The greenback ended broadly higher yesterday as ongoing Greek-PSI negotiations quickly overshadowed Fed QE 3 optimism. As markets in Asia opened shop, U.K. newswires cited an anonymous senior Greek official as saying progress was being made and aimed at concluding a deal with the private sector soon, and that talks were likely to continue on Friday and probably into the weekend as well.

Seemed a bit contradictory to me and price action in currency markets suggests the market may not be buying in either as EUR/USD trades pretty much unchanged from this same time yesterday.

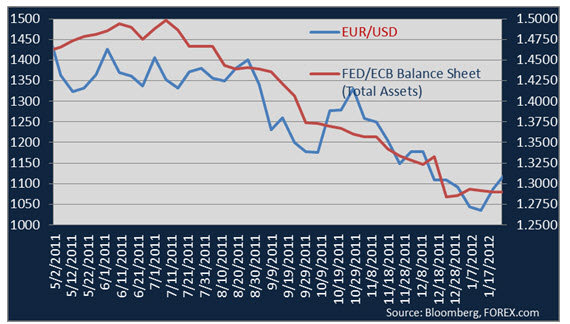

Perhaps more significant is the fact the single currency wasn’t able to gain ground versus the buck, not even on the heels of a more dovish FOMC outlook just yesterday. Admittedly, ECB balance sheet expansion has been more rapid than the Fed as of late and rightfully so considering Europe being the source of global systemic risk.

As seen in the figure to the left, the pace of balance sheet expansion between the Fed & the ECB have been relatively well correlated as of late and suggests further downside could be in store for the CCY. Central bankers and officials shared similar opinions as my FX VIEWS throughout Asia market hours as central bank speak from RBNZ, BOJ, and BOK officials noted downside domestic economic risks stemming from Europe’s debt crisis.

While Europe headlines are likely to remain the primary determinant of currency price action moving forward, it was Japan dominating *data/news flows as well as price flows in Friday’s Asia Session:

*Japan Dec. Overall Consumer Prices fall -0.2% y/y

*Japan Dec. Consumer Prices ex. food, energy fall -1.1% y/y

*Japan Dec. Core Consumer Prices fall -0.1% vs year earlier

*Japan Dec. Retail Sales better at 2.5% vs. expected 2.1% & prior -2.3%.

*Japan Dec. Retail Sales better m/m as well at +1.8% vs. expected +0.4% & prior -2.1%.

* BOJ members also said Europe crisis along with JPY strength hurting domestic exports.

* Some BOJ members concerned EU banks may sell more USD denominated asset

* Japan P.M. Noda expects BOJ to use `bold' policy management

Both USD/JPY and EUR/JPY getting slammed ahead of the Tokyo close. Prospects for additional ECB policy accommodation still weighing on the euro while similar prospects for Fed policy has resulted in USD weakness. Put two and two together - EUR/USD and USD/JPY – and we have EUR/JPY outpacing most G10 and EM currency pairs with losses of about -0.60%, at moment of writing.

EUR/JPY posted multiple hourly closing breaks below the key 100-hr sma (guided EUR/JPY upside since crossing above the moving average in mid-January). While it’s difficult to reason out any fundamental framework for a EUR/JPY recovery, selling at current levels seems a risky proposition considering the policy reputation of an easy BOJ.

Elsewhere, RBNZ Governor Bollard also put some blame on Europe for potential slower growth in New Zealand:

* RBNZ Governor Bollard: Greece most likely to default over other EU member states

* Bollard: Comfortable with market view for rates to stay unchanged for a year.

* Bollard says much more comfortable with NZ inflation track

* Bollard: Growth expectations haven't changed much

* Bollard: Inflation very comfortably within zone

Up ahead in Europe, Greek: PSI talks STILL in focus and while the possibility of a debt swap deal may be gaining traction, would deem similar long debates/negotiations a high probability in coming quarters as other fundamentally weak Euro-area economies will likely follow in Greece’s footsteps in a cat & mouse game for what at the end of the day boils down to free paper.

Lighter G10 data slate in the upcoming UK Session relative to most other days so far this week with Swiss Jan. KOF Leading Indicators (0800GMT), EZ Dec. M3 s.a. 3-month & y/y (0900GMT), and Italian 182-day & 331-day bill auctions (1000GMT) due out ahead of a full schedule of speeches from Euro-area officials.

