Key Points:

This morning’s FOMC Meeting Minutes from October show that most members were comfortable not raising rates in October but that December is very much in play. I’ve extracted a few of the key lines from the minutes in summary:

“Most participants saw the downside risks arising from economic and financial developments abroad as having diminished and judged the risks to the outlook for domestic economic activity and the labor market to be nearly balanced.”

“…(Most officials felt conditions in favour of a hike) could well be met by the time of the next meeting.”

This hawkish rhetoric was topped off by language that offered a far more specific hint on the timing of a rate hike than policy makers had previously used.

“…at its next meeting.”

How did the USD react?

So how did the US Dollar react to seemingly hawkish comments? Well markets again took it as the Fed sending some mixed signals. This uncertainty again proving counter-productive as they almost contradicted themselves by again chopping and changing.

There was first of all excitement from traders at the seemingly hawkish nature of the rhetoric but this was soon replaced with disappointment as uncertainty took over as it was realised that this is still nothing new and really just adds to the confusion of how much of a sure thing December now is.

The result for USD pairs was whipsawing price action that has pretty much seen us settle where we began.

A Look at Some Charts:

I wanted to focus on how some of the pairs we have been watching this week have been playing out.

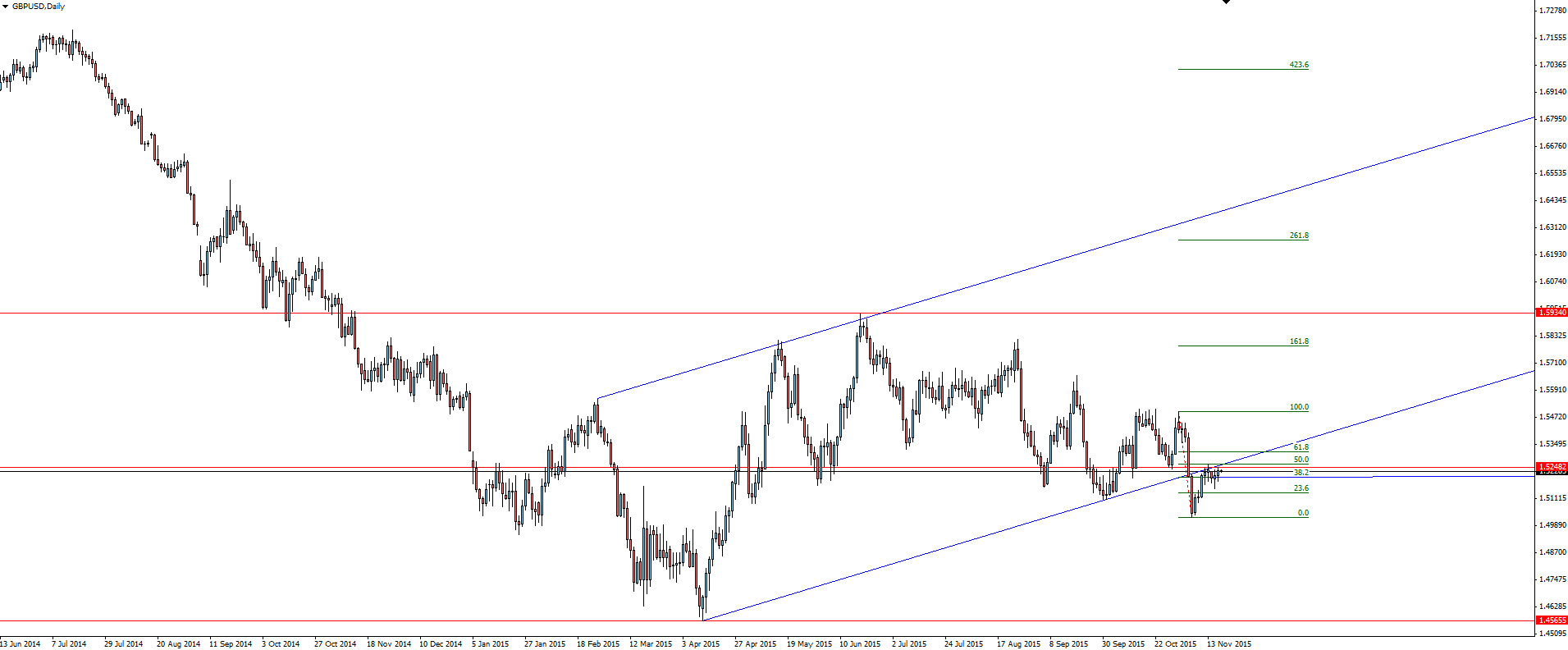

A few days ago we featured Cable as our Chart of the Day. With the pair still in a major bearish trend, price had come back to re-test the previously broken, short term trend line.

