Global Payments (NYSE:GPN) is a leading payment processing company, based in a Atlanta, GA. It facilitates more than 10 billion transactions a year, which makes it the fifth biggest credit card processor in the US.

While revenues and profits have been growing at a healthy clip year in and year out, the stock has recently been suffering. As of yesterday’s close at $118.93, the share price is down more than 46% from its April, 2021 record.

Apparently, even a very high-quality company can lose half its market value in just a year. Can we expect a bullish reversal soon or is the stock poised to keep dropping? Let’s try and find the answer with the help of the Elliott Wave chart below.

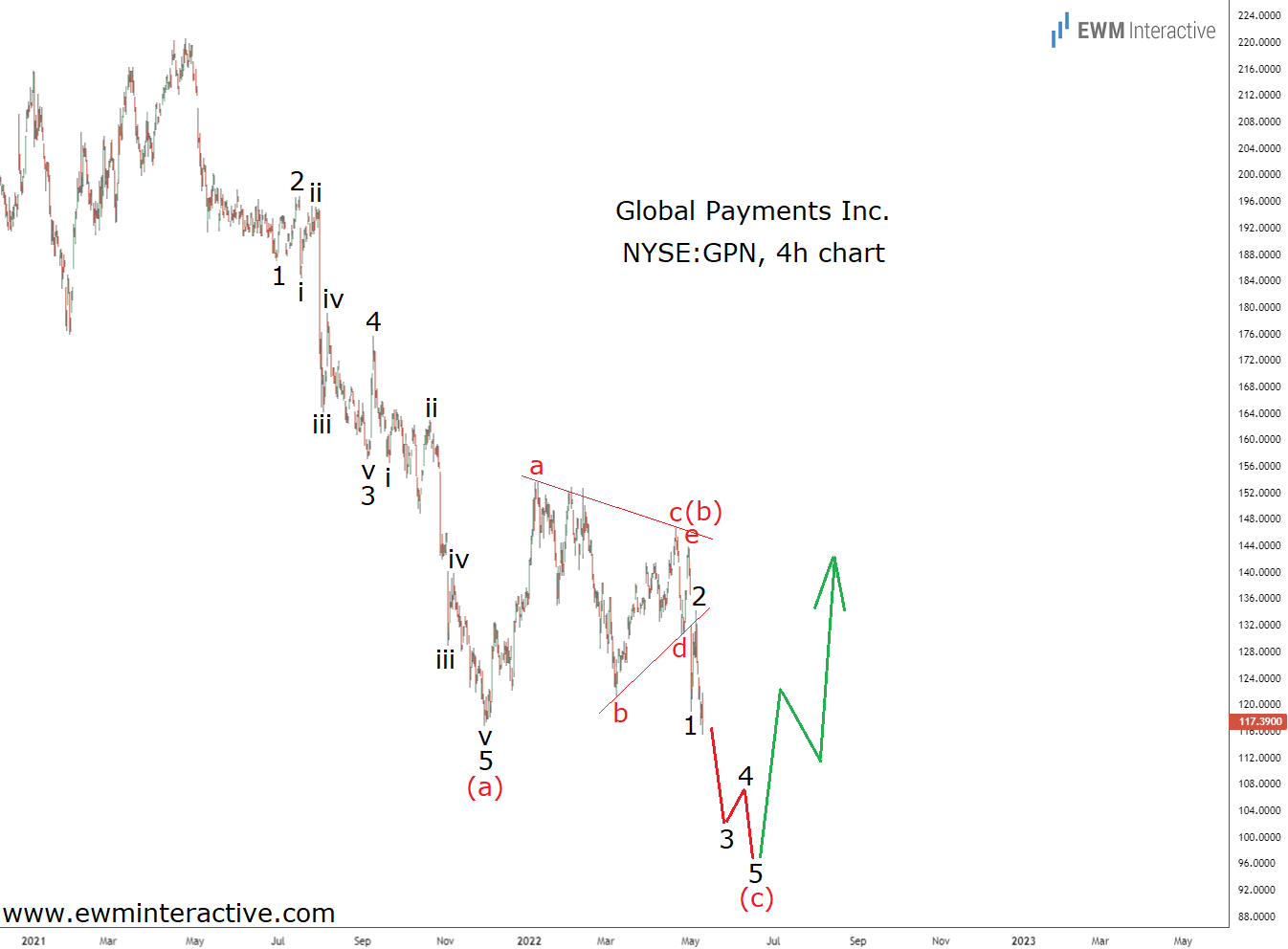

The 4-hour chart of Global Payments stock reveals the structure of its entire crash from $220.81. Since GPN was clearly in an uptrend prior to April, 2021, it makes sense for the current selloff to eventually evolve into some kind of a three-wave correction. So far, it seems to be shaping up as a simple (a)-(b)-(c) zigzag correction.

Fundamentals And Elliott Wave Might Soon Align In Global Payments Stock

Wave (a) is an impulse pattern, labeled 1-2-3-4-5, where the five sub-waves of 3 and 5 are also visible. It dragged the stock below $117 in late-November, 2021, and was followed by what appears to be an a-b-c-d-e triangle in wave (b).

Triangles precede the last wave of the larger sequence, which means the final wave (c) is most likely in progress now.

Wave (c) is supposed to develop as a motive pattern, as well. Currently that is not the case, meaning the bears can reach lower levels before giving up.

If this count is correct, Global Payments stock can dip below $100 a share. Once there, however, both the company’s fundamentals and the stock’s Elliott Wave setup would be pointing north.

Honestly, we can barely wait.