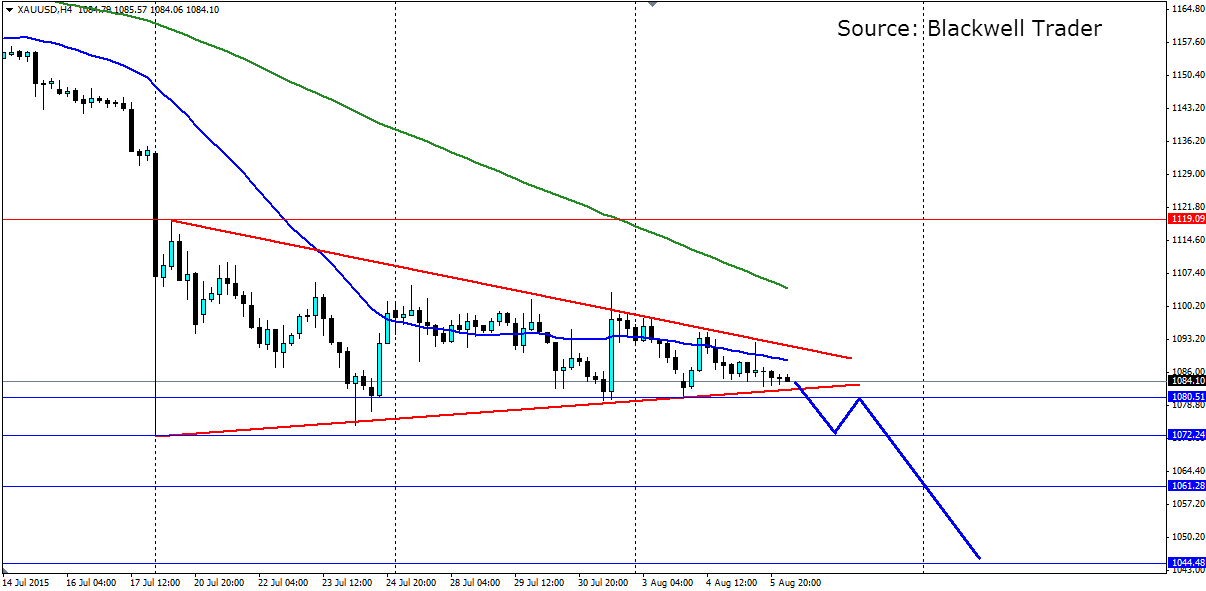

Gold has once again found itself in a consolidation pattern and this time it looks rather like the textbook version of a bearish flag pattern. This is likely to lead to a sharp breakout lower that will take gold close to the psychological level at the $1,000 an ounce handle.

After gold’s ‘flash crash’ two weeks ago, where someone dumped $2 billion dollars worth of the precious metal, it has consolidated not far above the lows it found. This sharp drop forms the ‘flagpole’ of the consolidating bearish flag pattern. From there we saw a roughly 50% retracement back up to $1,119.09 which forms the top of the shape. The price has consolidated and is now getting close to the sharp end of the shape so we can expect a breakout in the near term.

The Stochastic Oscillator also confirms the consolidation pattern. It has formed higher lows and lower highs as each wave gets tighter. Look for a break below the recent low on the Stoch to confirm a breakout. This will likely occur simultaneously as a price breakout.

The fundamentals also point to a weaker gold price. The Federal Reserve is widely expected to raise interest rates when they meet in September. This will certainly be bearish for gold because fixed interest assets will yield relatively more. Also keep an eye on the US Nonfarm Payroll figures due later on this week. If the result is stronger than expected, we could see it force the breakout of the flag pattern.

Traders looking to take advantage of the set-up can wait for the break of the minor support at 1080.51, which is outside the shape and will confirm a breakout if it holds as resistance. The length of the flagpole is generally used to determine the target for the breakout. In this case the flagpole is roughly $70 an ounce in length so we will be looking for a $70 breakout of the pattern. Further support levels that will be targeted are found at the recent low of 1072.24, and previous support levels at 1061.28, 1044.48 and 1026.74.