Following the FOMC minutes on Wednesday, gold has seen a massive two day move that brought the precious metal to five-week highs.

Worries mount as market participants are beginning to realize that the Federal Reserve is stuck within a liquidity trap.

The minutes statement indicated that the Fed saw risks to near-term inflation (as the five-year breakeven rate hit five-year lows) and growth. The once "sure bet" on a September rate hike quickly dwindled, and the possibility of another round of quantitative easing is growing.

There has been a lack of attention to two key revelations within mainstream media:

The Bank of International Settlements (the central bank of central banks) and the St. Louis Fed have come out publicly to express that quantitative easing has been the epitome of failure. Both institutions have stated that the massive balance sheet expansion and zero interest rate policy (ZIRP) has not added any growth to the real economy.

The BIS has even gone as far as to say that the world is defenseless against the next crisis, which many "Main Street" analysts believe is around the corner. In regards to a efficacy of ZIRP, the white paper publish by the St. Louis Fed said:

"A Taylor-rule central banker may be convinced that lowering the central bank's nominal interest rate target will increase inflation. This can lead to a situation in which the central banker becomes permanently trapped in ZIRP.

With the nominal interest rate at zero for a long period of time, inflation is low, and the central banker reasons that maintaining ZIRP will eventually increase the inflation rate. But this never happens and, as long as the central banker adheres to a sufficiently aggressive Taylor rule, ZIRP will continue forever, and the central bank will fall short of its inflation target indefinitely. This idea seems to fit nicely with the recent observed behavior of the world ís central banks."

But, this is not just the Fed's problem. Quantitative easing has been a failure in Japan and Europe. In a "defenseless" world and crisis looming, gold stands to greatly benefit.

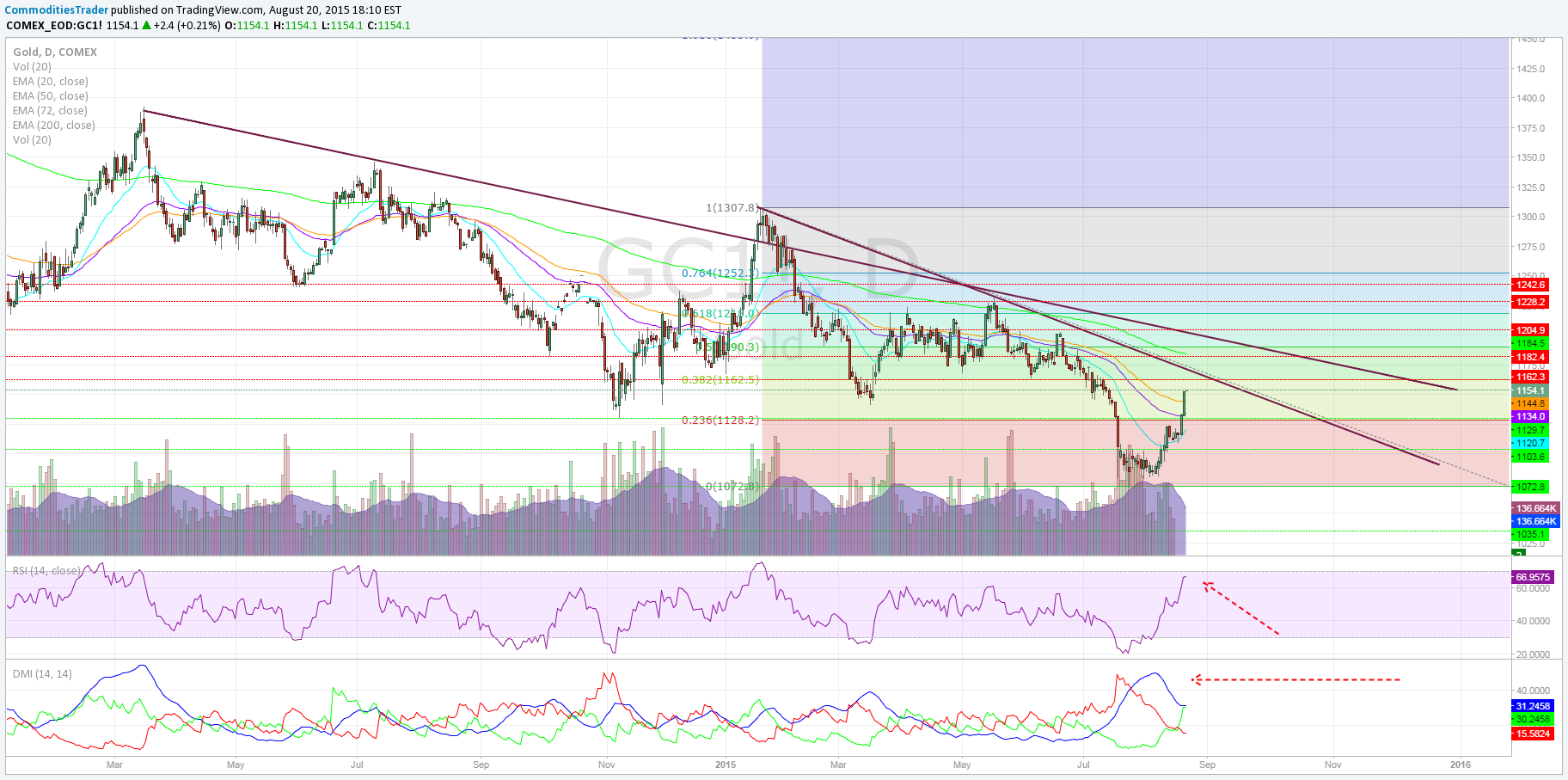

Price action for gold is fueled by short-covering (near-term) because the dollar just base-jumped of the hopes and expectations of a Wall Street recovery. However, as Pandora's box is opened, gold's upside potential becomes great.

