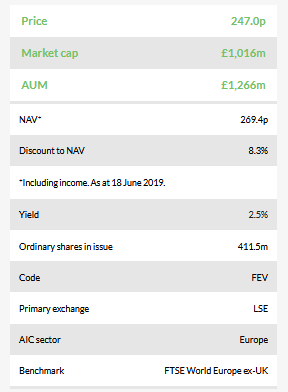

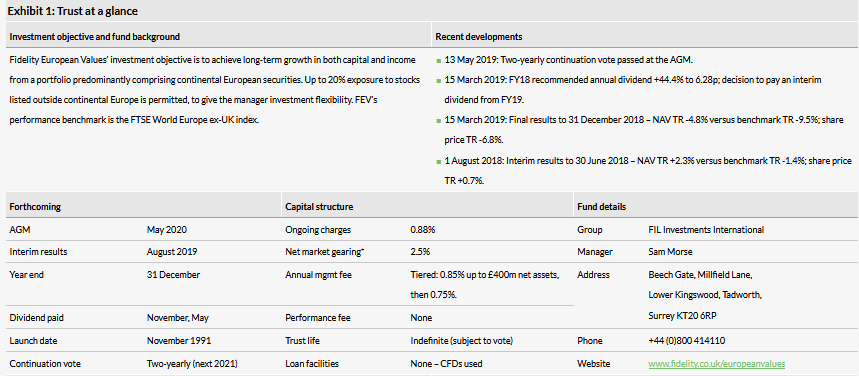

Fidelity European Values (LON:FEV) has had a conspicuously strong period of outperformance since March 2017, building on its positive long-term track record. Its NAV total return is ahead of the AIC Europe sector average over one, three and five years, ranking first or second out of eight over each period, and FEV has clearly outperformed its benchmark over one, three, five and 10 years to end-May 2019. Helped by a reallocation of expenses between the revenue and capital accounts, the board raised the FY18 dividend by 44.4% to 6.28p – representing a 2.5% yield – while also adding to reserves, and an interim dividend will be introduced in FY19. FEV’s discount has narrowed to 8.3%, similar to the sector average of 8.5% but wider than its five-year low of 2.8%, and from 2019 the board is seeking to maintain the discount in single digits in normal market conditions.

