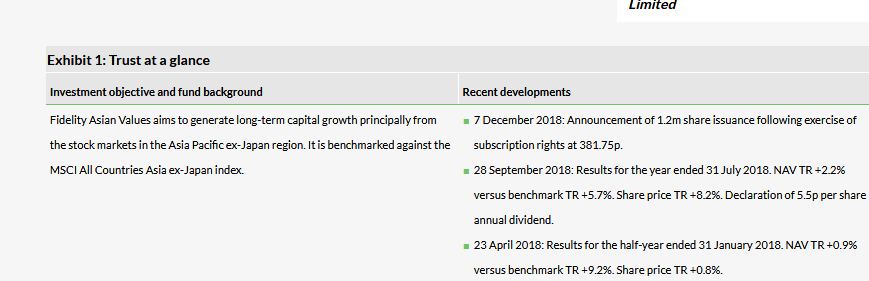

Fidelity Asian Values (LON:FAS) significantly outperformed its benchmark in the 2018 market sell-off, helped by its focus on capital preservation as well as growth. Manager Nitin Bajaj says that recent stock market volatility has enabled him to purchase market-leading businesses at very attractive prices, as valuation multiples have compressed while corporate earnings have remained robust. Bajaj notes that FAS’s portfolio is currently trading on a relatively low aggregate P/E multiple and is generating a relatively high return on equity. The trust has a long-term record of outperformance versus the MSCI AC Asia ex-Japan index. Its share price is ahead over one, three, five and 10 years, while its NAV has outperformed over one, five and 10 years.

The market opportunity

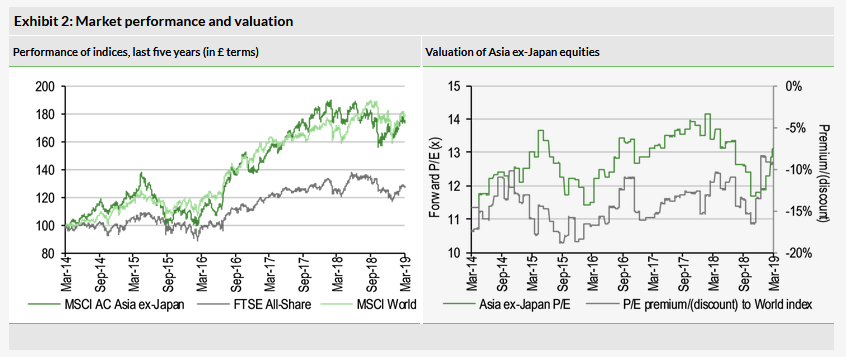

There is a very large (greater than 18,000) number of companies in the Asia Pacific ex-Japan investment universe. Equities in the region have broadly kept pace with the global stock market over the last five years (in sterling terms), while performing considerably better than UK shares. However, Asian equities continue to trade at a meaningful discount to world equities, despite significantly better economic growth prospects in the region.

Why consider investing in Fidelity Asian Values?

Diversified portfolio of primarily smaller-cap Asia ex-Japan equities: good businesses, with good management teams, purchased at a good price.

Well-defined, value-orientated investment process.

Focus on capital preservation as well as long-term capital growth.

Strong absolute total returns over three, five and 10 years.

Long-term outperformance versus the MSCI AC Asia ex-Japan index.

Good relative performance versus its peers.

