The dollar extended its gains from Wednesday’s US session in today’s Asian trading as the Fed’s positive assessment of the US economy suggested that a September rate rise remains a strong possibility despite the lack of clear signals. In its statement, the FOMC said that the labor market is ‘nearly balanced’ but that inflation continues to run below the target rate. This could indicate that the Fed would be more comfortable if inflation was closer to its 2% objective before starting to raise rates.

GDP data for the second quarter out later on Thursday should give a better picture on the strength of the US economy. The dollar broke above the 124 handle against the yen in late Asian session, rising to 124.18. The euro fell to its lowest level in a week as it slipped to 1.0957, while the pound was steadier at 1.5598 in Asian session after yesterday’s losses against the dollar.

Shares in Asia were mixed with Japanese equities closing around 1% higher but shares in China were struggling and gave up earlier gains to close lower by over 2%.

Preliminary industrial production figures in Japan came in above estimates but had little impact on the yen. June industrial production rose by 0.8% from the previous month, against forecast of 0.3% rise. It was up by 2% from a year earlier, versus estimates of 1.3%, which is the highest increase since June 2014.

The aussie was initially buoyed from Australian housing data, which despite unexpectedly declining in June, showed a healthy year-on-year rise of 8.6%. The Australian dollar had climbed to 0.7322 in early Asian session but later dropped to 0.7297. Stronger oil prices did not provide much support to the Canadian dollar, as Brent crude futures rose by 0.2% to $53.60. The greenback advanced to 1.2977 against the loonie in late Asian session.

Coming up later today are German unemployment and inflation figures for July. But the main focus will be on US GDP numbers. Second quarter growth is expected to have picked up to 2.5% on an annualised basis. Any surprise in the actual figure is likely to cause sharp dollar volatility given the Fed’s data dependence approach on deciding the appropriate timing for an interest rate increase.

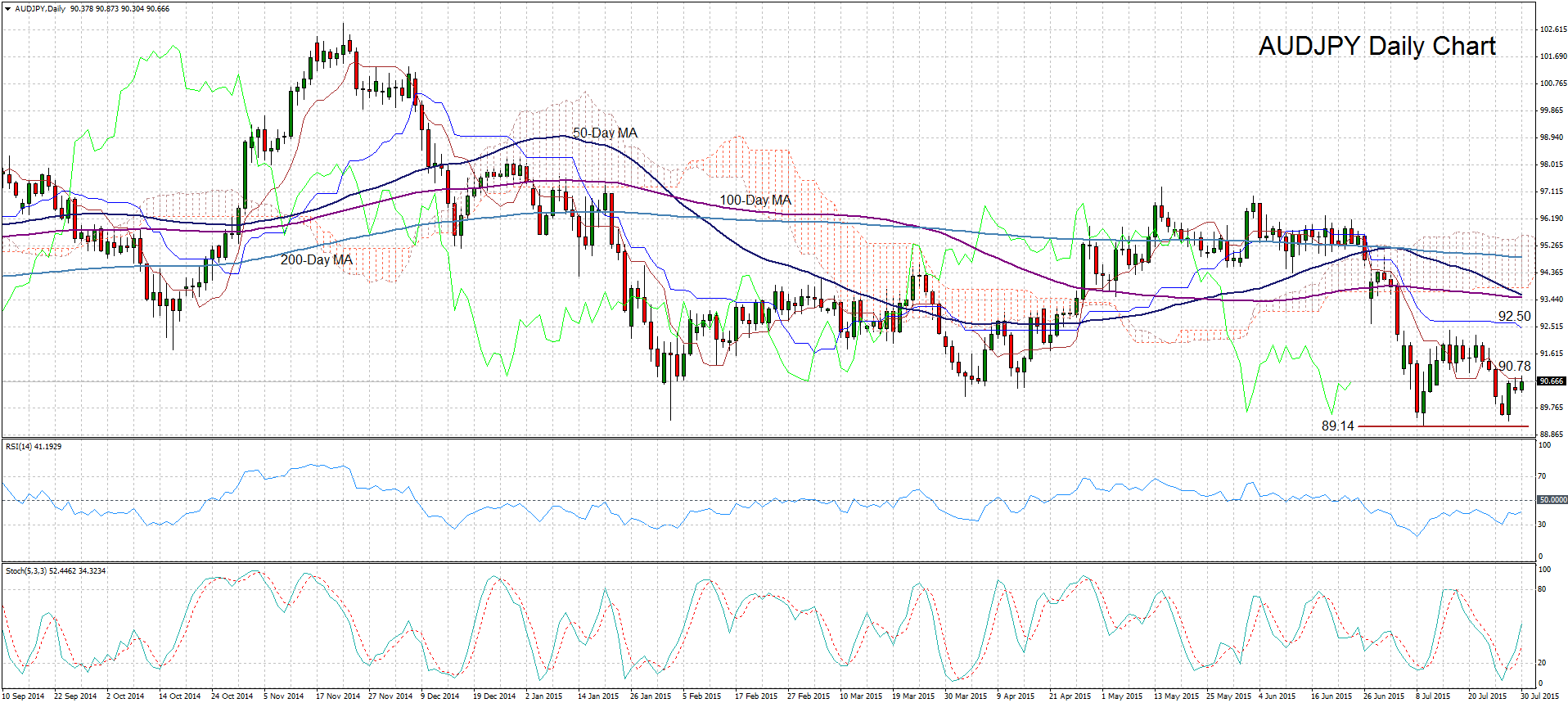

Technical Analysis – AUD/JPY looking bearish after brief rally loses steam

AUD/JPY was unable to sustain the rally from July 28 after finding resistance at the tenkan-sen line at around 90.78. The intra-day bias is on the upside with the stochastics still rising but RSI is in bearish territory, though it’s pointing up.

In the medium term, the outlook for the pair is looking bearish as prices are below the Ichimoku cloud and the moving averages. AUD/JPY would need to cross above the kijun-sen line at 92.50 if it’s going to gain stronger momentum to break into the cloud and climb out of its long-term range.

On the downside, the nearest support level is the July 9 low of 89.14. A break below this level would take it to new one-year lows and possibly into a new downtrend.