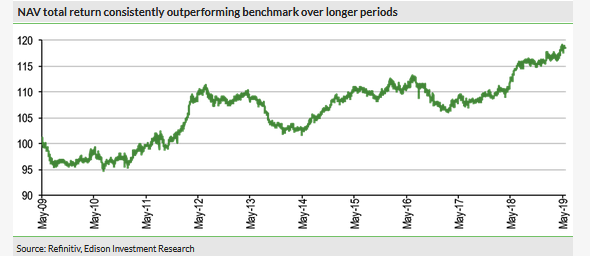

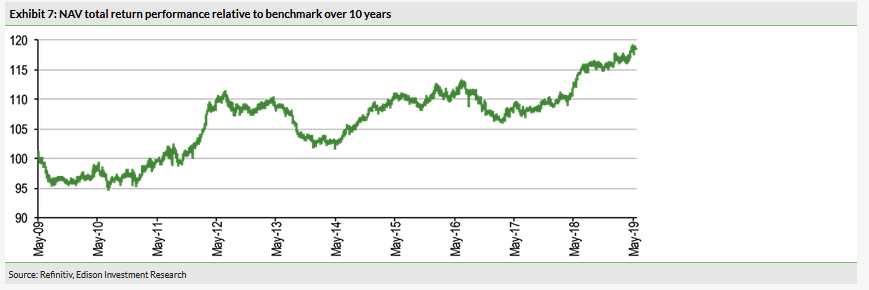

NAV total return consistently outperforming benchmark over longer periods

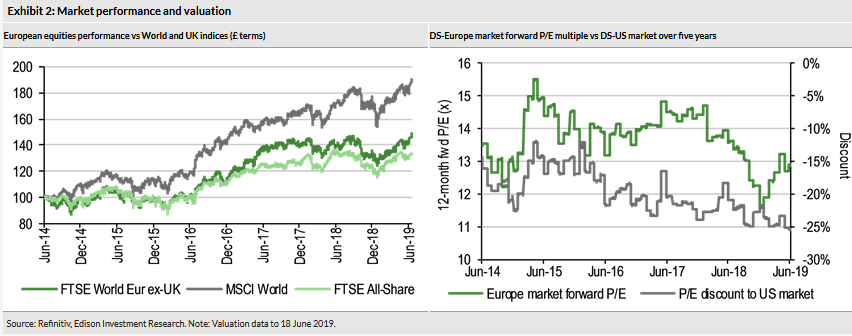

The market opportunity

Despite the 2019 market rebound, European equity valuations are unstretched compared with historical average levels, and European stocks have de-rated further relative to the US market – valuation discount now 25% versus a 20% five-year average. Given the mixed near-term growth outlook for Europe, along with geopolitical uncertainties, a more selective investment approach may be warranted.

Why consider investing in FEV?

- Enviable near- and long-term track record of outperforming its benchmark.

- Experienced manager follows a consistent, proven stock selection process, supported by Fidelity’s in-depth research capabilities.

- Active board: management fees reduced; expenses reallocated to support an increased dividend; interim dividend being introduced; and discount management policy tightened.

Lower charges, higher dividend, narrower discount

The lower fee structure in place since April 2018 has given FEV a more competitive 0.88% ongoing charge, while the 75% allocation of management fees and finance costs to capital from FY18 also supports a higher, fully covered dividend. Together with recent outperformance, these moves appear likely to have contributed to FEV’s discount narrowing to 8.3% from a wide point of 17.3% in July 2016.

Market outlook: Valuation upside but risks remain

As illustrated in Exhibit 2 (left-hand chart), continental European equity markets have outperformed the UK stock market over the last five years but have lagged the world market, which has been driven largely by the strong performance of US equities. Increased volatility was evident across all major markets in 2018, but 2019 has seen a strong rebound from the pronounced sell-off in the fourth quarter of 2018, with many markets reaching new highs. As shown in Exhibit 2 (right-hand chart), despite the 2019 market rebound, European equity valuations are unstretched, with the Datastream Europe index’s 12.9x forward P/E multiple 6% below its five-year average. European markets have also continued to de-rate relative to the US market, and are now at a 26% discount to the US market’s 17.3x forward P/E multiple, compared with a five-year average discount of 20%.

The 2019 market rebound appears to have been mainly driven by reduced fears over US interest rate tightening, as the outlook remains clouded by geopolitical uncertainties such as the US-China trade dispute and the UK’s withdrawal from the EU. Additionally, in its April 2019 outlook, the IMF lowered its global growth forecasts, with Germany and Italy seeing the biggest downgrades for 2019 among advanced economies, suggesting a weaker near-term outlook for corporate earnings growth. However, euro area GDP growth is projected to improve from 1.3% in 2019 to 1.5% in 2020, with global growth rising from 3.3% to 3.6%. Against this backdrop, with the outlook for European corporate earnings growth mixed and clouded by geopolitical uncertainties, while equity valuations appear undemanding relative to history and US equities, investors may find appeal in a focused and relatively defensively positioned fund with a strong performance track record.

Fund profile: Focused European equity portfolio

FEV ranks as one of the largest LSE-listed, continental Europe-focused investment trusts and has an established track record approaching 30 years. Acting as FEV’s portfolio manager since January 2011, Sam Morse has more than 26 years’ investment experience and also manages the open-ended Fidelity European Fund. He has followed a consistent approach throughout his career, investing in companies with sustainable medium-term dividend growth prospects, seeking capital and income growth. The manager aims for FEV to outperform the benchmark FTSE World Europe ex-UK index by 1–2pp pa over the long term. No top-down sector or geographic allocations are imposed, but Morse aims to maintain a balanced portfolio in terms of sector, market cap and underlying geographic exposures, to ensure that stock selection is the primary performance driver. Single-stock CFDs are used to add gearing and to take short positions, while index futures are also used to add gearing, as well as to hedge short positions and general market risk.