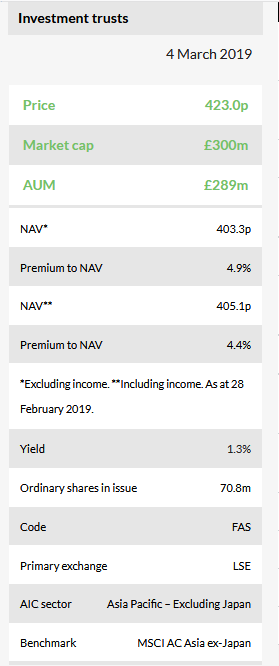

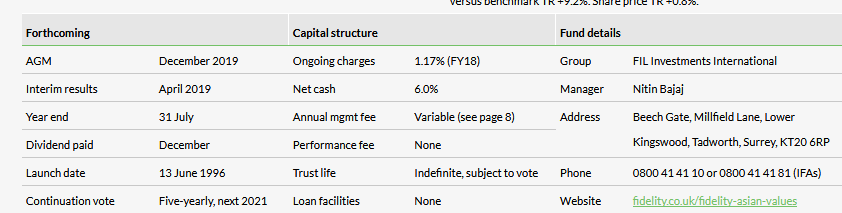

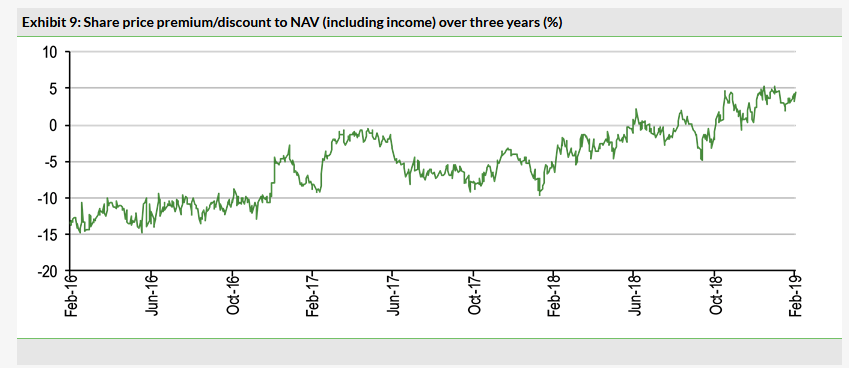

Higher demand has led to a consistent premium

FAS is currently trading at a 4.4% premium to cum-income NAV, which compares with a 10-year widest discount of 14.8% in mid-March 2016. Over the last one, three, five and 10 years, the trust has traded on average discounts of 0.2%, 5.3%, 7.6% and 8.5% respectively. While focusing on capital growth rather than income, the trust also offers a 1.3% dividend yield. At end-January 2019, FAS had gross market gearing of 1.3%, which was more than offset by a 7.3% cash holding, resulting in a net cash position of 6.0%.

Market outlook: Relatively high growth prospects

The performance of Asian, UK and world equities over the last five years (in sterling terms) is shown in Exhibit 2 (LHS). Asian share prices have broadly kept pace with the world market, having rallied sharply from early 2016, and have significantly outperformed UK equities over the period. In recent years, Asian share prices have been supported by robust corporate earnings growth; drivers include increased consumption by an expanding middle class, and ongoing infrastructure spending. However, Asian equities remain relatively attractively valued: the Datastream Asia ex-Japan index is trading on a forward P/E multiple of 13.1x, which is a 9.3% discount to the Datastream World index, albeit somewhat narrower than the average 14.3% discount over the last five years. The Asian region also has relatively attractive economic growth prospects. In its World Economic Outlook January 2019 update, the International Monetary Fund forecast GDP growth in emerging and developing Asia of 6.3% in 2019 and 6.4% in 2020, which is meaningfully higher than 3.5% and 3.6% respectively for world output. Given this valuation and growth backdrop, investors may wish to consider allocating funds to Asia in an environment where earnings growth – including in developed markets such as the US, UK and Europe – is slowing.