In EMEA, Poland kicks off an important EM economic data schedule at (0900GMT) with the releases of 2011 GDP, Dec Retail Sales, Dec. Unemployment Rate, & Dec. Budget Level y-t-d. Hungary will release Dec. unemployment rate which may trend higher upwards of +11% ahead Dec. PPI. Also on tap is Turkey Dec. Trade Balance and all eyes will be on whether Istanbul can narrow its deficit, considering the IMF’s negative growth comments last night.

By tomorrow morning, would think volatility for EM Eastern European currencies at a minimum catches up with recent JPY gains in Asia hours due to heavy data risk and further downside potential from continued hurdles for Greek: PSI negotiations. Additional risk for recent paring of gains may come from US 4Q A GDP at 0830EST, any positive data surprise will likely narrow the scope for QE3 to come sooner rather than later. However, at the moment JPY price action dominating Asia trading and there’s no doubt coming days will see the spotlight shining brightly on the BOJ.

STRATEGY VIEWS – Updates

NZD/USD potential shorts 0.7855 from FX VIEWS (ASIA/LONDON): S/t summit rallies to provide m/t value for shorts?...posted 12.08.11 squeezed out on post FOMC USD weakness. Hurts a bit and still think commodity CCYs overbought at current levels but difficulty timing CB intervention measures seems to skews reward: risk ratios in favor of high commodity-beta CCYs due to the upside price implications from ECB, BOE. Moving forward, would rather take a m/t to l/t buy dips approach.

GBP/USD potential shorts around 1.5750 from FX TECH LAB: GBP underperformance looks set to continue (UPDATE)...posted 09.27.11 still in the black by just +80 pips now on what I think could be just another short squeeze.

Resistance still comes in around the 1.5750 m/t pivot which may provide decent reward: risk value for sterling bears – a lot of EZ exposure in UK banking sector could hurt an already struggling domestic economy which increases scope for more MPC QE as well as further cable weakness.

Pulling stops down to above the 200-day sma seems a bit more reasonable and bringing potential limit targets higher to slightly above the key horizontal weekly pivot around 1.4850 still may provide just about 2:1 reward: risk ratio at current levels.

EUR/TRY potential shorts around 2.4750 from EM FX INSIDER (Weekly Strategy)...posted 10.25.11 in the black by about +10 figures plus positive carry value on diverging ECB: CBT monetary policy paths.

In its recent MPC meeting, the CBT kept all rates unchanged and maintained its current tightening bias while the ECB’s balance sheet continues to balloon with further scope for a more orthodox large scale asset purchase program if Euro-area conditions deteriorate further.

Taking a look at rate differentials compared against volatility (as suggested by G10 and EM FX implied vols via 6-month at-the-money options), EUR/TRY shorts may continue to provide better relative carry value as its 6M A-T-M implied volatility is lower than most G10 & EM pairs at around 12.56% while rate differentials are much higher than most CCY pairs at above 10% (unchanged FX VIEWS from Wednesday’s London Session)

EUR/USD potential shorts tiered for half a position each and a final average rate of about 1.2950 from FX VIEWS (Asia): Position squaring paving the way for EUR/USD downside?...posted 01.18.11 just missed the 1.3188 potential stop zone by a couple hairs overnight.

Technicals look bearish – doji on daily charts – and previous pattern of disappointing price action after any promise of some positive EU debt crisis delivery saw sharp EUR/USD downside follow.

As always, past performance not always indicative of future performance but think EUR under-performance continues this year as evidenced in Thursday price action just after the market’s dovish take following the FOMC release. However, think pushing stops up a bit above the daily pivot at around 1.3248 for another 60 pips added risk may make sense as I’ve seen way too many double doji formations take stops out before reversing.

Over-reaction to FOMC?

While markets were surprised by what seemed to be a more dovish FOMC and likewise comments by Bernanke, I was a bit surprised by the extent of USD weakness. Markets seemed to have been pricing in around a 60bp hike by early-mid 2014 & didn’t really think re-pricing of inflation was warranted quite yet.

During the press conference, Mr. Bernanke didn’t rule out QE3 but he also didn’t rule out other options and that the committee would have to review the efficacy of easing at any junture. Actually thought Chairman Bernanke was pretty balanced as he reiterated the Fed’s dual mandate on numerous occasions throughout the press conference. Additionally, each comment regarding possibility for further easing was followed immediately by ‘if conditions warrant’.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Views: FED, Ecb Lax Policy Outlooks to See an Even Easier BOJ

Published 01/27/2012, 05:35 AM

Updated 05/18/2020, 08:00 AM

FX Views: FED, Ecb Lax Policy Outlooks to See an Even Easier BOJ

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.