Since the 2018 AGM, FEV’s stated investment objective has been to achieve long-term growth in income as well as capital. The introduction of an explicit income objective reflected the manager’s attention to dividend income, rather than signalling any change in investment approach.

The fund manager: Sam Morse

The manager’s view: Value in consistent, long-term approach

Morse is circumspect on the outlook for European equities, noting that continental European stock markets have significantly underperformed the US market over the last 12 months and sentiment towards Europe remains weak. However, he views market valuations in general as reasonable and suggests that any improvement in sentiment could lead to a re-rating of European equities. On a different note, he emphasises the consistent value creation of his long-term approach to investing, with major changes to the portfolio seldom made, highlighting FEV’s 10.1% pa NAV total return over his tenure as manager (to end-May 2019), versus a 7.7% pa return for the benchmark FTSE World Europe ex-UK index. He observes that many of FEV’s current investments have been held in the portfolio throughout his more than eight-year tenure as manager, and notes that the long-term approach is reflected in FEV’s low portfolio turnover of 17.3% in 2018 (down from 23.3% in 2017).

The manager underlines that portfolio stocks are continually reassessed and those held for many years can still make a material contribution to FEV’s performance. As an example, he cites leading European exchange Deutsche Börse, which has been in the portfolio since before his appointment as manager and ranked as one of the top three contributors to FEV’s relative performance in 2018. He points to the company’s strong fundamentals and attractive valuation that continue to justify its place in FEV’s portfolio. Among the stock’s attractions, Morse highlights that Deutsche Börse has an attractive business model whether markets are rising or falling, with several effective monopoly businesses, structural growth from exchanges taking share from over-the-counter (OTC) trading, and its mostly fixed cost base means margins rise as revenues grow. Management’s cost discipline is reflected in a stable 20% return on equity (ROE), cash generation is strong, as is the balance sheet, while the stock yields 2.5% and dividends are growing at a double-digit rate.

Commenting on portfolio activity in 2018, Morse notes further portfolio concentration during the year, with FEV selling its holdings in BIC Group, Elior, Anheuser-Busch InBev and Aena, while Grifols was the sole portfolio addition. The first three holdings were sold due to deteriorating fundamentals creating concerns over their dividend outlooks, while Spanish airports owner and operator Aena was sold on valuation grounds. Grifols is a global leader in plasma-derived treatments, which the manager believes will see earnings growth accelerate ahead of current market expectations. Morse has monitored Grifols for a couple of years and now sees the company enjoying improved pricing power. While the business has relatively high financial leverage and is quite capital intensive, turnover growth is strong, and Morse sees great potential for margin recovery following a number of recent acquisitions. This is expected to support a growing dividend, while the preference ‘B’ shares, which currently yield c 2%, also have some takeover protection.

Asset allocation

Investment process: Selecting for sustainable dividend growth

Morse seeks companies with sustainable medium-term dividend growth prospects, irrespective of sector, country or market cap. His investment approach includes three core principles:

- Bottom-up stock selection – driven by cash flow generation and dividend growth potential.

- Long-term view – considered to improve investment performance, as well as reducing costs.

- Cautious approach – managing downside risk as a foundation for long-term outperformance.

The regular flow of research from Fidelity’s in-house team of 40 pan-European analysts provides a primary source of investment ideas for the manager. Once he identifies a stock as potentially suitable for inclusion in the portfolio, a more detailed evaluation is conducted, which includes at least one management meeting. Prior to adding a stock to the portfolio, Morse aims to define three specific reasons to invest – two relating to fundamentals and one to valuation. Morse seeks companies with robust fundamentals, including structural growth prospects, disciplined capital allocation and a proven business model. Strong cash flow generation is viewed as a prime indicator of dividend growth potential, while a robust balance sheet indicates a company’s ability to sustain dividend payments alongside investing for growth. A valuation review completes the analysis, with investments only made if a company’s shares are trading at a discount to the analyst’s assessment of its intrinsic valuation. Stocks are sold when they no longer meet the investment criteria, usually when fundamentals deteriorate, reducing dividend prospects, or when valuations become less attractive. The outcome is a relatively concentrated portfolio, typically comprising 40–60 holdings.

