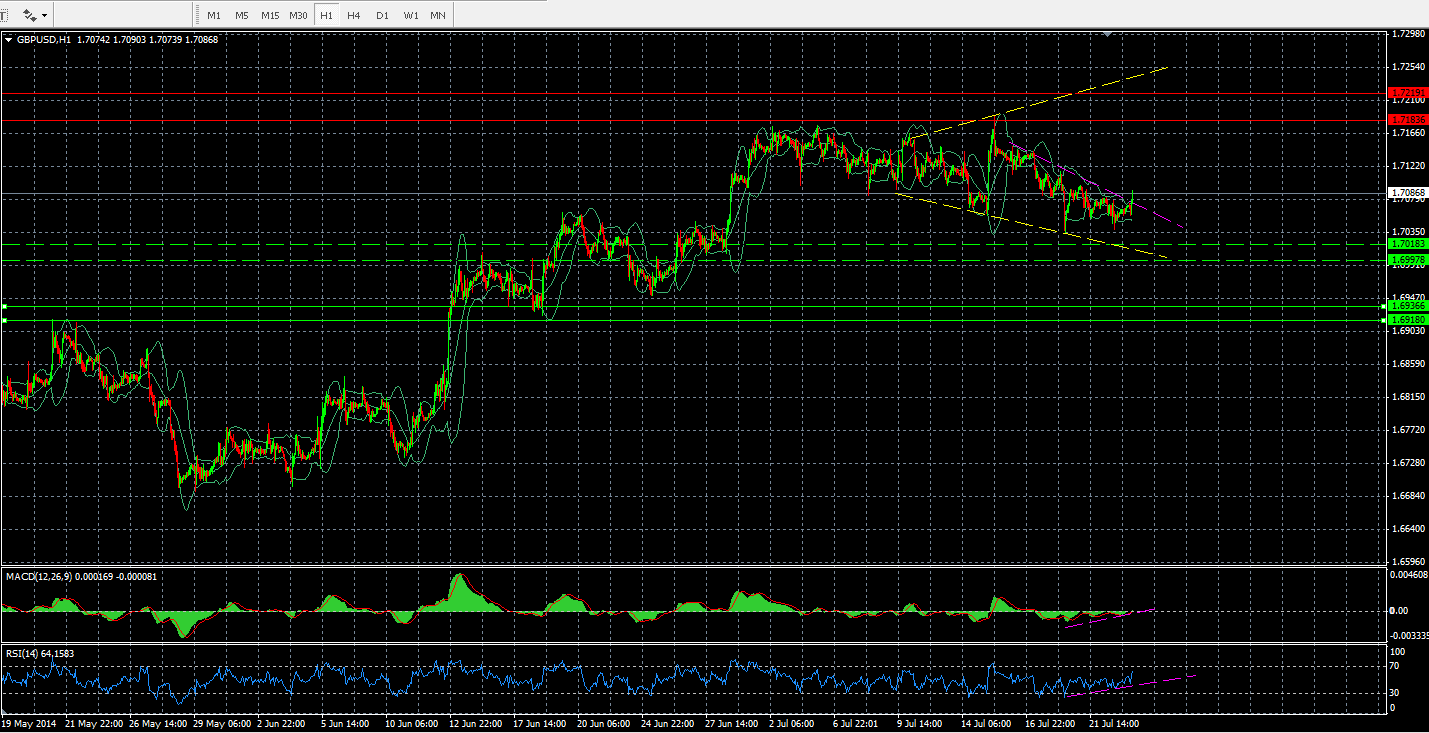

The GBP/USD is trading within the inverted wedge pattern on a 60 minute time frame. The price is also trading in a downward wedge pattern and a break of this wedge pattern will confirm that we could be touching the resistance level which is mentioned below and crossing the 1.72 mark. The volatility for the pair is low as it is trading within the Bollinger band and close enough to its 20 day moving average.

The RSI indicator is showing a clear sign of divergence which means that while the price is making the lower low, the RSI has failed to confirm this and this increases the odds for the upward move. The MACD indicator is showing a slowdown in the downward momentum which further confirms the above argument.

Resistance Zone

1.7219-1.7183 Major

Support Zone

1.7018-1.6997 Minor

1.6936-1.6918 Major

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.