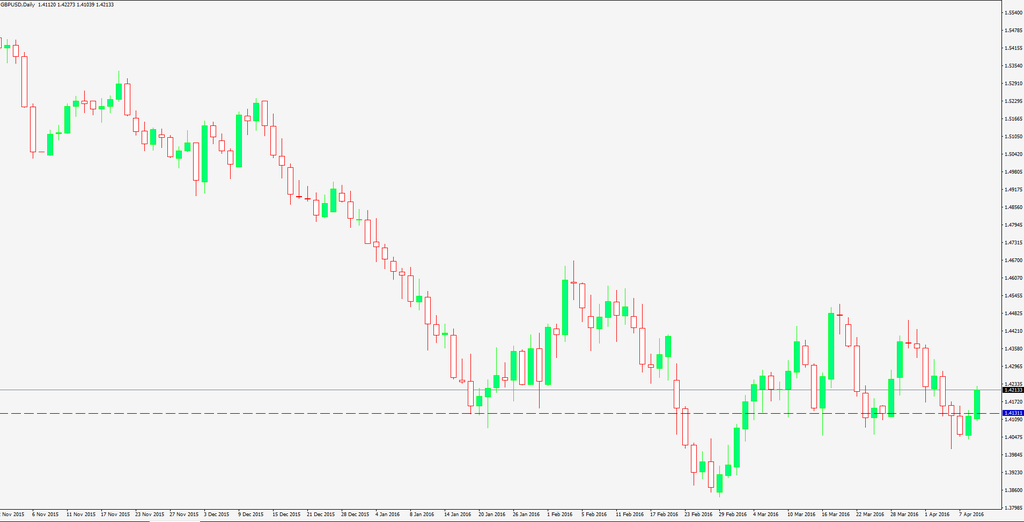

GBP/USD trade sentiment stays above long-term support ahead of BOE meeting

GBP/USD has appreciated and traded above 1.4060 after dovish Fed comments on interest rate hike expectations this year. Sticky UK inflation will push the GBP/USD higher, and cutting 1.4190 continues increasing to 1.4220, 1.4245 and 1.4265 as next resistance levels.

However, the Bank of England (BOE) meeting this week might have a dovish tone, as the central bank is widely anticipated to retain its current policy, which will push GBP/USD lower. Breaking 1.4100 will create a downside movement again and will drive the pair toward 1.4075, 1.4045 and 1.4020 respectively.

Disclaimer: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.