Portfolio stocks are ranked using a prospective total shareholder return (TSR) analysis and relative weightings are determined accordingly, with the best prospects allocated a higher weighting. The TSR analysis incorporates medium-term earnings growth prospects, dividend yield and potential for re-rating/de-rating, as well as liquidity, volatility, downside risk, and Fidelity’s in-house analyst rating.

Portfolio exposure is limited to 10% of gross assets for a single company, 20% for companies outside the benchmark (including UK-listed companies) and 10% for unlisted securities. Gearing up to 30% of net assets is permitted, and gross short exposure is restricted to 10% of net assets.

Current portfolio positioning

FEV’s portfolio has become more concentrated in recent years. The number of holdings reduced from 57 to 49 in 2017, when eight short positions were also initiated, and long exposures declined further to 46 in 2018, with short positions scaled back to four. Despite this, FEV remains fully invested, having recycled sales proceeds into existing holdings.

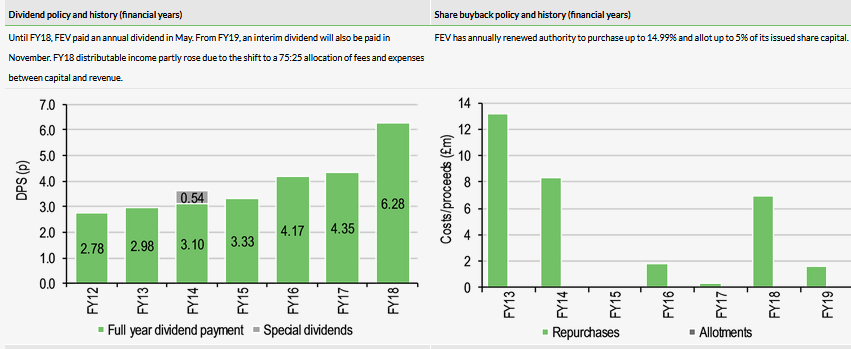

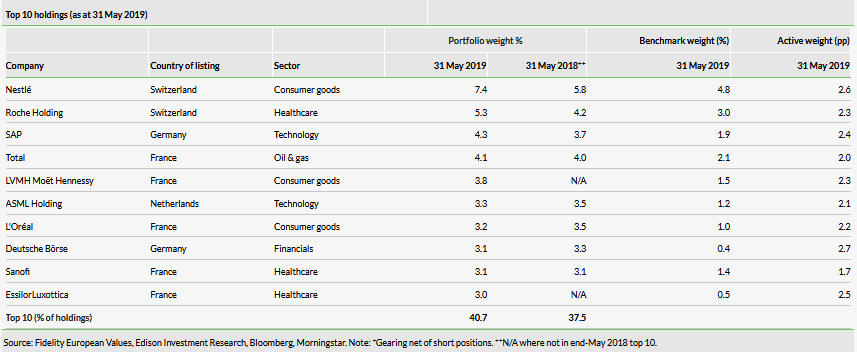

While the portfolio has become more concentrated, exposure is still fairly evenly spread, with the top 10 holdings representing 40.7% of the portfolio at end-May 2019, compared with 37.5% a year earlier. The trust has become more tilted to large-caps over the last year, with stocks below £10bn market cap declining from c 22% to c 15% of the portfolio (see Exhibit 1). At end-May 2019, single-stock short positions equated to c 1.4% of net assets (hedged by Euro Stoxx 50 index futures).