Fund profile: Focus on finding undervalued securities

FAS was launched on 13 June 1996 and is listed on the Main Market of the London Stock Exchange. Lead manager (since 1 April 2015), Nitin Bajaj aims to generate long-term capital growth by investing in a diverse portfolio of Asia ex-Japan equities that are trading at a discount to their intrinsic value. He is able to draw on the resources of Fidelity’s well-resourced Asia Pacific ex-Japan investment team, which includes five dedicated small-cap analysts. The manager invests across the market cap spectrum, and geographic and sector exposure is unrestricted, although Bajaj limits single country and sector exposure to 25% and 15% of the portfolio respectively. At the time of investment, up to 10% of gross assets may be invested in a single company, although the manager prefers to limit this to 3.5%. A maximum 5% of gross assets may be invested in companies listed outside the Asian region, if they have a high economic exposure to the area. Bajaj may invest up to 5% of gross assets in unlisted securities (if they are expected to list in the foreseeable future), and derivatives are permitted for efficient portfolio management and to enhance investment returns. Total derivative exposure is limited to 40% of NAV based on gross assets and 30% of NAV based on net market exposure. The board expects net market exposure to be in a range of 90% to 115% in normal market conditions. In terms of gearing, long contracts for difference (CFDs) are used as a cheaper alternative to bank debt. The manager is able to take out short positions up to 10% of total assets, but in practice short exposure is much lower. FAS’s currency exposure is generally unhedged.

The fund manager: Nitin Bajaj

The manager’s view: Macro likely to drive the market in 2019

Bajaj says that 2018 was a tough year for global equities and his focus was on capital preservation in a volatile stock price environment. Asian markets in particular have been negatively affected by the ongoing trade dispute between the US and China, which the manager says has presented him with attractively priced investment opportunities. Over the last few months, he has been able to acquire a selection of strong businesses that are trading on single-digit P/E multiples. Bajaj believes that stock markets in 2019 will continue to be driven by macro events, and if the dominant US market declines, Asian stocks could become extremely inexpensive. The manager says that the overall macro environment is ‘muddy’, with uncertainties around the US economic outlook given peak employment and a rising cost of capital. Within Asia, Bajaj says that the key Chinese economy is slowing, suggesting it is particularly prudent to avoid companies with cyclical businesses or stretched balance sheets. He notes that in keeping with the late stage of the investment cycle, where the economy is still okay but markets are falling, value stocks are outperforming.

The manager says that as a result of share price weakness in 2018, primarily due to multiple compression rather than lower earnings, the aggregate P/E on the fund is now in single digits (9.2x, which is the lowest since he started managing the trust). He argues that while investors focus on the negative effects of the trade dispute, there are other important factors in the region to consider. Although China’s growth is moderating, only 6–8% of Chinese GDP is exports to the US. There is much ongoing discussion about Chinese production moving overseas; however, the manager says that this has been a trend for a number of years. He invests in traditional businesses, for example footwear, where 15–16% of China’s manufacturing has already moved overseas to countries such as Bangladesh, India and Vietnam. Bajaj says that China remains a low-cost producer, but where it is losing low-end business, it is making up for this by moving up the value chain. The manager also highlights Chinese government stimuli, including lower reserve requirements in the banking sector to encourage lending, and a reduction in personal taxes to stimulate consumer demand.

Asset allocation

Investment process: Aiming for capital growth and preservation

The manager aims to capitalise on the relatively high economic growth in the Asia Pacific region by buying strong businesses, run by trusted management teams, and which are trading on reasonable valuations. He favours small and medium-sized companies, as they tend to be less well researched and can be mispriced; he says he aims to buy ‘the winners of tomorrow’ before these companies are appreciated by the wider market. The investible universe is made up of more than 18,000 companies, providing the manager with plenty of investment opportunities.

Bajaj says that a key part of the process is to understand the businesses in which he invests, focusing on the key drivers and industry structures. He examines 10–20 years of a company’s financial reports to understand its historical returns and the cyclicality of its business. The manager only invests in companies with strong management teams that act with skill and integrity, and are fully able to explain and understand any headwinds that may have been encountered in the last 10–15 years. An ideal investment is in a company with a history of strong returns, with scope for margin improvement, a wide economic moat and the ability to survive rocky periods. Bajaj invests in companies that are trading at a significant discount to their intrinsic value; he aims to generate a 50% total return on each investment with a three-year view. He explains that buying companies at a discounted valuation provides a margin of safety, and offers a level of protection in periods of stock market weakness. In terms of capital preservation, Bajaj avoids ‘blue sky’ companies (firms with untested business models or high expectations in a tough market), companies with high levels of debt, turnarounds in bad businesses, high-growth companies with low barriers to entry, and momentum stocks trading at unattractive valuations. The manager also generally avoids businesses that are at risk of an external policy change or where the market underestimates the impact of these; however, he says that some companies can be overly punished by the threat of a policy change, which may provide a good investment opportunity.

