STOCKS: The world economy is has begun to heal if we look at the PMI figures across the world. However, there remain clear headwinds to the continuation of this healing, like potentially higher interest rates. Quite clearly, we feel risk is being mispriced at current levels given the economic backdrop and developing pressure upon corporate revenues/margins/ earnings. But, the QE pillars continue to hold prices higher than would be seen in non-QE times.

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1415; and the standard 200-dma support level at 1652. But perhaps more importantly, the distance above the 160-wma has regained the+27% level that denotes a “bubble-like rally” threshold. If it expands towards 30%, then an upside explosion may be under way.

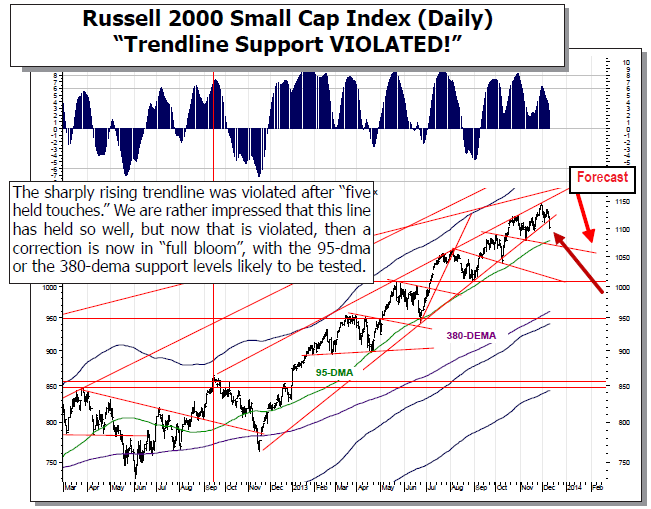

WORLD MARKETS ARE LOWER ACROSS THE BOARD, with European shares hitting two-month lows as concerns start to develop that the Fed shall taper, and whether that taper takes place in December, January or March, it isn’t important. The Fed is on the cusp of pulling back their bond-buying campaign as economic data has been better-than-anticipated, although we could poke several holes in that statement, but on balance certainly better, and the Congress has decided to come up with a budget agreement for the next 21-months. This latter point removes one more impediment to the uncertainty for businesses surrounding the economy. So, the prospect of stronger US growth means that corporate profits shall falter as margins are squeezed as capital is deployed to support that growth.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Futures: European Shares Hit Two-Month Lows Amid Taper Concers

Published 12/12/2013, 02:27 AM

Updated 07/09/2023, 06:31 AM

FX Futures: European Shares Hit Two-Month Lows Amid Taper Concers

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.