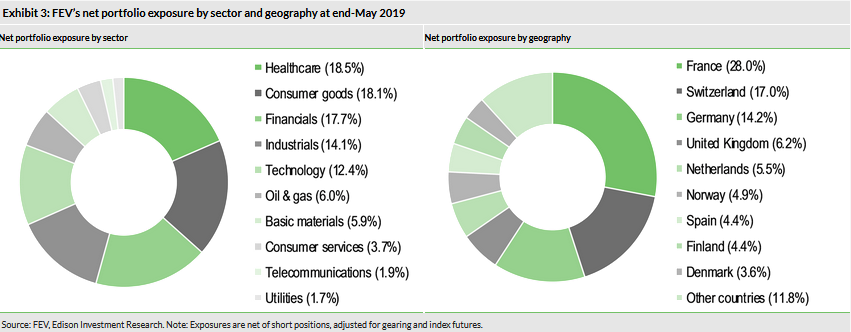

FEV’s portfolio remains well diversified by sector and geography, with exposures at end-May 2019 (see Exhibit 3) broadly similar to a year earlier. The largest sector changes over the year were a 4.5pp decrease in industrials and a 1.8pp increase in consumer goods. Technology (+6.0pp versus the benchmark) and healthcare (+3.6pp) are FEV’s largest overweights, with the manager noting that FEV’s four technology holdings Dassault Systemes, ASML, Amadeus IT Group and SAP are all well-established dividend payers. Significant underweights are utilities (-2.9pp), financials (-2.6pp) and consumer goods (-2.3pp). The greatest shift in geographical exposure over the year was a 2.4pp increase in Switzerland, offset by small declines for many countries, with the UK (+6.2pp) and France (+4.7pp) the greatest overweights, and Germany (-4.7pp) the largest underweight.

Performance: Ahead of benchmark over one to 10 years

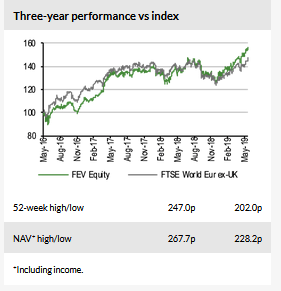

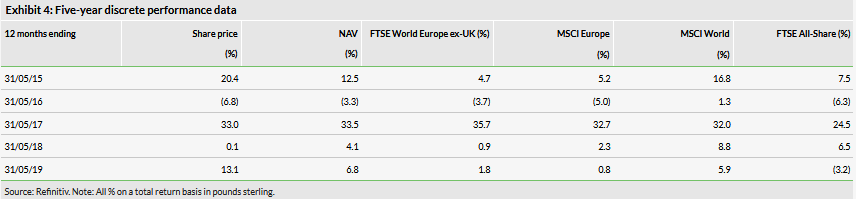

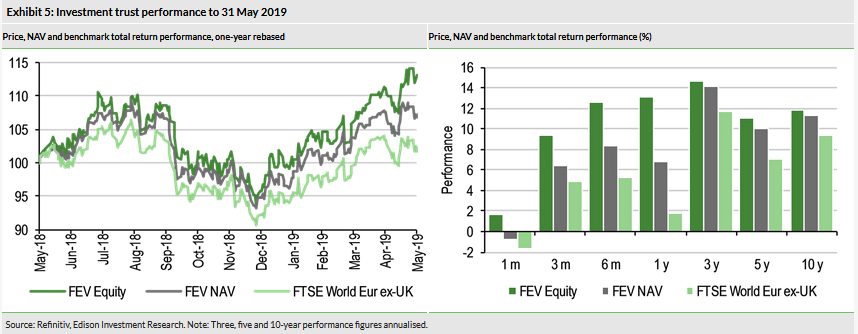

As shown in Exhibit 5, FEV’s share price and NAV total returns were both materially ahead of its benchmark FTSE World Europe ex-UK index over the year to end-May 2019, with outperformance evident during market strength and weakness, which contrasts with FEV’s historical tendency to outperform mainly during periods of market weakness due to its relatively defensive positioning.

