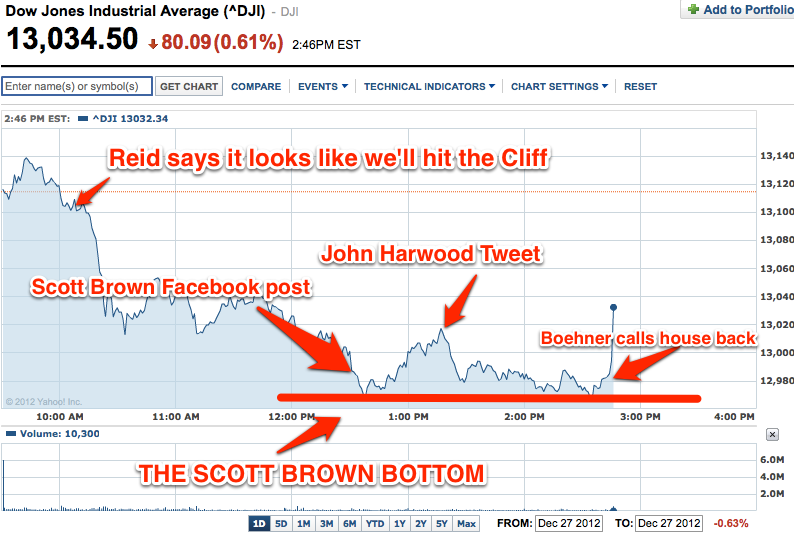

That was today's story. The market gyrations lacked a grounding in reality. Joe Weisenthal charts the day, with my comments to follow.

Here are a number of rhetorical questions:

- After weeks of public posturing on both sides, would we really expect Reid, McConnell or Boehner to make a conciliatory speech from the floor?

- Did we think that Obama would come back early from vacation without even a rumor of a new plan?

- With 100 Senators and 435 Congressmen, do we think that they will all remain silent as negotiations proceed?

- Perhaps we should expect that many will be claiming a few minutes of fame without any new information at all!

If you were making trades by accepting this "information" you were on the wrong side today!

The Reality

While the market is following the public news sources, including anyone who will go on TV, none of this information is very helpful.

There have been continuing back-channel discussions at the staff level. There is also escalating pressure, especially on Republicans, to reach some kind of deal. The doctors, those affected by the AMT, and the business executives stymied by uncertainty are mostly from the GOP.

If they had a chance to vote on a compromise proposal, many GOP legislators would support a compromise. The compromise would be close to the most recent Obama/Boehner discussion, with perhaps a little more concession from the President on spending. While there is support for such a plan, there is a key problem of who goes first, both in terms of party and also which House. Revenue bills are supposed to originate in the House. This partly explains why the Senate-passed bill on the Obama plan has never formally gone to the House.

This is only going to work if the Senate finds a compromise, without a filibuster, that Boehner is also willing to accept for a House vote. There is still some possibility of this, and we may well know the verdict tomorrow. The path to a compromise would start with the Senate considering such a proposal. The House would take it up on Sunday.

The other alternative is the "bungee jump." I have noted that legislators are creative when it comes to deadlines. They might extend their deadline by going "over the cliff" while sending a message that there will be an early vote by the new Congress.

The Nature of Compromise

I enjoyed reading the description of compromise from Alan Grayson, a Democratic Congressman-elect from Florida. To appreciate the key point, don't think about his particular perspective, but instead focus on the process he is describing:

"Here are what I modestly and humbly refer to as "Grayson's Laws of Legislating":

1) Vote for what you're in favor of.

2) Vote for what you can live with, if you must do that to get what you need.

What we've been seeing in the House of Representatives lately has been a series of massive and pervasive violations of Grayson's Laws of Legislating. Instead of "I'll vote for X because it's right," or "You don't like X and I don't like Y, but I'll vote for X and Y if you vote for X and Y," it's "If I don't get Z, I ain't votin' on nothin'." And that's the problem."

He provides a colorful example of where nearly everyone in Congress agrees on most of the fiscal cliff issues. On the remaining 10% he provides a colorful example of trading help for the unemployed for more defense spending. It is a good description of how Congress has worked for decades.

The key question is whether we can see this sort of horse trading within the next few days.

Trading and Investing

The volatility is a natural opportunity for traders. You need only to fade the statements of whatever politician spoke most recently.

Investors should look a month or so ahead. If you are willing to conclude that there will eventually be a solution, you can go shopping for bargains whenever there is apparent bad news.

These were today's opportunities, and we might well see the same thing tomorrow.