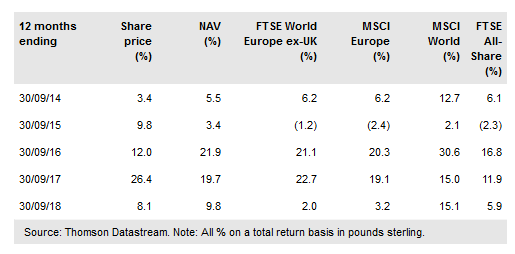

Fidelity European Values (LON:FEV) is a relatively defensively positioned trust investing primarily in continental European equities. Recent performance has been strong relative to its FTSE World Europe ex-UK index benchmark and peers, helped by its exposure to defensive technology stocks, less interest rate-sensitive banks, and energy stocks, as well as holding no automotive stocks. The portfolio remains well-balanced, but is now more concentrated in a smaller number of stocks (currently 47), as the manager has taken profits where prospects for sustained dividend growth have weakened, and few new ideas have met his investment criteria. FEV’s consistent longer-term track record and tendency to outperform in periods of market weakness may find appeal in an uncertain market environment.

Investment strategy: Selecting for dividend growth

To achieve FEV’s capital and income growth objective, the manager seeks to invest in companies with sustainable dividend growth prospects on a three- to five-year view. Stocks are selected on a bottom-up basis, focusing on cash flow generation and dividend growth potential, with strong attention to downside risk as well as upside potential. FEV maintains a balanced portfolio, typically containing 40-60 holdings and up to 10 short positions, via single-stock contracts for difference (CFDs). Gearing is permitted up to 30% of net assets, and is achieved using CFDs and index futures, which are also used to hedge the overall short exposure.

To read the entire report Please click on the pdf File Below..