Eyes are fixed firmly on Ukraine this morning. Tensions had been waning in recent days it seemed but a speech by President Putin last night that congratulated and encouraged further the efforts of Russian rebels within Eastern Ukraine. Except Putin didn’t call it Eastern Ukraine, he called it ‘Novorossiya’ – New Russia.

This came hours after NATO announced that it believed Russia had 1000s of troops operating within Ukraine. The Ukrainian President has called for an emergency meeting of the UN Security Council today and EU leaders will likely be playing a game of telephone with each other to discuss further sanctions on Putin’s Russia. Russian rouble has moved to a record low of 37.00 against the US dollar overnight.

Asian equity markets have continued yesterday’s overall slippage and are gearing traders up for a negative session to end what has been a quiet week.

Japanese assets were already in retreat after the latest Japanese Personal Consumption figures showed a 5.9% decline compared to a year ago. Once again the reason for and cause of this sharp contraction is the move in sales taxes from 5 to 8% in April. The move has boosted inflation handily but as we have said before, the true test of its efficacy will be in Q3 as we see how much lasting damage the move has caused.

CPI in Japan has remained at 3.4% in July but Tokyo August numbers have suggested a fall to 2.8% in the month – price pressures are coming lower in Japan already.

US GDP data was a notable bit of good news yesterday as Q2 growth was revised higher to 4.2% on an annualised basis. Growing personal consumption – that was revised to 2.5% from 2.4% – and stronger business investment. Imports and government spending weighed on the release but the lower level of inventory spending suggests that consumption should remain buoyant moving forward. Unfortunately, a continuation of growth levels between 3-4% will only see 2014 GDP hit around 2.2-2.4% for the year – not exactly inspiring.

Eurozone inflation at 10am is the obvious highlight of the week and with thoughts of a slip to new cyclical lows of 0.3% YoY on the cards, we can easily see pressure on the euro continuing. The key is more likely the core figure, which discounts away food and energy prices, and currently sits at 0.8% YoY. Should that move any lower, the ECB will feel compelled to ratchet up the aid. Yesterday’s confirmation of German CPI at 0.8% may be the final nail in the coffin for those who had been looking for some form of action from the European Central Bank next week.

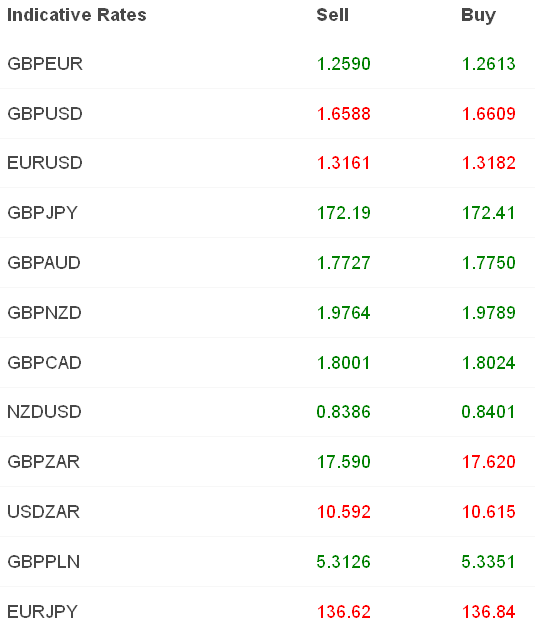

Positioning in euro crosses does seem ripe for a snap back in our opinion and a surprise hold in inflation at 0.4% instead of a fall to 0.3% could give the single currency some legs. There is no doubting that the euro remains a sell on rallies, especially against GBP and USD.