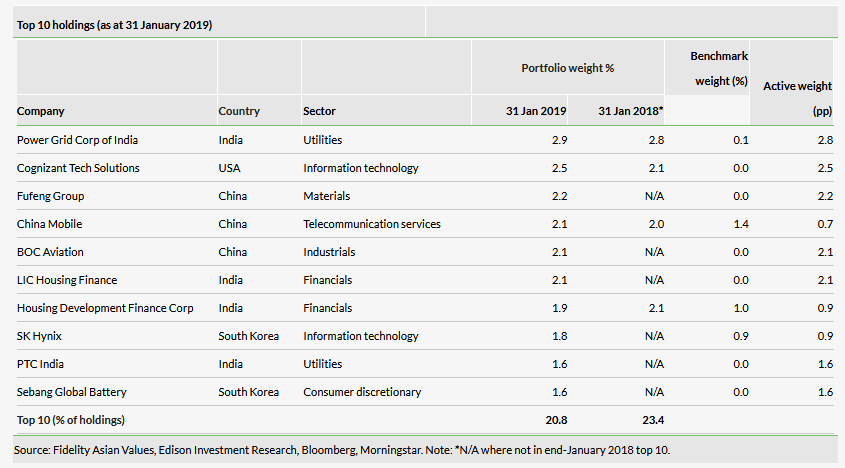

Current portfolio positioning

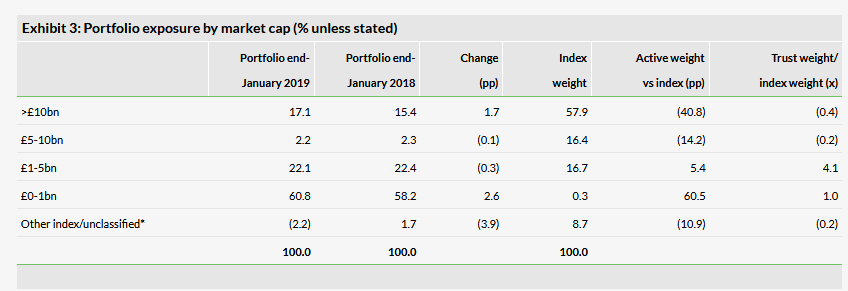

While we show the breakdown of the trust’s portfolio in Exhibits 3 to 5, the manager is keen to stress that all exposures are a result of bottom-up stock picking. As noted earlier, the aggregate P/E multiple of the portfolio is 9.2x, which is a 30% discount to the market and the lowest multiple since Bajaj became lead manager in April 2015. The aggregate return on equity for the fund is 15%, which is meaningfully higher than the market’s 11%. FAS currently has an active share close to 96% (a measure of how a fund differs from its benchmark, with 0% representing full index replication and 100% no commonality). The portfolio holds c 150 positions and turnover is typically 30–40% pa, but was somewhat higher in 2018 due to heightened levels of stock market volatility.

There have been modest changes in the structure of the fund in terms of market cap over the last year. FAS’s small-cap bias is evident, with c 80% of the portfolio invested in companies with a market cap below £5bn.

