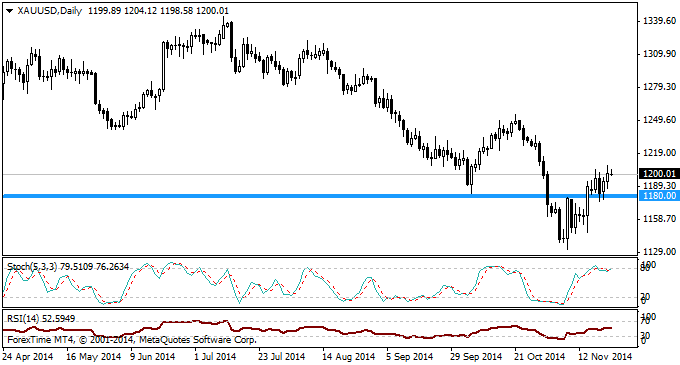

Compared to previous weeks, volatility in the Gold markets was quieter than what we have noticed recently. Gold largely traded between $1177 and $1205, with the latter being seen as resistance. The precious metal withstood pressure on Wednesday evening when the latest FOMC Minutes largely hinted that the first US interest rate rise would occur between the middle and latter 2015 – increasing demand for the USD. However, the widely spoken about $1180 psychological support level came to the rescue once again, with Gold touching $1177 before concluding the week as high as $1207.

Although Gold has spent the majority of the latter half of 2014 trading strictly in accordance with US economic news, it might be worth investors keeping an eye out on economic news elsewhere. For example, the early Monday morning news has already suggested that global business confidence is at a five-year low and with the People’s Bank of China (PBoC), European Central Bank (ECB) and (Bank of Japan) (BoJ) all easing to stimulate their economies, further global economic concerns could push investor attraction towards Gold. In regards to US economic data, attention should be paid towards US GDP and Consumer Confidence (Tuesday), Durable Goods (Wednesday) Initial Jobless Claims (Thursday). Further signals of the US economic outlook continuing to improve this week would likely pressure metals.

In reference to the technicals, Gold has currently found resistance around the $1205 area and would need to surpass this level if it were to make a move towards future resistance around $1215 and $1223. Support can be found at $1190, with critical support being located around the $1180 support level. If the value of Gold was to decline back to the $1150 area, a solid break below $1180 would be required.

Disclaimer: The content in this article comprises personal opinions and ideas and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime Ltd, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability as to any loss arising from any investment based on the same. There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold: $1180 Support Comes Back Into Play

Published 11/24/2014, 04:07 AM

Updated 06/07/2021, 10:55 AM

Gold: $1180 Support Comes Back Into Play

ForexTime

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.