On Thursday, the US dollar climbed to three-week highs, bolstered by upbeat data, recovering slightly from the Fed's decision to cut its monthly bond-buying program by $15 billion.

Thursday, the Labour Department said that initial jobless claims fell 14,000 to 269,000 seasonally adjusted for the week ended Oct. 30, the lowest level since the middle of March 2020.

The ADP National Employment Report released on Wednesday also showed solid gains in private payrolls in October, reinforcing expectations for an acceleration in job sector growth ahead of the nonfarm payrolls release on Friday.

BOE's dovish stance on slowing growth

Meanwhile, the Bank of England (BoE) surprised the markets by keeping interest rates steady, which is interpreted to put slowing growth ahead of inflation worries. As a result, GBP/USD slumped to its one-month lows around 1.35300.

Officials indicated that consumption is weakening because of supply constraints and an increase in the cost of oil, natural gas, and electricity. In addition, they stated the job market remains highly uncertain after the government furlough program ended.

In addition to trimming growth outlooks, policymakers revised up predictions for inflation, with the consumer price index expected to reach 5% in April 2022, the highest level since 2011.

Technical Outlook

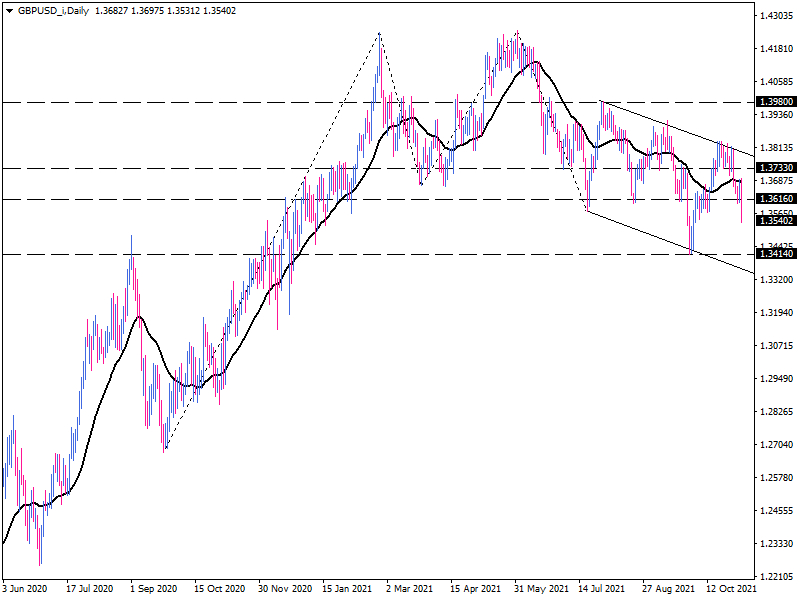

From a technical view on the daily chart, GBP/USD has formed a double-top pattern, and the price is declining within a descending channel.

A decisive break below the support level of 1.36160 has motivated more sellers to contribute to the prevailing bearish momentum.

With the momentum oscillator heading south and crossing the 100-level baseline, the RSI is about to exit sideways territory below 40.

The price action suggests bears have their eyes on the 1.34140 zone as the next support.

Alternatively, 1.36160 is seen as an immediate resistance level on the upside. As long as the upper channel line is not penetrated, sterling's outlook remains bearish.

Solid Jobs Report Could Be On the Way

It seems job growth in October was healthy. Nonfarm payrolls are expected to increase by 450,000, which would bring the unemployment rate down to 4.7%.

Meanwhile, wages are expected to rise as well. As a result of substantial inflationary pressures and a shortage of skilled staff, the average hourly earnings are predicted to increase to 4.9% YoY from 4.6% previously.