GBP/USD Daily:

Click on chart to see a larger view.

The Pound has been the strongest currency against the USD, with Cable not managing to fall to new lows when everything else was getting hammered during the FOMC Minutes whipsaw. However, as long as price is capped below the trend line resistance we have been watching, this short term strength is all still a bit academic.

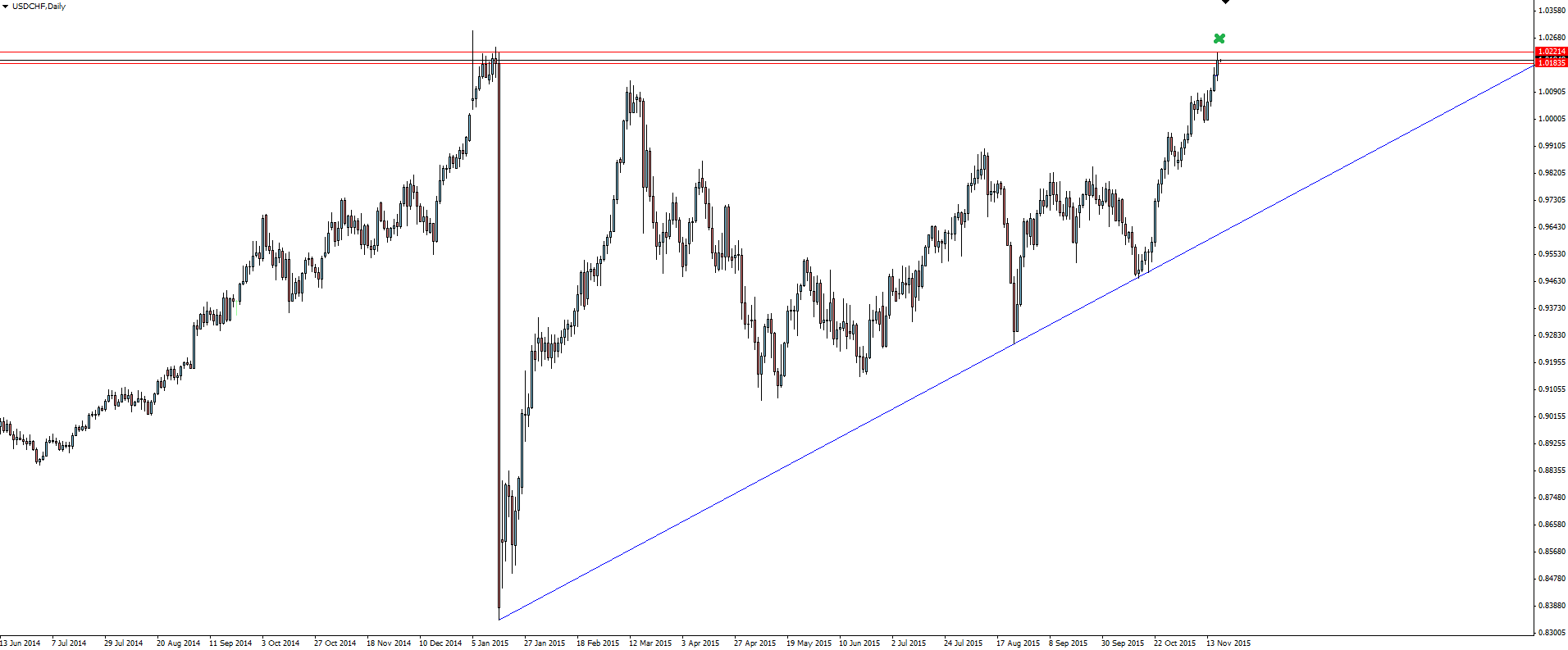

The Swissy on the other hand took a bit of a beating, retracting back to the pair’s SNB floor level and hopefully some of you got paid on our post.