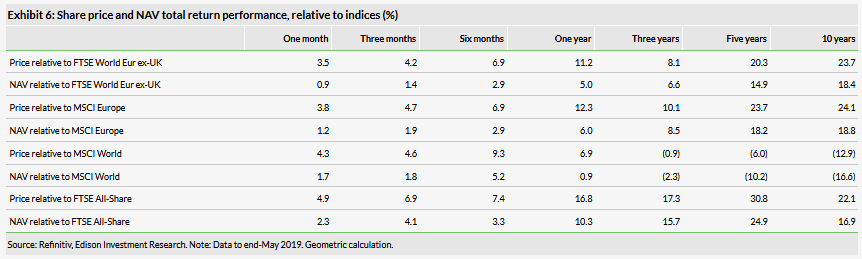

As shown in Exhibit 6, FEV’s share price and NAV total returns are ahead of its benchmark FTSE World Europe ex-UK index over one, three, five and 10 years, and have also outperformed the MSCI Europe and FTSE All-Share indices over these periods.

As illustrated in Exhibit 7, FEV has seen three periods of extended outperformance relative to its benchmark (August 2010 to July 2012; May 2014 to July 2016; and March 2017 to May 2019) over the last 10 years, with three lesser periods of underperformance.

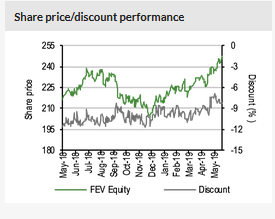

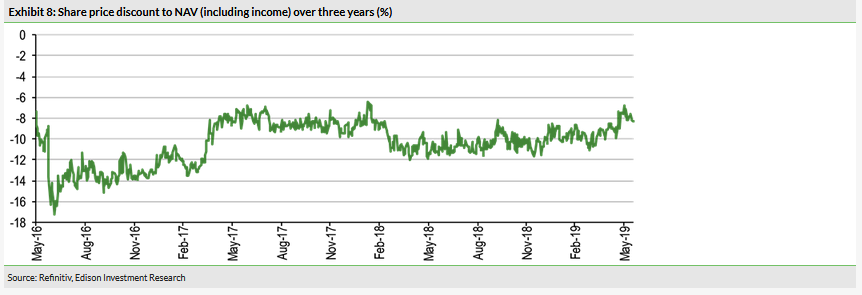

Discount: At the narrow end of its one-year range

FEV has an active discount management policy, and from 2019 the board is seeking to maintain the discount in single digits in normal market conditions. As illustrated in Exhibit 8, FEV’s share price discount to NAV (including income) has moved in a relatively broad range over the last five years. Having widened from its low of 2.8% in July 2015 to its wide point of 17.3% in July 2016, shortly after the UK’s vote to exit the EU, the discount has since contracted appreciably. The current 8.3% discount is at the lower end of its 6.8% to 11.7% one-year range, and is narrower than its 10.0%, 10.4%, 9.2% and 11.0% averages over one, three, five and 10 years, respectively.

Capital structure and fees

FEV has 411.5m ordinary shares in issue, having bought back 0.7m shares (0.2% of issued capital) since March 2019, when repurchases were restarted after a six-month pause. The board has authority to repurchase up to 14.99% and allot up to 5% of FEV’s outstanding shares, but buybacks have been modest since 2014 (see Exhibit 1) and no shares have been issued in the last 10 years. FEV’s general policy is to employ a low level of gearing via CFDs to enhance investment returns, with index futures used to hedge short positions. However, index futures have recently also been used to add gearing, as this acts to broaden FEV’s market exposure, partly offsetting the increase in portfolio concentration arising from the number of holdings declining over the last two years. At end-May 2019, gross market gearing was 5.3%, including c 1.4% in individual stock short positions, c 3.0% in long CFDs and c 0.8% in Euro Stoxx 50 index futures, while net gearing was 2.5%.

FEV introduced a tiered management fee structure in April 2018, with a reduced 0.75% per annum payable on net assets above £400m, and an unchanged 0.85% per annum charged up to this level. No performance fee has been payable since 2014. The ongoing charge declined from 0.93% in FY17 to 0.88% in FY18, reflecting the new fee structure and a rise in net assets. A further modest decline in the ongoing charge is expected in FY19, when the fee reduction has a full-year effect.