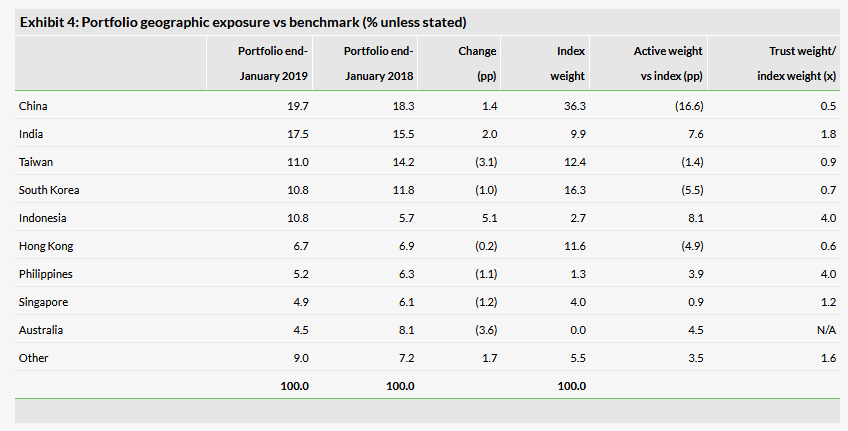

Over the last year from a geographical perspective, the largest changes are a higher weighting in Indonesia (+5.1pp) and lower weightings in Australia (-3.6pp) and Taiwan (-3.1pp). The trust retains a significant 16.6pp underweight versus the benchmark in China, with the largest overweight positions in Indonesia (+8.1pp) and India (+7.6pp).

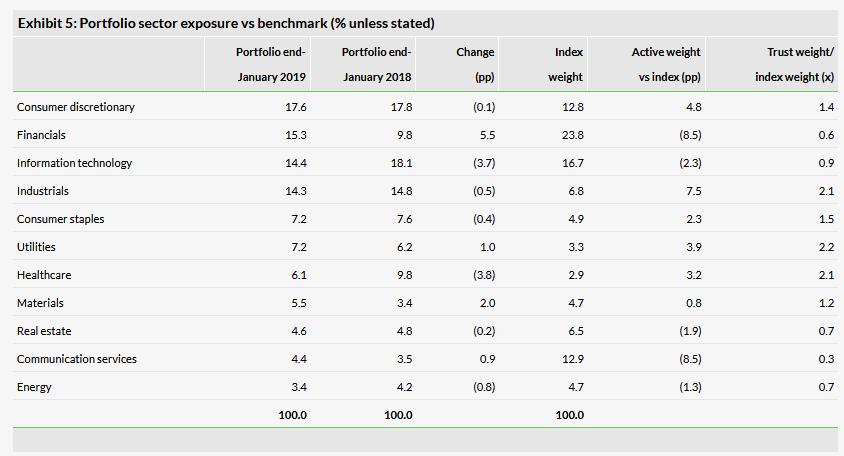

In terms of sectors, the largest changes over the last 12 months are a higher financials weighting (+5.5pp), with lower exposures in healthcare (-3.8pp) and information technology (-3.7pp). FAS is most overweight industrials (+7.5pp) and consumer discretionary (+4.8pp), with underweight exposures in communication services and financials (both -8.5pp).

The manager highlights some recent purchases:

Matahari Department Store – while Bajaj acknowledges that investors may question the long-term viability of the department store model due to the growth in online purchasing, he explains that Indonesia is an island economy and people continue to visit the stores. The stock is trading around an 8x forward P/E multiple and offers a c 8% dividend yield.

Nien Made Enterprise Company – a Taiwanese provider of window shutters and blinds, with a large US exposure. Bajaj explains that the company has a high-quality consumer brand and its business has a high barrier to entry. Nien Made’s share price declined due to a downturn in the US housing market and concerns about the US/China trade war, but has rallied significantly since mid-October 2018, so the manager has been taking profits.

Xingda International – a Hong Kong manufacturer of steel tyre cords. The manager says its products are an essential commodity, and the firm is one of the lowest-cost producers. He believes the company has a very wide moat, which provides a good margin of safety. It is currently trading on less than 10x mid-cycle earnings and has net cash on its balance sheet.