USD/CHF Daily:

Click on chart to see a larger view.

I still can’t see how negative rates can work long term but there’s at least a short term endorsement for the SNB.

———

On the Calendar Wednesday:

JPY Monetary Policy Statement

JPY BOJ Press Conference

GBP Retail Sales m/m

USD Unemployment Claims

USD Philly Fed Manufacturing Index

———-

Chart of the Day:

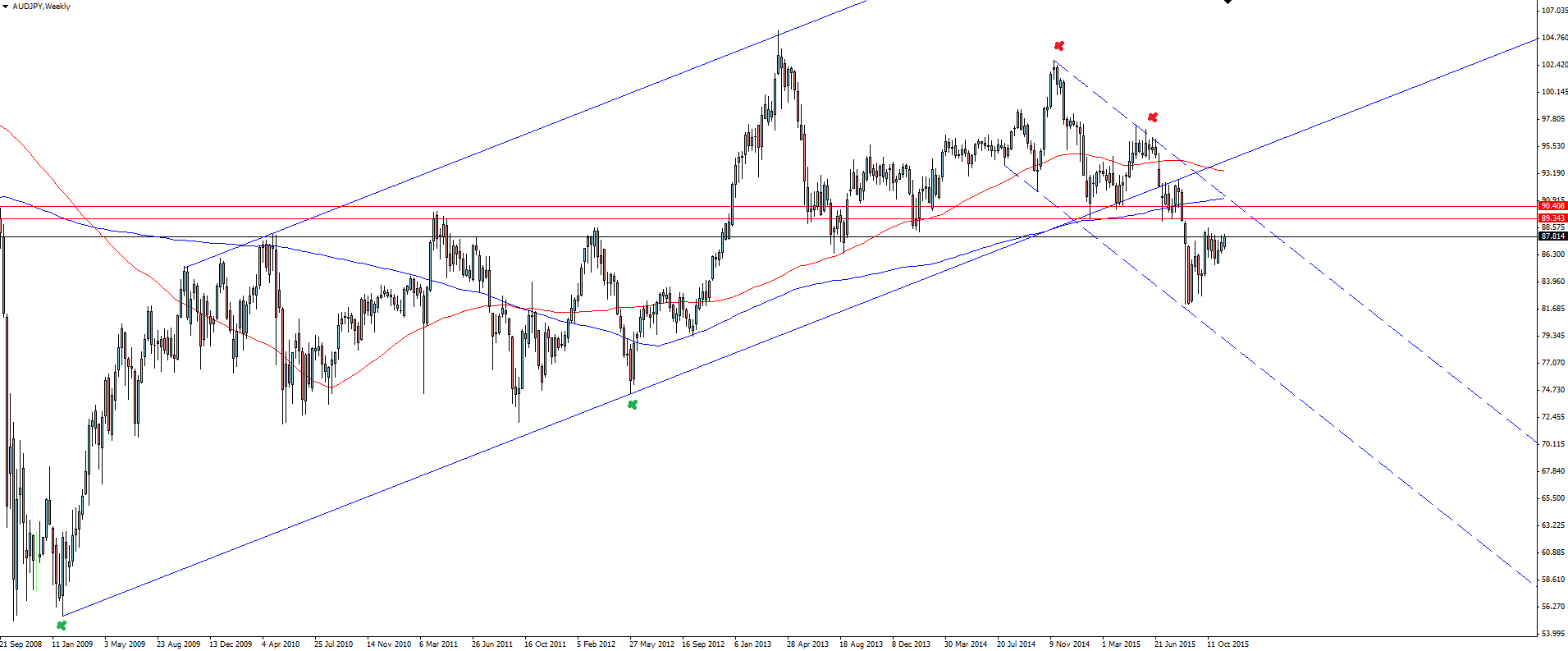

For today’s chart of the day I was asked to do this AUD/JPY chart with moving averages and our traders at Vantage FX get what they want. This is my first posted chart that includes any sort of lagging indicator, so please don’t shoot the messenger!

AUD/JPY Weekly:

Click on chart to see a larger view.

The weekly chart shows the dominant, bullish channel now broken and at least a short term trend change in effect.

Inside this newly formed bearish channel, price looks to be forming a flag as it heads toward resistance.

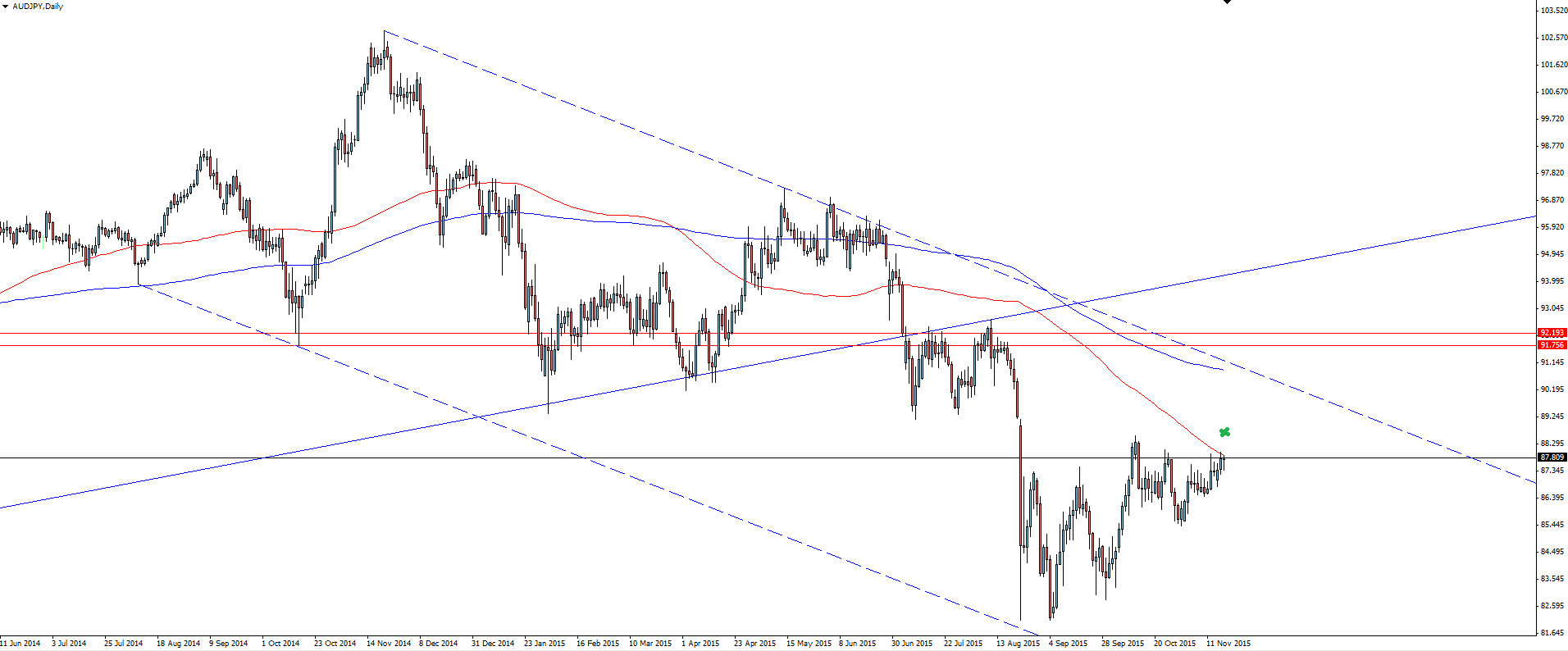

AUD/JPY Daily:

Click on chart to see a larger view.

Zooming into the daily, we have the 100 SMA on the chart because price is now testing the level as dynamic resistance.

With channel resistance still 300 pips away, is it still a little too early to blindly sell into a moving average?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument, Expert Advisors or manual. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance. Free Forex VPS Hosting is now available.