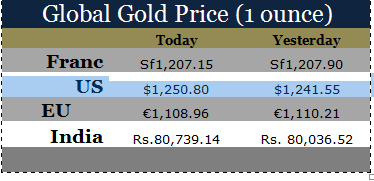

Gold Today –New York closed at $1,244.30 yesterday after closing at$1,255.90 Friday.London opened at $1,250.00 today.

Overall the dollar was slightly weaker against global currencies, early today. Before London’s opening:

- The EUR/USD was weaker at $1.1256 after yesterday’s$1.1199: €1.

- The Dollar index was weaker at 96.97 after yesterday’s 97.25.

- The Yen was weaker at 111.77after yesterday’s 111.49:$1.

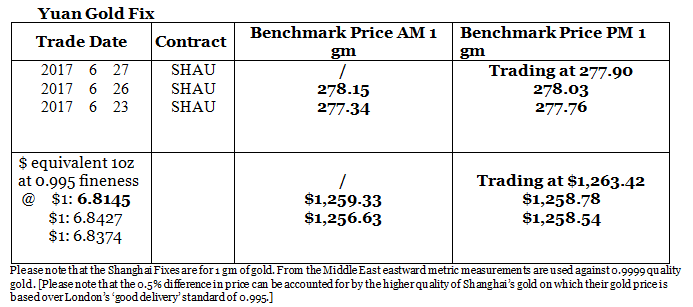

- The Yuan was weaker at 6.8145 after yesterday’s 6.8427: $1.

- The Pound Sterling was slightly weaker at $1.2748after yesterday’s $1.2751: £1.

Shanghai ignored the price action in London and New York. As you can see above, the gold price there has steadily risen in the last three days and adjusted for the gyrations in the Yuan as it suddenly went strong after weakening in the last two days. With both London and New York recovering fast now Shanghai is pulling them up. New York went $16 lower than Shanghai yesterday, but London opened $13.42 lower than Shanghai. If the recovery continues in both London and New York today, we will see more evidence of Shanghai dominating pricing power.

The action on the Yuan corrected our view that thought that the P.B. of C. was allowing the Yuan to weaken. Its sudden strength showed they do not want a weaker Yuan at all and will act accordingly. Those positioning in a weaker Yuan paid a hefty price. We think such actions by them discourage speculative action by punishing speculators with losses.

Silver Today –Silver closed at $16.57 yesterday after $16.70 at New York’s close Friday.

LBMA price setting: The LBMA gold price was set today at $1,250.40 from yesterday’s $1,240.85. The gold price in the euro was set at €1,111.17 after Friday’s €1,109.88.

Ahead of the opening of New York the gold price was trading at $1,250.80 and in the euro at €1,108.96. At the same time, the silver price was trading at $16.68.

Gold (very short-term) The gold price should consolidate with a stronger bias, in New York today.

Silver (very short-term) The silver price should consolidate with a stronger bias, in New York today.

Price Drivers

Yesterday, we thought the sale at the open in London must have been a physical sale, but it wasn’t, it was a ‘paper’ sale, where it was thought that someone made a huge mistake selling ‘lots’ in the futures market instead of ounces. The deal was 56 tonnes of gold a massive amount that has not been seen since the gold price was crushed in 2013. Whatever it was, we learned a great deal about the behavior of markets then right up until now and likely tomorrow.

Lesson 1: Shanghai, a physical gold market, is not influenced by London and New York in such speculative lurches.

Lesson 2: To impact the gold price solidly, physical sales are needed in gold’s global markets.

Lesson 3: The influence of ‘paper’ gold markets [Futures and Options] is declining rapidly as physical sales or purchases directly affect gold prices. Paper sales do not involve physical gold sales in such cases. The speed of the price recovery in the face of such massive sales confirms what we are saying.

Lesson 4: When such speculative sales take place dealers in London and New York take up defensive positions in case of stop losses or further sales, but return to higher prices when buyers came in, which they are doing in both the ‘paper’ and physical gold markets. The charts may show a rapid take up of such ‘paper’ contract sales, as one saw in the F & O markets, probably by ‘limit’ purchase orders below the market prices. Nevertheless, the SPDR gold ETF saw buyers come in at these levels to buy physical gold. The markets both physical and ‘paper’ now know the strong underlying strength below $1,250. The ‘Golden Cross’ remains intact!

We see the gold price recovering to levels seen before the sale, at least, as physical dealers move prices higher for fear of more physical gold buying, likely from Shanghai through arbitrageurs. If the sale of 56 tonnes was an attempted ‘bear’ raid we do not expect to see more in the future, unless they involve large amounts of physical gold. When they do come in, expect Shanghai to pick up the physical stock sold.

SPDR Gold Shares (NYSE:GLD) ETFs – Yesterday saw purchases of 2.666 tonnes of gold from the SPDR gold ETF but no change in the Gold Trust. Their holdings are now at 853.684 tonnes and, at 208.41 tonnes respectively.

Since January 4th 2016, 250.346 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 49.64 tonnes have been added to the SPDR gold ETF and the Gold Trust.