GROWTHACES.COM Trading Positions:

- EUR/USD: long at 1.2920, target 1.3100, stop-loss 1.2830

- EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

EUR/USD: Draghi’s speech on Monday of key importance

(downside risks in the short therm, still bullish bias in the medium term)

- Euro zone’s current account surplus (non-seasonally adjusted) amounted in July to EUR 32.3 bn vs. EUR 24.8 bn in June. The data were much higher than the median forecast of EUR 21 bn. Trade balance went up to EUR 21 bn vs. EUR 18.7 bn. Surplus on services account amounted to EUR 15.5 bn vs. EUR 11.3 bn. in June. After seasonal adjustment current account surplus went up to EUR 18.7 bn from EUR 18.6 bn and was higher than the market consensus of EUR 16.5 bn.

- The upcoming economic week will be under influence of ECB’s Draghi speech on Monday and the preliminary PMI releases as well as the national business climate figures for the euro zone and its major member countries. Euro zone PMIs are likely to be down again or stabilize at reduced levels. On the other hand, the weakening of the EUR that started in May will probably begin to translate into the real economy providing some buffer against the adverse economic environment. We expect German PMIs as well as the Ifo business climate index to ease further, but less strongly than in the previous month.

- The EUR/USD peaked on Friday at 1.2926 but then eased in European session mainly on cross flows (EUR/JPY and EUR/GBP were the big movers).

- Downside risks are not over for the EUR/USD in the short term. However, we keep our medium-term bullish bias and the target of 1.3100. First, the EUR/USD is now more than 10 figures below its May peaks and the ECB may be satisfied with this correction. Secondly, the ECB has now used all available weapons except full quantitative easing which in our opinion is unlikely. Thirdly, the EUR/USD net short positions became less significant which means that the rate may be starting to bottom out.

Significant technical analysis' levels:

Resistance: 1.2931 (high Sep 18), 1.2982 (high Sep 17), 1.2995 (high Sep 16)

Support: 1.2834 (low Sep 17), 1.2800 (psychological level), 1.2788 (61.8% of 1.2042-1.3995)

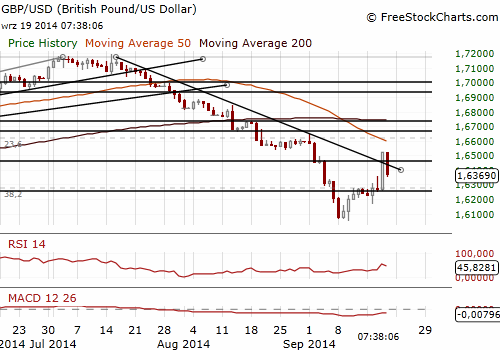

GBP/USD: Scotland votes to stay in the UK. Let’s go back to trading on fundamentals

(looking to go long again)

- Scotland rejected the independence in a historic referendum. Unionists won 55% of the vote while separatists won 45% with 31 of 32 constituencies declared.

- Credit ratings agency Standard & Poor's said the rejection of independence by voters in Scotland had no impact on its AAA rating for the United Kingdom, nor its stable outlook for the rating.

- The GBP jumped to a two-week high against the USD and two-year peak against the EUR on Friday on relief that Scottish voters rejected independence in a referendum. The GBP/USD peaked at 1.6525 and is easing in European session. We have taken profit on our long position (1.6220-1.6510). GrowthAces.com trading idea is to go long again near 1.6320.

- The GBP volatility is likely to fall in the coming days. After referendum investors can go back to trading on fundamentals. The focus will be directed towards expectations on the first rate hike for the BOE and the Fed and the ECB’s desire to expand its balance sheet.

Significant technical analysis' levels:

Resistance: 1.6525 (hourly high Sep 19), 1.6615 (high Sep 2), 1.6645 (high Sep 1)

Support: 1.6305 (hourly high Sep 16), 1.6279 (38.2% of 1.6622-1.6052), 1.6253 (10-dma)

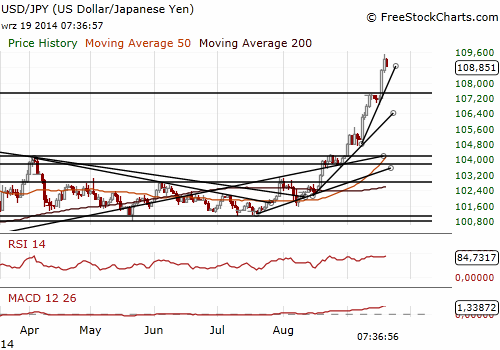

USD/JPY: BOJ’s Kuroda sees no problem with JPY depreciation.

(buy offer at 108.50)

- Bank of Japan Governor Haruhiko Kuroda said on Friday he saw no big problem with recent yen declines against the dollar, stressing that exchange rates should move in a way that reflects economic fundamentals. He declined to comment on whether he saw recent yen falls as too rapid, or whether the current USD/JPY level was still beneficial for the economy.

- Japanese economy minister Akira Amari said that rapid moves in currencies are undesirable and that he wants exchange rates to move in a stable manner reflecting Japan's economic fundamentals.

- The government cut its view on private consumption saying that consumer spending is seen pausing although a pick-up trend remains intact. The government flagged the risk of a prolonged impact of the tax hike hurting the Japanese economy in future. In its monthly economic report for September, the government left its cautious assessment unchanged for other key components such as capital spending, exports and industrial output.

- Japan’s Prime Minister Abe said he aimed to carry out pension reform as soon as possible. He added that economic conditions in the July-September period should be watched carefully to decide on whether to raise sales tax again.

- The USD/JPY broke significantly above 109.00 but then eased in European session. GrowthAces.com is looking to get long at the 108.45 level ahead of Wednesday’s 108.32 low. Technical situation highlights the overall upside potential of this pair.

Significant technical analysis' levels:

Resistance: 109.46 (high, Sep 19), 109.57 (high Aug 29, 2008), 109.94 (high Aug 26)

Support: 108.65 (session low Sep 19), 108.32 (session low Sep 18), 107.92 (hourly low Sep 17)