The last 20 years have seen a new asset category grow in popularity… farmland.

And it’s easy to see why, because farmland is profitable.

In fact, the National Council of Real Estate Investment Fiduciaries’ (NCREIF) Farmland Index had an average annual return of 12% over 20 years.

That beat the NCREIF’s Commercial Property Index and the S&P 500’s return of about 9%. It also topped investment-grade corporate bonds, which had returns in the 7% range.

Institutional Money Going Country

Not surprisingly, farmland’s outperformance has caught the attention of institutional investors.

In the past two years alone, institutional investment into U.S. farmland topped $2 billion, according to iiSearches, the data arm of Institutional Investor.

And the trend seems to be continuing. In August, TIAA-CREF announced that it raised $3 billion for its second global farmland investment partnership.

Institutions, however, still own less than 1% of the $2.4 trillion U.S. farmland market. And their share of farmland ownership is sure to rise in the years ahead.

It’s the perfect investment for institutions with long-range investment goals, such as pension funds. It’s a real asset, not correlated with stocks and bonds. And it pays steady income, as farmers pay rent on the land.

The average rent for U.S. farmland over the past 16 years rose about 5% annually. It was about $141 per acre in 2014, according to the U.S. Department of Agriculture.

Farmland REITs

Farmland is a real asset tied to a megatrend – rising global food demand. The middle class is expected to grow from 1.8 billion in 2010 to 3.2 billion in 2020 and 4.9 billion in 2030, with 85% of that growth coming from Asia.

This real asset pays a steady income, making it suitable for mom and pop investors, too. And the good news for those looking to invest in farmland is that there are now three farmland real estate investment trusts, or REITs. These are equity REITs that lease the land to farmers.

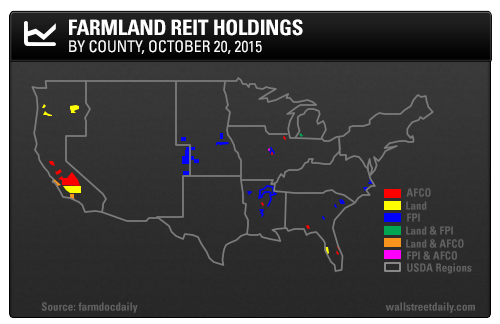

The three REITs, from the oldest to the most recent, are Gladstone Land Corp. (O:LAND), which IPOd in 2013, Farmland Partners Inc. (N:FPI), which IPOd in 2014, and American Farmland Co. (N:AFCO), which IPOd this year.

Farmland REIT Breakdown

Each REITs focuses on a different type of farmland:

Gladstone Land began with fruit, vegetable, and berry operations mainly in California and Florida. It has since expanded to other states.

Farmland Partners is focused on crops such as corn, wheat, soybeans, rice, and cotton in the central and southeastern United States.

American Farmland’s acreage is roughly a third grapes, nuts, and specialty crops, a third in crops similar to Farmland Partners’, and a third in farmland being developed to grow grapes, nuts, and citrus.

Thanks to University of Illinois professors Paul Peterson and Todd Kuethe, this graphic shows the geographic breakdown.

The Outlook

To date, none of these REITs have performed well – though, to be fair, American Farmland is new to the market.

Perhaps the companies were overpriced when they IPOd. They’ve also been hit by Wall Street concerns over commodities in general.

But in typical Wall Street fashion, investors are only looking at the short term.

One thing is certain in farming, and that’s Mother Nature’s tendency to be fickle. This year may be great for growing crops, leading to oversupply and weak prices. But next year may bring vastly different conditions, leading to soaring crop prices.

Investors should take the institutional perspective on these farmland REITs and hold them for the long term. The Wall Street Journal even quoted some institutional investors as saying that it’s like “gold with a coupon.”

Good investing,

by Tim Maverick