Performance: Solid absolute and relative returns

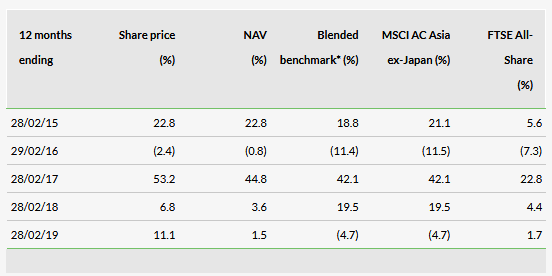

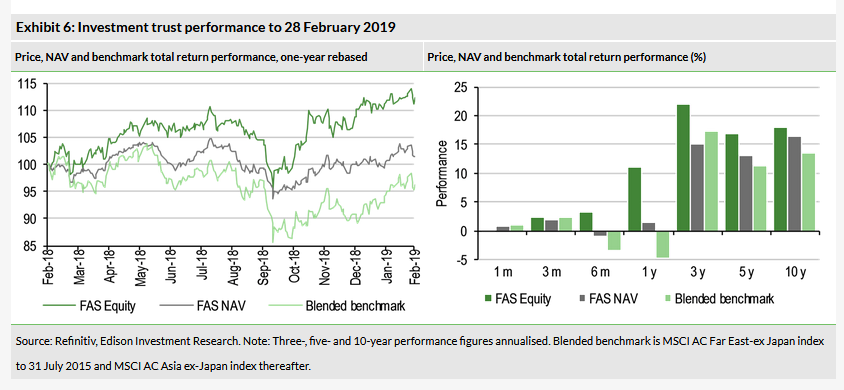

FAS has generated solid absolute total returns for investors (Exhibit 6, RHS); over the last three, five and 10 years it has delivered annual NAV returns in a range of 13.1% to 16.3%, and share price returns in a range of 16.9% to 22.1%.

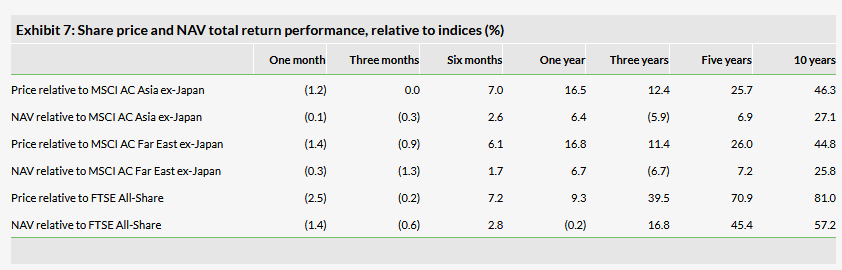

The trust’s relative total returns are shown in Exhibit 7. Its NAV has outperformed the local indices over one, five and particularly over 10 years, while lagging over three years; however, its share price has also outperformed over this period, closing the discount. The trust has continued to build on its considerable record of outperformance versus the FTSE All-Share index.

