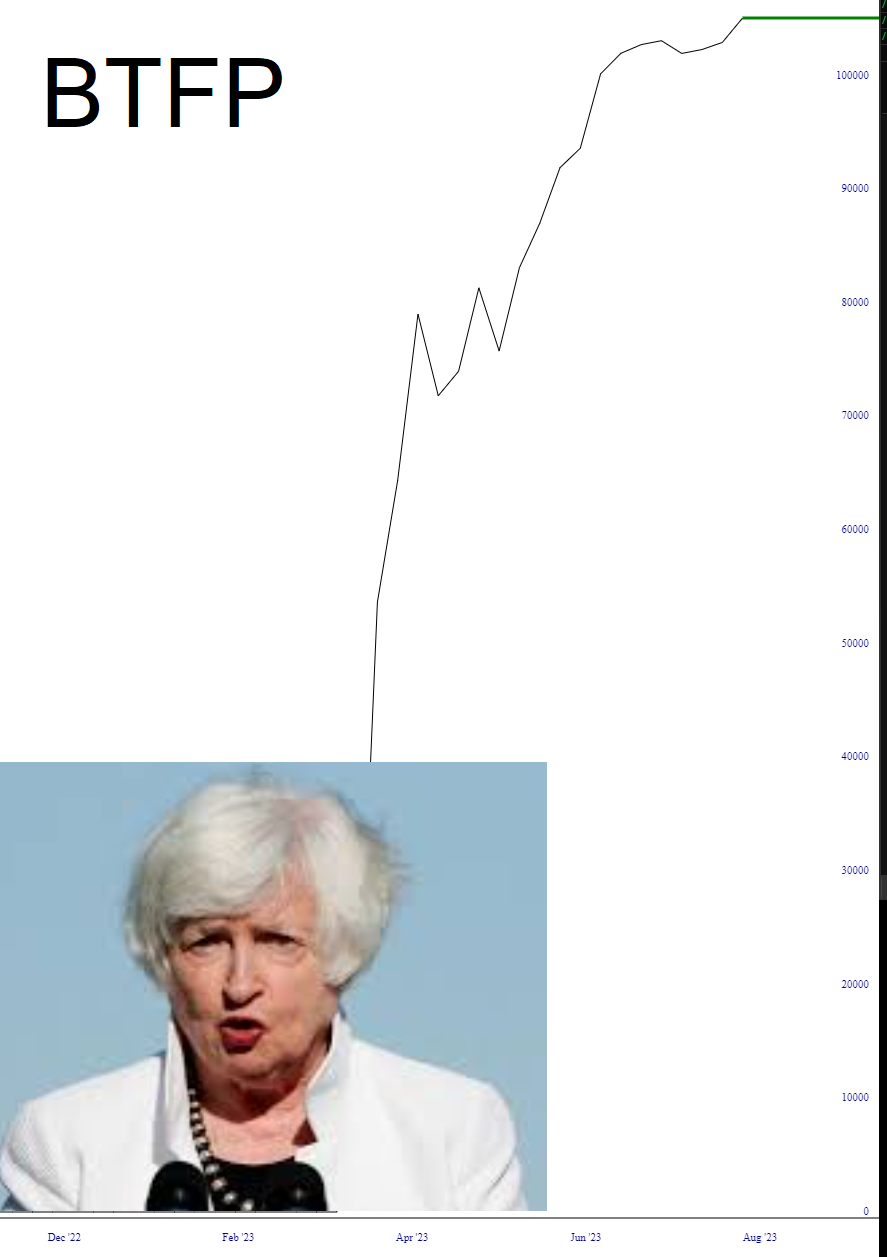

And why? Because of Yellen’s BTFP program, that’s why. As you can see from the latest data, the bankers keep piggishly gobbling up all those free billions and ramming those billions right back into equities. It’s revolting, but it certainly explains a lot.

The point is that had “mid-March” not happened, things would be radically cleaner and easier to untangle than they are these days. But………..we are we we are.