To say it has been a turbulent week in markets would be a dramatic understatement. The moves around the US election were nothing short of incredible. We wrote last week about fading a risk off move over the election, and whilst we expected market nerves to calm after an initial period of uncertainty, we were completely blindsided by the pace and magnitude of the reversal. Nowhere are we more surprised than in the yellow metal’s reaction to the result. Not only do we view it as an overreaction, but actually view the gold prices as significantly undervalued in the current environment.

Inflationary Fiscal Policy

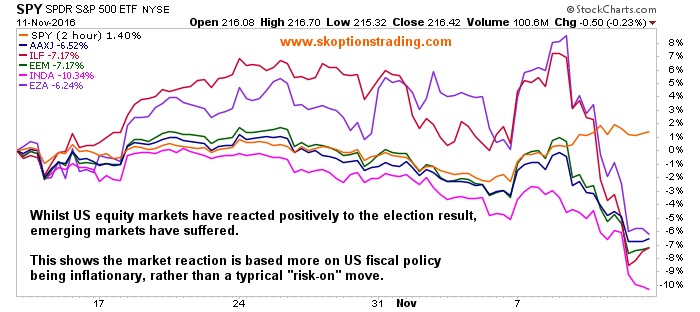

The market appears to have taken the view that a Trump presidency will be inflationary. Bonds have been sold, interest rates have risen, and the market has stepped up its expectations of Fed tightening. Given a December hike as a given, then market now has over 100bp of hikes priced in over 2017-2019.

It is important not to confuse this inflationary reaction as “risk on”. Although the S&P 500 has rallied, this is again a symptom of the inflationary reaction. Emerging markets have been crushed.

We are cautious about the reaction. Whilst aggressive US fiscal policy can be inflationary, the effects of such policies take time to feed through. Of course such policy still has to be proposed, agreed upon, and implemented.

When the Hoover Dam project was announced during The Great Depression, thousands of unemployed Americans flocked to Nevada looking for work, shovels at the ready. They were bitterly disappointed when they learned that it would be years before any labour was required, since the dam still needed to be designed, construction planned, and materials sourced.

The story that inflation is coming has been repeated numerous times since the Global Financial Crisis, yet it has yet to really make an entrance. Treat rhetoric along the lines of “this time it’s different” with a large grain of salt.

Gold Drops Back To Support Zone

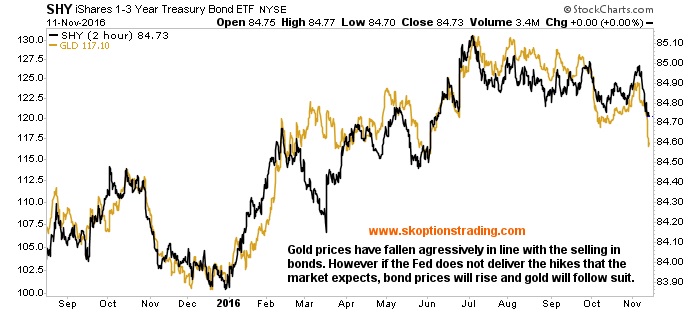

We saw a big drop in the yellow metal this week as it fell right back to the $1225 support zone. This was in line with the fall in bond prices and USD strength, with the move turbo charged by the realisation that a Fed hike is now just a month away and 85% priced in.

Despite the price action, we find ourselves turning increasingly bullish on gold prices. When we consider the macro economic factors at play and how they have changed over the week, we struggle to come to any other conclusion than that gold could go through a major rally over the next year.

Consider Foreign Policy, Not Just Fiscal

We have mentioned the potential for US fiscal policy to be inflationary, but haven’t touched on foreign policy. There are two major changes to note there. Firstly the geo-political risk premium should increase given the change in government and its more aggressive stance on numerous issues in the Middle East.

Secondly the change in government is likely to result in more protectionist policies, tariffs, import duties and similar measures to protect domestic industries against foreign competition with the aim of increasing domestic growth and employment. This is undoubtedly a policy path that leads to USD weakness in our view.

FOMC Will Maintain Cautious Stance

The Fed is going to struggle to deliver what the market now expects in terms of tightening. We are nearly seven years into the economic recovery and we are only just approaching the second hike. Yet the market expects another three hikes over the next two years.

Yellen has said that the Fed would be happy to see inflation overshoot their targets, rather than tighten prematurely. Not only will the inflationary impacts of US fiscal policy take time to be reflected in the data that the Fed has made monetary policy dependent on, but the Fed would be content to see inflation tick higher without tightening, to ensure the economy is running hot enough to take some cooling from higher rates. Of course, this all presumes that such projects do go ahead, and quickly.

Mispriced Risks Creates Opportunities

Bringing this back to gold, given the balance of risks and the current level of gold prices, we see an asymmetric risk of a major rally. The market is counting on a Republican government to rapidly put into place aggressive fiscal spending, which will flow through to inflation and lead the Fed to aggressively hike, seeing gold prices fall $75 this week.

However we believe the market is nearly fully discounting the following risks;

- Government spending is delayed or doesn’t come at all

- Said spending does not lead to inflation due to slack in the US economy

- The Fed lets inflation run higher without hiking aggressively

- Protectionist policies see the USD weaken

- Increased geo-political uncertainty in the Middle East

- Large systemic risks from Brexit

- US economic data turns after seven years of improvement

Risk-Reward Dynamics In Favour Of Gold

Therefore when we look at the risk-reward dynamics in long term options on gold they are very compelling. We will likely begin to execute some of these strategies in the coming weeks and layer into a significant medium term long position in gold.

The next $25 or $50 move in gold prices could be either way given the current volatility. However the next $250 move is far more likely to be higher than lower in our view. Therefore we intend to position accordingly and use options to tailor our trades to fit our view, whilst optimising risk-reward dynamics.