Fundamental Forecast for Gold: Bearish

Gold prices are sharply lower for a fourth consecutive week with the precious metal off by more than 2.6% to trade at $1331 ahead of the New York close on Friday. The losses come amid continued strength in the greenback with the Dow Jones FXCM U.S. Dollar Index also marking a fourth weekly advance into fresh monthly highs. The recent price action suggests that the resilience in the USD may continue to drive market volatility as the Fed prepares households and business for higher borrowing-costs.

The semi-annual Humphrey-Hawkins Testimony before the House Financial Services Committee and the Senate Banking Committee further supports calls for a 2015 rate hike with Fed Chair Janet Yellen maintaining an upbeat outlook for the economy. Although Yellen did cite concerns over subdued inflation, the lag has largely been attributed to “transitory” factors with the committee anticipating stronger price growth in the second half of the year. With the Fed on track to remove the zero-interest rate policy (ZIRP) later this year, the bullish sentiment surrounding the greenback may continue to dampen the appeal of bullion and raises the risk for fresh 2015 lows.

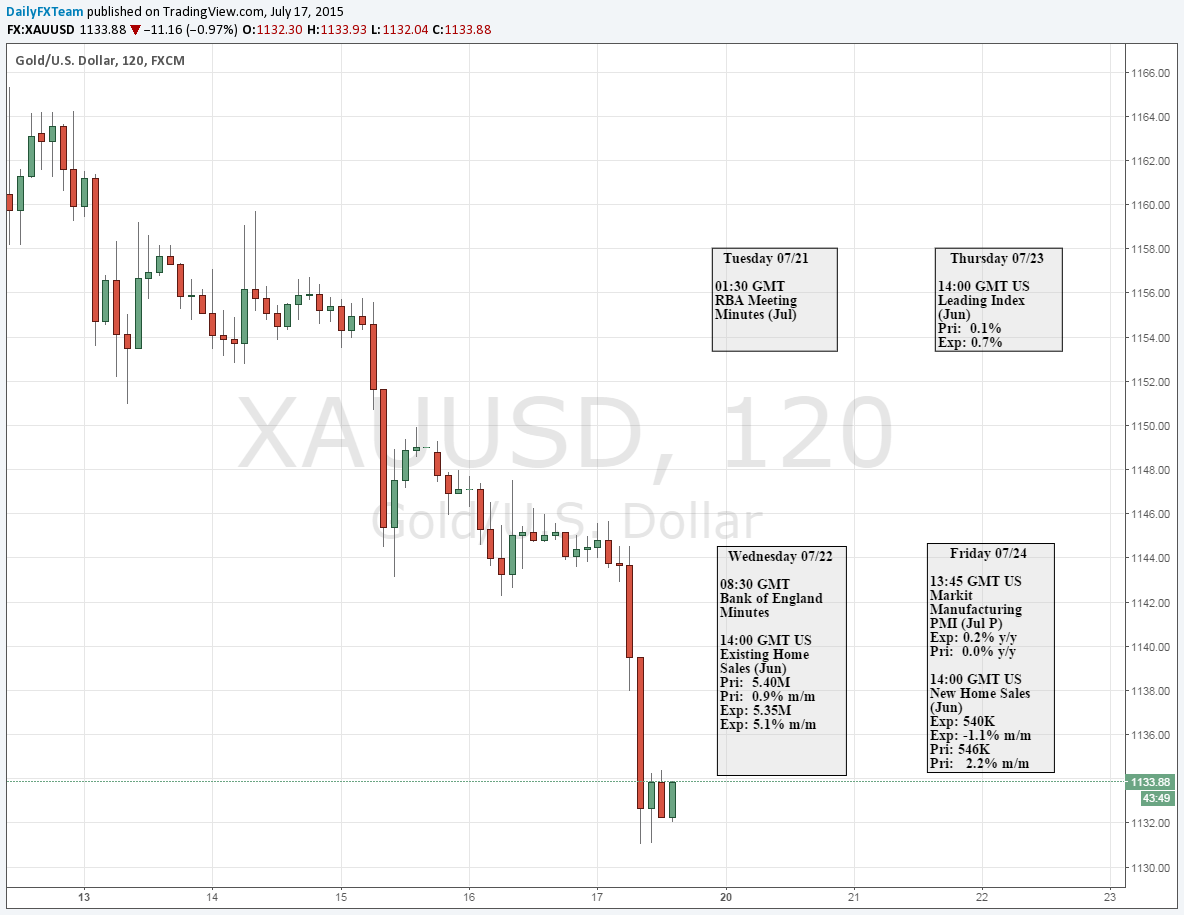

Despite the limited U.S. event risk scheduled for the week ahead, gold is unlikely to find a meaningful bid following the failure to hold above the March low (1142), and the previous metal may continue to search for support in the days ahead amid the broader decline in global commodity prices.

From a technical standpoint, gold has broken below key support and the technical damage done leaves prices vulnerable while below 1150. Look for interim support at 1130 early next week where the 2014 swing low converges on the lower median-line parallel extending off the June low. A rebound off this level may be on the cards, but the broader picture remains weighted to the short-side with subsequent support objectives eyed at the 1.618% extension off the 2014 highs at 1100 backed by 1044/54. A breach above this week’s high at 1164 would be needed to shift the focus back to the long-side of gold.