It’s been a wild ride in 2016 for most gold community investors. Rather than wane, the violent price action may be about to accelerate.

Top Goldman analysts are open to a stunning move in the oil price over the next 24 hours, as a key OPEC meeting takes place!

Tactics? Oil is likely to move higher in 2017 regardless of the outcome of this meeting, so I want to be a buyer of any significant price weakness.

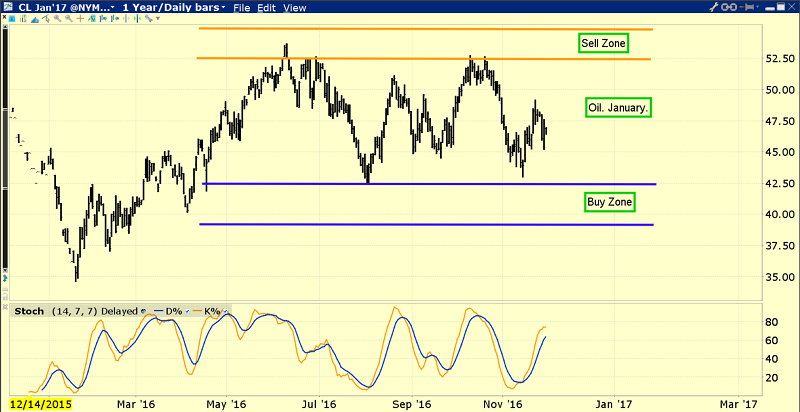

These are the current buy and sell zones for the daily bars oil chart.

There may not be any OPEC-related pullback to my $40 area buy zone, but oil price enthusiasts should be decent buyers there, if it happens.

If oil moves as violently as Goldman is predicting, gold could also experience some wild price movement.

Note the buy zones and my 14,7,7 Stochastics series oscillator that I use exclusively on daily charts for major asset classes.

A beautiful buy signal for that oscillator is very near at hand!

Many investors are wondering what caused this violent decline in the price of gold that began on US election night. Here’s the likely answer:

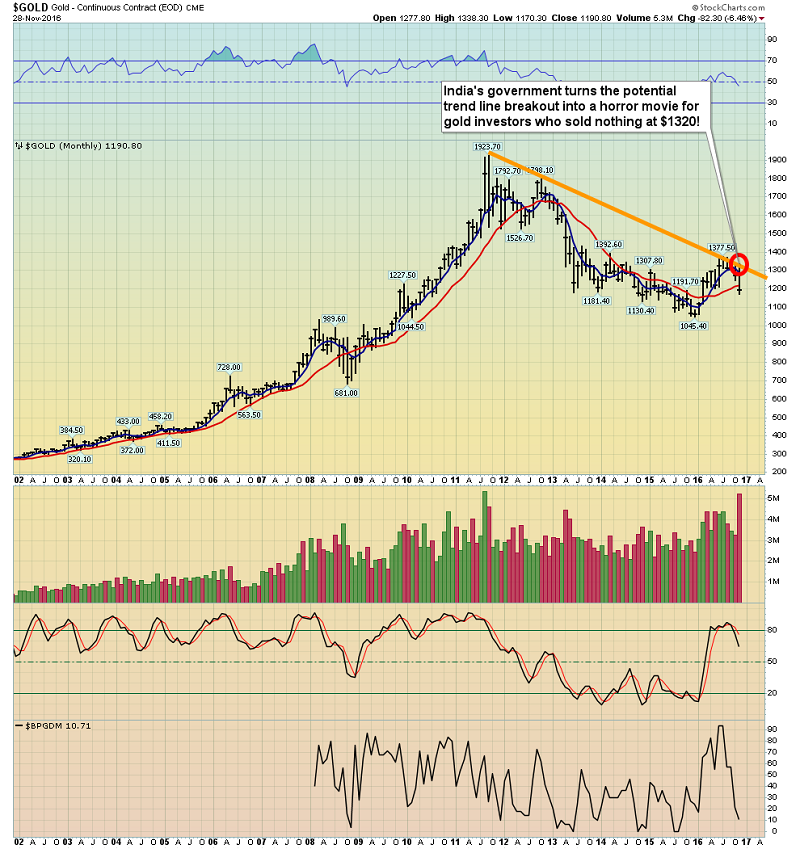

When vote counts began to show that Donald “The Golden Trumpster” Trump would win the US election, gold surged well into my key sell zone at $1320, reaching about $1337.

This is the monthly bars gold chart.

I sold a decent amount of gold as it rose into the sell zone, even though the price was flirting with an upside breakout from a key monthly chart downtrend line.

In my professional opinion, gold would have achieved the trend line breakout, but only if the Indian government had not suddenly showed up on the scene that same night… with a horrific announcement that overwhelmed the US election news.

The bottom line is that a massive fiat cash call-in was announced, crimping the ability of Indian citizens to buy large amounts of physical gold.

As the true size of the call-in became understood, gold tumbled violently down to my fresh but modest buy zones of $1215 and $1180. I’ve taken buy-side action, and I urge the entire world gold community to do so as well. Buy modestly, but buy!

Whenever gold bullion enters a buy zone of modest size, gold stocks and silver bullion can also be bought, also with modest size.

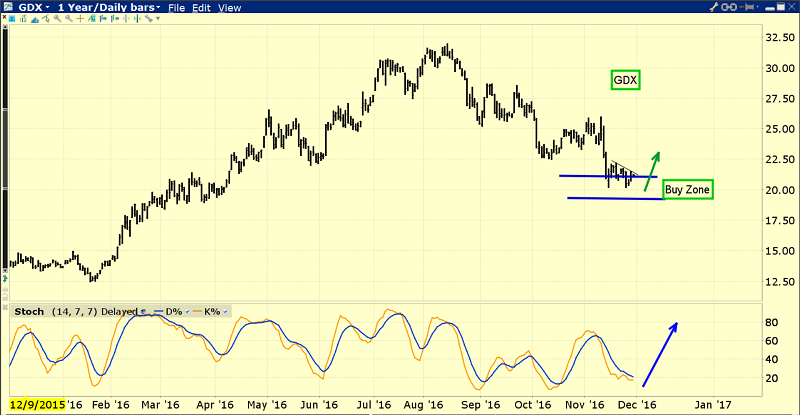

This is the GDX (NYSE:GDX) chart.

GDX has entered the $21.42 - $19.02 accumulation zone, and all gold stock enthusiasts should take buy-side action.

This is the GDX daily bars chart. Note the excellent position of the Stochastics oscillator at the bottom of the chart.

The current time may be a confusing one for the world gold community. The election of Trump was supposed to send gold soaring. There is now talk of an imports ban in China. The action in India borders on the surreal.

My view on the situation is this: gold is the ultimate asset, so investors need to be prepared for “ultimate price action” on any one of the 365 days in a year!

While the Chindian situation is mildly concerning, it’s temporary and countered by the upcoming Fed meeting. A rate hike will further incentivize banks to make loans, and that is the next step needed to reverse money velocity and generate serious institutional interest in gold ownership.

A fresh upcycle in oil seems imminent, and the Italian referendum comes next week. As of today, a billion Muslims will have the means to legally invest in gold products that were previously off-limits.

This is very important news for the world gold community. It should add about 1000 tons of demand over the next 12 months. It will also help to make gold a more respected mainstream asset. Bullion ETFs and perhaps even gold stock ETFs like GDX will be enthusiastically embraced. The official launch date has not been announced, but I’m predicting it will occur before this year ends!

Disclaimer: Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: