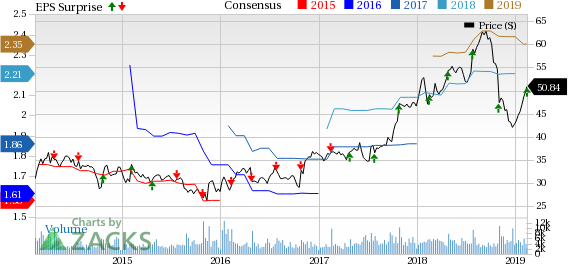

FLIR Systems Inc.’s (NASDAQ:FLIR) fourth-quarter 2018 adjusted earnings of 62 cents per share surpassed the Zacks Consensus Estimate of 60 cents by 3.3%. The reported figure also increased 6.9% from 58 cents registered in the prior-year quarter.

Excluding the one-time items, the company reported GAAP earnings of 71 cents against a loss of 36 cents incurred in the year-ago quarter. The year-over-year upside was primarily driven by a $33.3 million reduction in accrued income tax as a result of the settlement of tax assessments issued by Belgium in connection with the European Commission’s 2016 decision on state aid.

The company’s 2018 adjusted earnings of $2.22 per share surpassed the Zacks Consensus Estimate of $2.21 by a penny. The reported figure also increased 18.1% from the prior-year tally of $1.88.

Inside the Headlines

FLIR Systems’ revenues declined 9.4% year over year to $448.5 million in the reported quarter. The top line also missed the Zacks Consensus Estimate of $466.7 million by 3.9%. Disappointing sales performance by the Commercial segment primarily resulted in the year-over-year decline in the top line.

Meanwhile, organic revenues remained flat when compared with the prior-year quarterly figure, excluding revenues from the previously disclosed divested security businesses.

FLIR Systems’ 2018 revenues dropped 1.4% to $1.78 billion from the prior year tally of $1.80 billion. The top line also missed the Zacks Consensus Estimate of $1.79 billion by a whisker. Organic revenue growth was 6.4%.

Segment-wise, quarterly revenues at the Industrial segment was flat year over year at $181.7 million as increased sales of cooled thermal cores, unmanned aerial systems (UAS) and automotive solutions were negatively impacted by decreased instruments and uncooled core sales.

At the Government and Defense segment, revenues totaled $171.1 million, down 2.5% on a year-over-year basis. The downside can be attributed to revenue declines in CBRNE systems and impacts from the government shutdown.

Moreover, the Commercial segments’ revenues plunged 30.5% to $95.7 million from the year-ago period.

Adjusted operating income came in at $107.9 million compared with $111.7 million in the prior-year quarter, reflecting a 3.4% decline. Also, the company’s total operating expenses decreased 11.7% year over year to $141.9 million.

Liquidity & Cash Flow

As of Dec 31, 2018, the company's cash and cash equivalents were $512.1 million compared with $519.1 million as of Dec 31, 2017. Long-term debt summed $421.9 million, marginally up from $420.7 million on Dec 31, 2017.

Cash flow generated from operating activities at the end of 2018 amounted to $374.2 million, up 21.3% from the prior-year tally of $308.3 million.

Outlook

FLIR Systems issued its guidance for 2019. The company projects its adjusted earnings per share in the range of $2.30-$2.36 on revenues of $1.92-$1.95 billion.

Currently, the Zacks Consensus Estimate for 2019 earnings is pegged at $2.35 on revenues of $1.87 billion. While the earnings estimate comes above the company’s guidance, the same for revenues falls below the projected range.

Zacks Rank

FLIR Systems carries a Zacks Rank #4 (Sell).

Recent Defense Releases

Northrop Grumman Corporation (NYSE:NOC) reported fourth-quarter 2018 earnings of $4.93 per share, which exceeded the Zacks Consensus Estimate of $4.45 by 10.8%. The company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Textron (NYSE:TXT) reported fourth-quarter 2018 adjusted earnings from continuing operations of $1.15 per share, which surpassed the Zacks Consensus Estimate of 98 cents by 17.3%. The company has a Zacks Rank #2 (Buy).

Hexcel Corporation’s (NYSE:HXL) fourth-quarter 2018 adjusted earnings of 82 cents per share outpaced the Zacks Consensus Estimate of 80 cents by 2.5%. The company carries a Zacks Rank #3.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

See them today for free >>

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Hexcel Corporation (HXL): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

FLIR Systems, Inc. (FLIR): Get Free Report

Original post

Zacks Investment Research