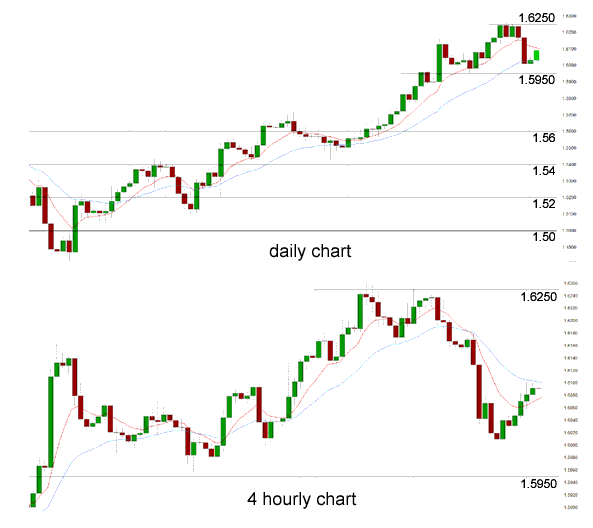

GBP/USD for Tuesday, October 8, 2013

In the last month the GBP/USD has rallied well and surged higher to move back up strongly through numerous levels which has now been punctuated by a push through to its highest level for the year just above 1.6250. For most of last week it was placing reasonable pressure on the short term resistance level at 1.6250 and looked poised to break through, although to finish out last week it eased back and has now found support at the 1.60 level. A couple of weeks ago it found solid support from the 1.5950 level which helped it move well up to the 1.6250 level. It did stall around 1.59 to 1.5950 for a few days a few weeks ago before clearing this area of congestion. About a month ago it fell down to a two week low near 1.54 before rallying back towards 1.5550. The week before it did well to maintain its level above the key 1.56 level and in the process moving to a new two month high above 1.57 which has now been surpassed by the present high. It immediately retreated strongly but continued to receive solid support from the 1.56 level before closing below at the end of that week.

Back in the middle of August the pound surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level. A couple of months ago the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

Earlier in July after having done very little for about a week, the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. Prior to the move higher, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It established a trading range in between 1.51 and 1.52 after it took a breather from its excitement just prior when it experienced a strong surge higher moving back to within reach of the 1.52 level from below 1.49, all in 24 hours. About a month ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. It experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. That movement saw it resume its already well established medium term down trend from the second half of June and move it to a four month low.

As implemented by Carney and his colleagues in the UK, guidance is hedged about with three separate “knockouts” – rates would rise if inflation, financial stability or the public’s inflation expectations got out of control. Moreover, the governor has stressed that the 7% unemployment rate is not a trigger for a rate rise, but a “staging post”, which will not necessarily prompt tighter policy. During a somewhat fraught hearing with MPs on the cross-party Treasury select committee last month, in which Carney sought to clarify the policy, chairman Andrew Tyrie expostulated that it would be a hard one to explain “down the Dog and Duck”. Financial markets have also been less than convinced. The yield, or effective interest rate, on British government bonds – partly a measure of investors’ expectations of future interest rates – has risen rather than fallen since the Bank’s announcement. That is partly because the latest data suggests the economic outlook is improving, but rapidly rising bond yields can be worrying because they tend to push up borrowing costs right across the economy. Carney, though, has insisted he is not concerned.

GBP/USD October 8 at 00:10 GMT 1.6096 H: 1.6100 L: 1.6026GBP/USD Technical" title="GBP/USD Technical" src="https://d1-invdn-com.akamaized.net/content/pic8e8ad866b2bcfb1bc9a7254be1dc26c2.png" height="233" width="514">

During the early hours of the Asian trading session on Tuesday, the GBP/USD is consolidating in a narrow range right below the short term resistance level at 1.61 after rallying well from down near 1.60 in the last 24 hours. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50 and is now enjoying a solid resurgence over the last couple of months moving back to above 1.62 and its highest point for the year. Current range: Right below 1.6100 at 1.6090.

Further levels in both directions:

• Below: 1.6000, 1.5950 and 1.5800.

• Above: 1.6100 and 1.6250.

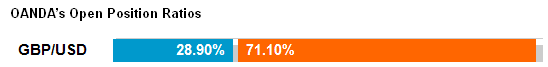

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved back below 30% again as the GBP/USD has remained above 1.60. Trader sentiment remains heavily in favour of short positions.

Economic Releases

- 00:30 AU ANZ Job Ads (Sep)

- 12:15 CA Housing starts (Sep)

- 12:30 CA Merchandise Trade (Aug)

- 12:30 US Trade Balance (Aug) ***

- 14:00 US IBD Consumer Optimism (Oct) ***