Resistance can be found at $1,162, which is slightly below the descending trend created in late January. If price action can close above these key levels, gold will attempt to challenge the 200-day EMA near $1,182. The 50 percent Fib. retracement of January's downtrend is at $1,189.

As long as the dollar remains soft, gold will be relatively supported at these levels. Although, price taking can take place and healthy. The daily RSI is approaching 69, but the weekly and monthly RSI is below 45.

Moreover, the weekly chart is showing a bullish +/- DMI crossover, suggesting a potential inflection point in the most hated asset on Wall Street.

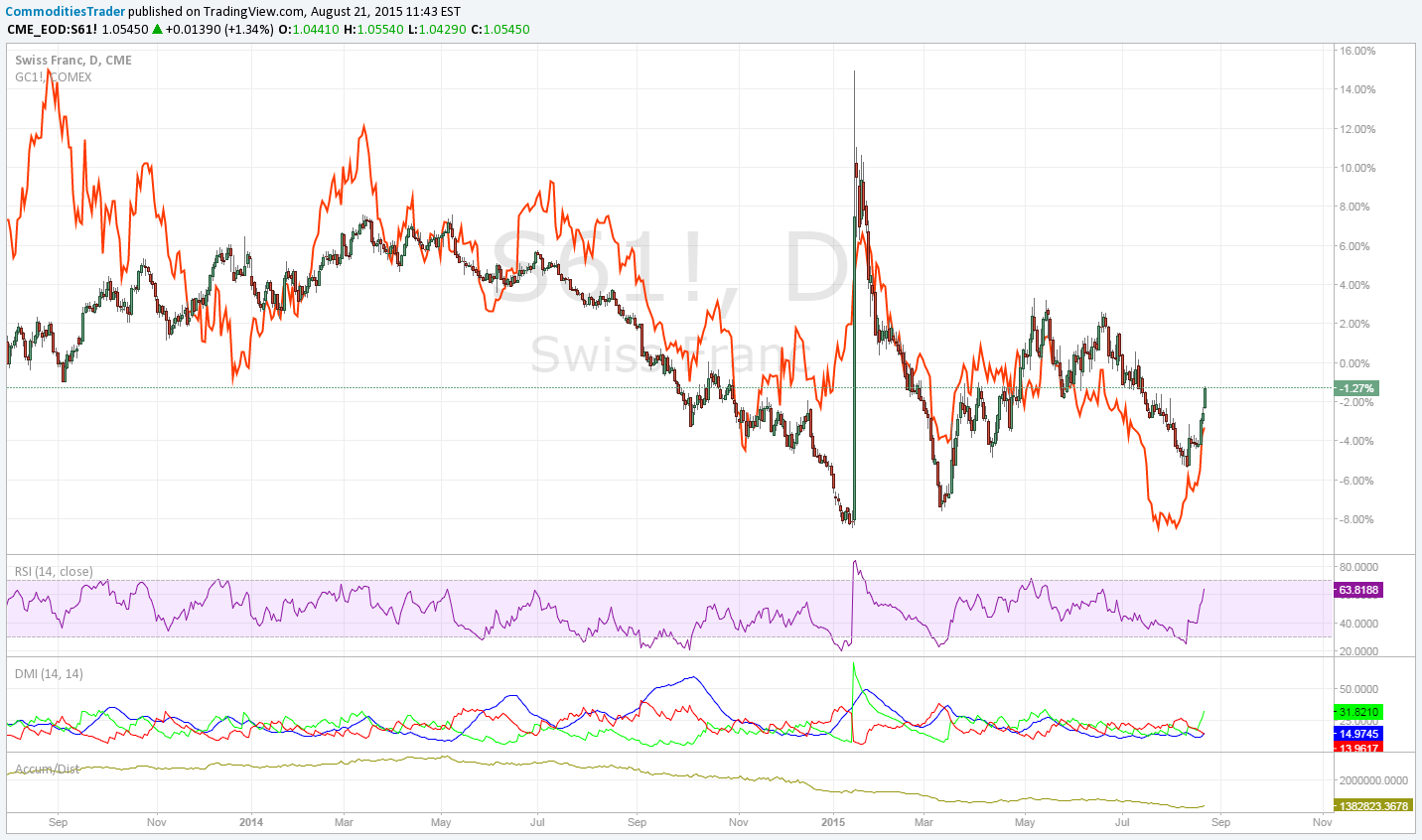

The Swiss franc continues to trade as a FX proxy to gold prices: