- Paul Tudor Jones

There are powerful arguments for why gold should continue to go up. There are also powerful arguments for why bonds (specifically U.S. Treasuries) should go down.

These arguments, in fact, are two sides of the same fundamental coin: An expectation of inflationary outbreak via mass money printing and central bank loss of control.

Consider, for example, the various scenarios in which U.S. Treasuries could crash (causing interest rates to skyrocket) and gold could go vertical:

1) Stimulus-enhanced recovery unnaturally accelerates, morphing into katastrophenhausse, or “crack-up boom,” as ZIRP-juiced credit activity amplifies leverage and the Federal Reserve refuses to withdraw accomodative monetary policy (for fear of the 1937 experience).

In this scenario, the markets recognize a new dominance of ‘hot money’ and accelerated speculative transactions, the “risk-on” gold rush comes to the fore, and bond prices collapse. Gold simultaneously rises along with food and energy inflation fears.

2) Global slowdown (first Europe, then Brazil, then China, then softening US gives way) leads to deflationary downward spiral - falling oil prices, falling equity markets, rising panic - which in turn leads to “nuclear” stimulus response efforts (QE III, LTRO II, Beijing Stimulus X, etc) that finally triggers a confidence-collapse tipping point in which traditional financial institutions are both symbolically and literally abandoned.

In this scenario gold comes into its own as “the ultimate credit default swap” - rising ever higher as a safe haven and currency debasement refuge - even as low-to-no-yield government securities are dumped as fiscal capital death traps.

Either of the two — red hot recovery or nuclear stimulus response - could fuel a fundamental backdrop in which gold skyrockets higher and bonds collapse.

There’s just one problem: The above is not what’s happening… neither price action nor real-time reaction to current events is confirming one of the two major “gold up, bonds down” scenarios.

If the macro picture were playing out towards the “gold up, bonds down” resolution in the major way so many fundamentally committed market participants are expecting, the charts would be hinting at such, or at least broadcasting a ‘neutral’ message.

Yet they aren’t…

We opened this piece with some food for thought via macro trading legend Paul Tudor Jones, re, importance of reading the tape, i.e. paying attention to price.

Here’s another PTJ gem, suitable for taping to the side of your monitor:

[No loyalty to positions] is important because it gives you a wide open intellectual horizon to figure out what is really happening. It allows you to come in with a completely clean slate in choosing the correct forecast for that particular market.

When it comes to macro forecasting, price action (charts) are an integral aspect of “choosing wisely” (insert Indiana Jones reference here).

As Mercenaries we have been bearish on gold for some time now.

At one point we were bearish on bonds - even labeling short Treasuries a potential “trade of the year” candidate - but stepped away from that view when the price action did not confirm (and when our low risk short bond position, pyramided off an initial profit base, closed out on sufficiently adverse price action to disconfirm the scenario in question).

This is “no loyalty to positions” at work. (Be loyal to your friends, not your trades!) In similar vein, we have no “loyalty” to our bearish gold stance at this juncture.

If gold starts “acting right” once again, we will consider a long side trade… but not before the market tells us to.

Why? Simple:

- When it comes to macro positioning, there are often multiple branches on the scenario tree (i.e. multiple ways things can play out).

- Furthermore, it is often the case these multiple branches have a bipolar aspect to them – meaning, scenario “A” is highly bearish for gold, yet scenario “B” is highly bullish and so on… or vice versa for bonds, equities etc… and we don’t yet know which one will crystallize.

- This is why intellectual flexibility and “tape reading,” i.e. paying attention to the charts, is so important. To trade macro successfully — or, heck, to invest at all successfully these days — you must

- 1) be intellectually aware of multiple scenarios,

- 2) be patient enough to wait for scenario confirmation,

- 3) be nimble enough to profit accordingly (w/ price action as your guide)

- all the while 4) practicing diligent risk control (fallibility awareness)

That last one, fallibility awareness, is huge. All you investors out there who stick like glue to your views, disregarding fallibility awareness completely… I gotta say I just don’t get it. You are either way too smart for me, or else my instincts are right and you treat your precious investment capital with the same regard as a parent who lets their kids play on the freeway.

Back to gold versus bonds and the price challenge to gold believers:

It is a tendency of macro-level fundamental players to dismiss near term price action as “noise,” and to rely on longer-term trends as backing for their general views.

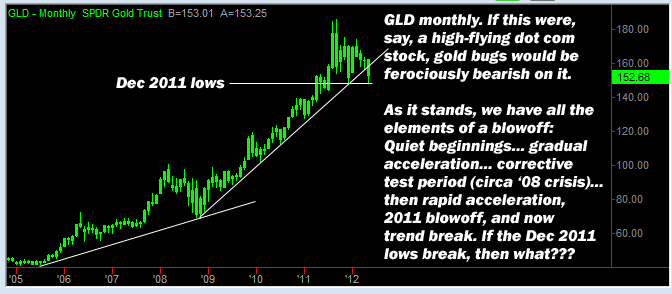

So with that in mind, let’s look to the monthly charts for gold and the ten year, via mega-popular ETFs GLD and IEF (click to enlarge).

Ayn Rand once said, “When you think you are facing a contradiction, check your premises.” You don’t have to be an Ayn Rand fan to recognize that as smart advice.

Right now the price action in respect to gold and bonds - on a monthly chart level, which is going to be least affected by short-term speculative activity - is saying in a thick Brooklyn accent, “YO, GOLD BULLS / BOND BEAHS: WE GODDA MAJA CONTRADIKSHUN HEAH.” (Sorry for that awful phonetic rendering.)

Side note: In reference to a “food for thought” tweet that inspired this global macro notes installment, someone on Stocktwits essentially replied to me: “Look at the 100 year chart [for gold].”

My tongue in cheek response: “So if the 100 year chart breaks trend, will gold bulls say switch to the 1,000 year chart?”

It is further notable to yours truly that gold is acting so weak against a backdrop of renewed European turmoil.

Some Larry King style musings (though hopefully of more substance):

- As FT Alphaville has noted, capital is leaving Europe. So why isn’t it flowing into gold?

- Gold saw acceleration and potential blowoff into mid-2011. What if that move represented the anticipation and pricing in of all that is happening now?

- GDX bulls are pounding the table on how out-of-whack gold stock valuations have become, relative to the price of gold. But what if that valuation discrepancy corrects with a crash in the gold price, rather than a true GDX rebound?

- Deflationary bond bull Hugh Hendry has observed that bull markets tend to end with a bang, not a whimper. What if the spectacular bull market in US Treasury bonds - arguably two decades running now - still has an incredible “bang” left (driving yields down to Japan-like levels)?

Another extended Hendry / Shilling “what if deflation wins” riff:

- With Europe slowing down…

- China near a tipping point and running out of options…

- Japan getting downgraded… the UK in deep recession…

- Emerging market equities in the toilet…

- and the US jobless recovery on shaky ground…

- Is it possible, just possible, given the compiled evidence above, that the unprecedented tsunami of stimulus thrown at the slowdown problem was actually far too little to forestall the market’s post-supercycle deflationary fate? Could it yet be that the global central banks’ “massive” stimulus efforts of the past three years, in comparison to the scope of the deflationary wealth destruction at hand, pending a collapse in multiple DECADES of leverage and structured credit drivers, are the metaphorical equivalent of tossing a mattress into a volcano?

If the above is true - that the deep undercurrents, the post-supercycle wealth destruction and economic contraction trends after 25 years of binge (1982 on), are to heroic central stimulus efforts as godzilla is to an oversized iguana… if “throwing a mattress into a volcano” is a CREDIBLE view of what is happening now, vis a vis stimulus versus deflationary impact… then a scenario in which bonds yet advance to incredible, bull market supernova levels, with correspondingly jaw-dropping low yields, actually makes sense as stimulus efforts slow-motion fail… with further stimulus thwarted by austerians on both sides of the Atlantic… and in such a scenario the gold price could yet drop like a hot rock (or even crash).

As a bonus reason for gold bugs to be nervous, John “Riverboat Gambler” Paulson, aka “Sino-Forest for the Trees” Paulson, is up to his eyeballs in underwater gold positions - and clients are none too happy about it:

Investors with legendary hedge-fund manager John Paulson aren’t taking a shine to his gold metal performance - in fact, some are heading for the exits.

Investors are upset over Paulson’s huge gold positions - specifically, his outsize holding of AngloGold Ashanti, down 20 percent this year, The Post has learned.

That has dragged down two of Paulson’s funds.

“I would be happier if he cut the gold position in half,” says one investor who put in a notice to take his money out of the fund in June. “He would have been up 4 percent in the first quarter if it weren’t for the goddamned gold.” -- Laying a Golden Egg, New York Post

You wanna hang around and wait for this guy to blow out the last chunk of his client base that hasn’t yet capitulated (but which is getting more fed up by the day)?

Me neither… even if one is truly agnostic on gold, and merely value based, the threat of the Paulson overhang has to be at LEAST as big a counter-concern as bullish gold stock fundamentals are a positive driver…

So let’s recap:

- To trade macro successfully, you have to pay attention to price. If you don’t, you will eventually get your head handed to you (ahem, Paulson cough cough)… there are too many bipolar branches on the scenario development tree for such to be otherwise.

- Whether they claim to be macro or not, bets on gold stocks and / or the gold price are distinctly macro in nature.

- There are credible scenarios for the “gold up, bonds down” outcome - red hot recovery or nuclear deflationary response, respectively - but there is also a credible scenario for the reverse: Gold price crash, bonds massively further up, as “mattress in a volcano” stimulus efforts fail to dent the true level of global credit / wealth contraction, even as austerian political impulses in Western economies (Bundesbank, Tea Party et al) hold central bankers in relative check.

- Right now, price action is NOT favoring the “gold up, bonds down” scenarios that so many fundamental gold bugs favor… and as we have said, ignore price long enough in the macro game and you will eventually get carried out.

Final note, which, based on the nature of comment replies, needs to be added: We are NOT perma-bears on gold, and would be happy to switch our orientation back to “gold up, bonds down” if price action started once again CONFIRMING, rather than disconfirming, that particular branch of the scenario tree…

But right now that ain’t happening.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for full disclaimer.