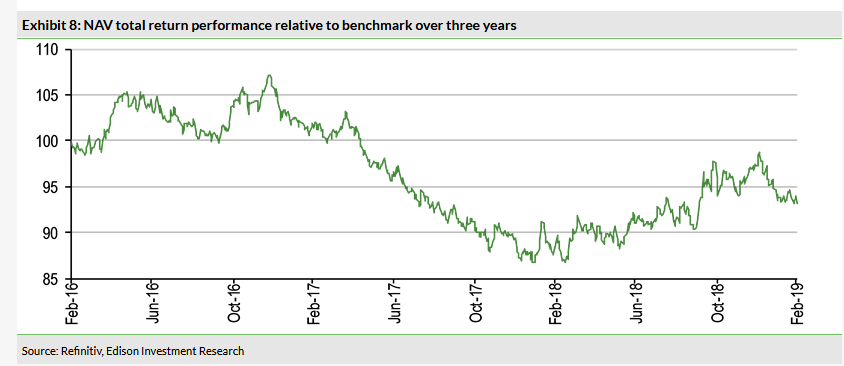

As would be expected, given its focus on protecting capital as well as long-term capital growth, FAS underperformed a very strong Asian stock market in 2017 (Exhibit 8), which was led by large-cap growth, rather than smaller-cap value stocks. However, the trust performed relatively better than the market during a more volatile period during 2018. One of the largest positive contributors last year was aircraft leasing company BOC Aviation, where the manager explains that he initiated a position before the company was appreciated by the wider market. It is trading on a single-digit P/E multiple and offers a 7% dividend yield. Other positive contributors included positions in India and Indonesia, which rallied in an environment of lower oil prices, along with defensive holdings that performed relatively well, such as China Mobile and Power Grid Corp of India. Negative contributors during 2018 included Australian day-care centre operator G8 Education, and technology company Redington India, which had performed well and the manager admits should have been sold; this would have avoided holding positions in the companies as their share prices subsequently fell. Bajaj explains that he was concerned about building up the trust’s cash balance to too high a level; he says that he has learned lessons from this mistake and will endeavour to lock in profits when appropriate.

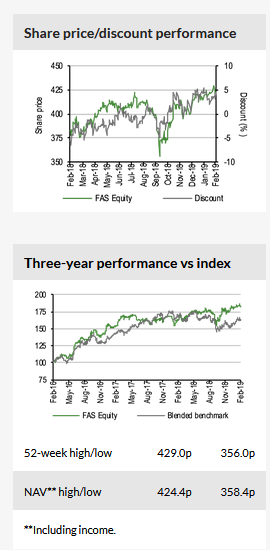

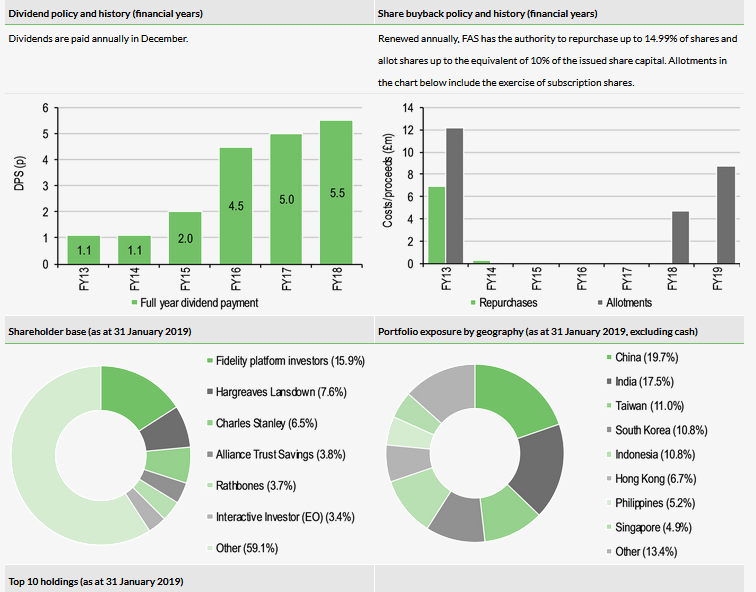

Discount: Now regularly trading at a premium

Looking at FAS’s share price discount/premium to NAV over the last three years (Exhibit 9), there has been a meaningful re-rating over this period. The current 4.4% premium to cum-income NAV compares with a range of a 5.3% premium to a 6.6% discount over the last 12 months. FAS has traded at average discounts of 0.2%, 5.3%, 7.6% and 8.5% over the last one, three, five and 10 years respectively. Approved annually, the board may repurchase up to 14.99% and allot up to 10% of shares in issue, in order to manage a discount or premium.

Capital structure and fees

FAS has 70.8m ordinary shares in issue. The trust had a one-for-five bonus issue of subscription shares on 2 December 2016, and there are currently 11.1m subscription shares outstanding. The remaining exercise period is in the 25 business days preceding the last business day in November 2019, at a price of 392.75p per share. Bajaj uses long CFDs to employ gearing, which is cheaper than using bank debt. At end-January 2019, gross gearing was 1.3% which, along with a 7.3% cash position, resulted in a net cash position of 6.0%.

