For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.0647, after Germany’s consumer price inflation remained steady at a two-year high level of 0.8% YoY in November, meeting market expectations, suggesting that the ECB may need to do more to achieve its inflation target.

In other economic news, the Euro-zone’s final consumer confidence index advanced to a level of -6.1 in November, confirming the preliminary estimates and following a reading of -8.0 in the previous month. Moreover, the region’s economic sentiment indicator advanced to an eleven-month high level of 106.5 in November, offering signs of brightened economic outlook in the common currency region. However, the reading was lower than market expectations of a rise to a level of 106.8, while it recorded a revised reading of 106.4 in the previous month.

The greenback gained ground against most of its peers, propelled by the release of a stronger-than-expected US gross domestic product (GDP) and robust consumer confidence data, that intensified prospects of a Fed interest rate hike in December.

Data indicated that, the second estimate of the US annualized GDP rose by 3.2% on a quarterly basis in 3Q 2016, marking its fastest growth in two years and surpassing market expectations for a rise of 3.0%, thus adding to optimism that the nation’s economic activity is gathering momentum. The preliminary figures had recorded a rise of 2.9%, while it had registered a rise of 1.4% in the previous quarter. Further, the nation’s consumer confidence index jumped more-than-anticipated to a level of 107.1 in November, hitting its highest level in nine-years, driven by renewed optimism over the nation’s economic prospects. Markets expected the index to rise to a level of 101.5, following a revised level of 100.8 in the prior month.

Meanwhile, the Federal Reserve (Fed) Governor, Jerome Powell, indicated that that the case for raising interest rates has strengthened since the central bank’s latest meeting, as US unemployment and inflation approach the Fed’s targets. He also warned that moving too slowly could eventually force the central bank to tighten monetary policy abruptly to avoid overshooting its objective.

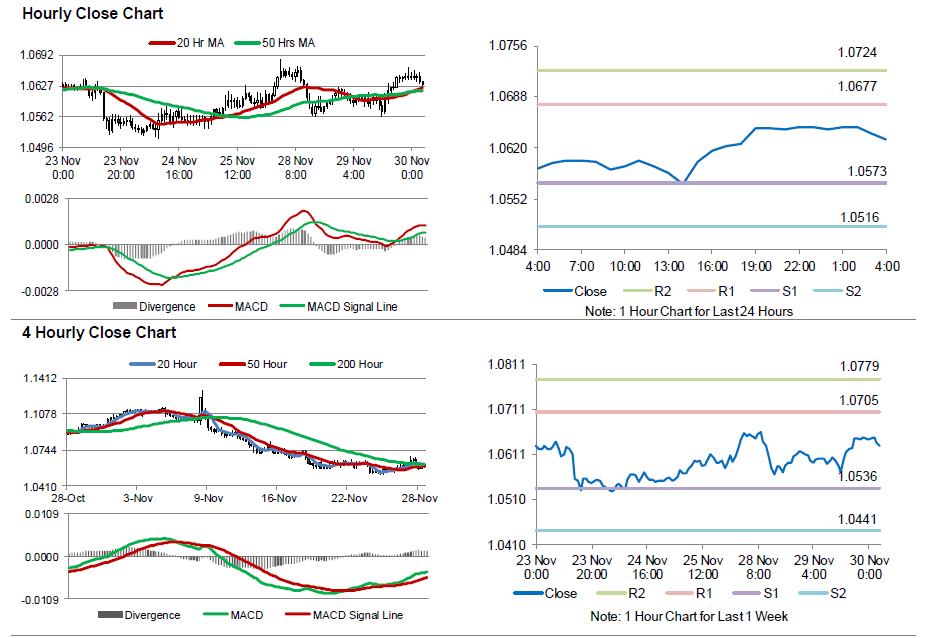

In the Asian session, at GMT0400, the pair is trading at 1.0631, with the EUR trading 0.15% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0573, and a fall through could take it to the next support level of 1.0516. The pair is expected to find its first resistance at 1.0677, and a rise through could take it to the next resistance level of 1.0724.

Looking forward, market participants would keep a close eye on the ECB President Mario Draghi’s speech, due later in the day. Moreover, investors will also look forward to a string of economic releases across the Euro-zone, consisting of preliminary Euro-zone’s inflation data and Germany’s unemployment rate, both for November, along with the nation’s retail sales for October, set for release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving average.