From FY18, management fees and finance costs have been allocated 75:25 between the capital and revenue accounts respectively, broadly reflecting the split of longer-term historical contributions to total return. Previously, these costs were charged entirely to revenue. The resulting higher share of revenue returns supported the strong uplift in the FY18 dividend, which was 1.1 times covered.

FEV is subject to a two-yearly continuation vote, with the next vote due at the 2021 AGM.

Dividend policy and record

Since the 2018 AGM, FEV’s stated investment objective has been to achieve long-term growth in both capital and income, with the explicit income objective introduced to reflect the manager’s focus on companies capable of growing their dividend. Revenue earnings have been largely distributed in full, with only limited reserves available to smooth dividend payments, but the board now aims to augment revenue reserves by retaining a small proportion of earnings each year (9% retention rate for FY18). FEV’s ordinary dividend has been increased in each financial year since 2010; and the trust currently yields 2.5%, which is in line with the sector average (see Exhibit 9). The FY18 annual dividend was increased by 44.4% to 6.28p (see Exhibit 1), with revenue earnings benefiting from the move to a 75:25 allocation of fees and expenses between the capital and revenue accounts. Sizeable increases have also been made in previous years, such as FY16 which saw a 25.2% increase, and the dividend had grown by a compound 9.4% pa over the five years prior to FY18.

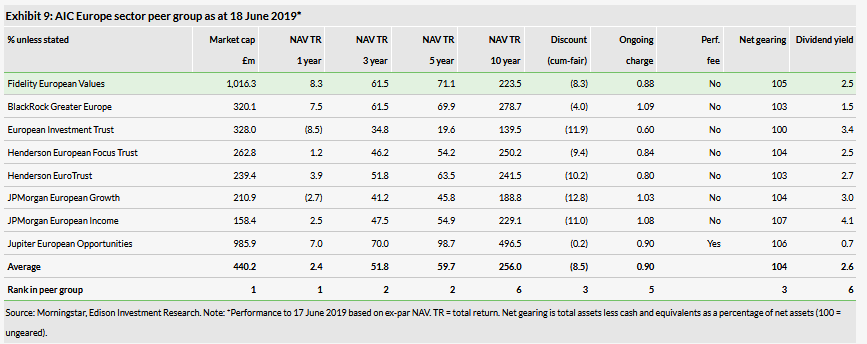

Peer group comparison

Exhibit 9 shows a comparison of the eight AIC Europe sector trusts, of which FEV is the largest, with a £1.0bn market cap. The trust’s NAV total return is ahead of the sector average over one, three and five years, ranking first or second over each period. Over 10 years, FEV’s NAV total return is lower than the sector average, but in line with the peer group average excluding Jupiter European Opportunities, which is differentiated by its c 25% UK exposure and has achieved an exceptional performance. We also note that FEV has clearly outperformed its benchmark over the 10 years to end-May 2019 (see Exhibit 7). Its 0.88% ongoing charge is close to the sector average and it does not charge a performance fee, similar to the majority of its peers. FEV’s share price discount to NAV is broadly in line with the sector average, while its net gearing is slightly above the mean, and its dividend yield is marginally below the average.

The board

FEV has five independent non-executive directors, who have backgrounds in asset management, investment banking, financial services and international affairs. Chairman Vivian Bazalgette (appointed director December 2015, chairman May 2016) was CIO at M&G and is a director of Brunner Investment Trust. Senior independent director Marion Sears (appointed January 2013) worked in investment banking mergers and acquisitions, broking and the pharmaceutical industry and is a director of Aberdeen New Dawn Investment Trust. Robin Niblett (appointed January 2010) is director and chief executive of Chatham House (the Royal Institute of International Affairs) and is a member of the World Economic Forum’s Regional Future Council on Europe. Paul Yates (appointed March 2017) was CEO of UBS Global Asset Management (UK) and is a director of The Merchants Trust and Witan Investment Trust. Fleur Meijs (appointed September 2017) was a financial services partner at PricewaterhouseCoopers and is a director of Invesco Asia Trust.