The board adopted a new variable management fee on 1 August 2018, replacing the historical 0.90% of gross assets up to £200m, and 0.85% of gross assets above this level. There is now a base management fee of 0.70% of net assets, plus or minus a 20bp variation based on the trust’s relative performance versus the benchmark. Hence, the management fee will be in a range of 0.50% to 0.90% of NAV pa. In FY18 (ended 31 July), ongoing charges were 1.17%, which was a 5bp reduction compared with 1.22% in FY17.

FAS is subject to a five-yearly continuation vote, with the next due at the 2021 AGM.

Dividend policy and record

FAS pays a single distribution in December, out of revenue reserves. It does not pay dividends out of capital. Over the last five years, the annual dividend has grown at a compound rate of c 38% pa. In FY18, the trust’s revenue return was 5.70p per share, which was 6.3% lower than 6.08p in FY17, while the dividend was 5.50p per share, an increase of 10% versus 5.00p in FY17. Based on its current share price, FAS offers a 1.3% dividend yield.

Peer group comparison

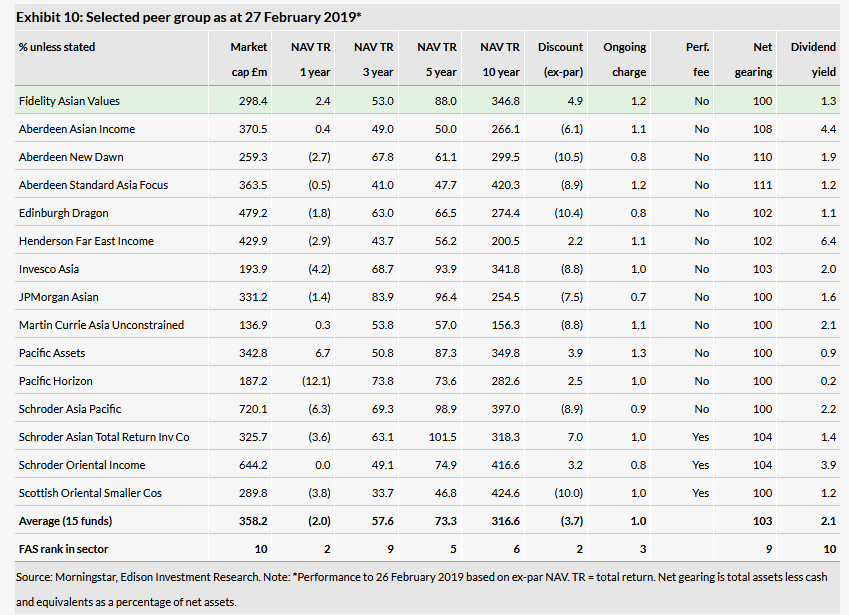

In Exhibit 10, we show the members of the AIC Asia Pacific – Excluding Japan sector with market caps above £100m. FAS’s NAV total return is above the peer group averages over one, five and 10 years, ranking second, fifth and sixth out of 15 funds respectively, while lagging over the last three years. The trust is one of six funds currently trading at a premium to NAV. FAS’s ongoing charge is higher than average, but has the potential to reduce following the introduction of the new management fee highlighted in the Capital structure and fees section; no separate performance fee is payable. The trust’s investment mandate is to generate capital growth rather than income so, unsurprisingly, its dividend yield is below average, ranking 10th out of 15 funds.

The board

There are five directors on FAS’s board, all of whom are non-executive and independent of the manager. The chairman is Kate Bolsover, who joined the board on 1 January 2010 and assumed her current role on 9 December 2014. Philip Smiley has been the trust’s senior independent director since 30 November 2015, having also joined the board on 1 January 2010. The other three directors and their dates of appointment are: Grahame Stott (24 September 2013), Michael Warren (29 September 2014), and Timothy Scholefield (30 September 2015). The board undertakes a biennial due diligence trip to the Asia Pacific region; the last visit was in January 2018 to Hong Kong, Shenzhen, Dongguan and Singapore. There was a broad range of meetings, including with economists to provide a macro perspective, and with Fidelity’s investment team, as well as accompanying the manager and his colleague to individual company meetings, witnessing at first hand the thorough, in-depth discussions with managements.