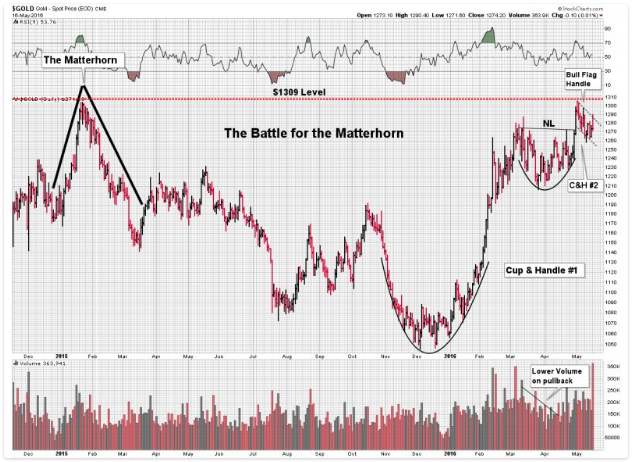

The voice of complacency says no pullback in gold. Anyone who took profits will not get a chance to reenter. Here is the chart.

Clearly this analyst was expecting gold to soon take out the 2014 high. It’s forming a bull flag and cup and handle patterns in preparation for the rocket launch, right?

Not necessarily. This is why I don’t put a lot of faith in chart patterns. They often morph into something else.

Doesn’t look much like a bull flag, or a cup and handle anymore does it?

As for analysts who said: “Bulls won’t get a reentry into the metals sector,” I’ve got news for you, we already have a 17% better entry, here (via VanEck Vectors Junior Gold Miners (NYSE:GDXJ)):

I’ll say it again. At intermediate turning points—either tops or bottoms—you need different tools to anticipate the turns. If you strictly follow chart patterns and technicals like most amateur analysts, more often than not you are going to get caught on the wrong side of the market.

And anyone who tries to convince you that the volatile metals market won’t have an intermediate degree correction, or that it will be mild, just hasn’t been paying attention. Gold is a very emotional asset for most traders. That means it tends to have big swings in both directions.

Let me stress again to have some patience. Both gold and silver will need to break their intermediate trend lines before the intermediate cycle low can be complete.

I’d also like to see the commercials reduce their large short positions considerably more, and I would like to see sentiment move a lot further in the bearish direction before I try to call an intermediate cycle low.