Royal Dutch Shell (LON:RDSa) plc RDS.A is set to announce second-quarter 2019 results on Aug 1, before the opening bell.

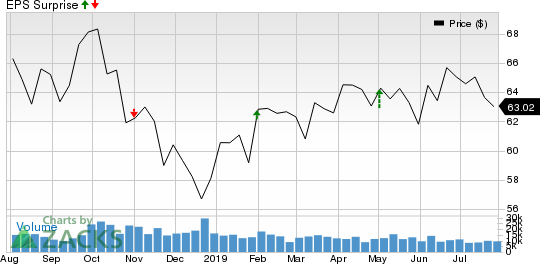

In the last reported quarter, the Hague-based supermajor came up with better-than-expected results on the back of stronger contribution from the Integrated Gas unit. Coming to earnings surprise history, the Anglo-Dutch energy company displays a mixed record, having surpassed earnings estimates in two of the last four quarters, with average positive surprise of 0.93%.

Investors are keeping their fingers crossed and hoping that the company can top earnings estimates this time around. However, our model indicates that Shell might not beat on earnings in the to-be-reported quarter.

Which Way are Top and Bottom-Line Estimates Trending?

The Zacks Consensus Estimate for second-quarter earnings per share (EPS) has been downwardly revised by a penny in the past 30 days to $1.22. Nonetheless, this compares favorably with the year-ago reported earnings of $1.12 cents per share. However, the Zacks Consensus Estimate for revenues is pegged at $91.6 billion, suggesting a decline from $99.3 billion reported in the prior-year quarter.

Earnings Whispers

Our proven model does not conclusively predict that Shell will beat the Zacks Consensus Estimate in the quarter to be reported. This is because it doesn’t have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is -0.96%. This is because the Zacks Consensus Estimate for earnings per share of $1.22 is pegged a penny higher than the Most Accurate Estimate.

Zacks Rank: Shell currently has a Zacks Rank #3, which increases the predictive power of ESP. But we also need to have a positive Earnings ESP to be confident of a positive surprise.

Note that we caution against stocks with a Zacks Ranks #4 or 5 (Sell rated) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Factors at Play

Shell expects second-quarter 2019 upstream volumes to increase in the range of 150,000-200,000 barrels of oil equivalent per day (BOE/D) on a year-over-year basis, mainly due to new field ramp-ups, boost in Permian output and lower maintenance activities. While higher output may buoy the company’s upstream results, we remain concerned of oil and gas prices that declined y/y amid rising fuel inventories, slowdown of global economy and trade tensions.

It is seeing mixed signals from the Refining and Marketing segment. Year-over-year widening of crack spreads and higher refining availability in the to-be-reported quarter are likely to fuel the segment’s results. However, oil products sales volume is expected to decline in the band of 40,000-70,000 BOE/D, which may dent the segment’s earnings.

Further, production from its Integrated Gas segment will likely decrease around 10,000-50,000 BOE/D, mainly attributable to asset sales. This may limit the company’s profits.

Overall, while higher upstream volumes and widening crack spreads bode well for the upcoming results, soft y/y commodity prices, weaker contribution from the Gas segment and lower oil products sales volume may play spoilsports.

Stocks to Consider

While earnings beat looks uncertain for Shell, here are some firms from the energy space that you may want to consider on the basis of our model, which shows that these have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Marathon Oil Corporation (NYSE:MRO) has an Earnings ESP of +0.48% and is a #3 Ranked player. The company is anticipated to release second-quarter 2019 earnings on Aug 7. You can see the complete list of today’s Zacks #1 Rank stocks here.

NuStar Energy L.P. (NYSE:NS) is set to report second-quarter 2019 earnings on Aug 8. The stock has an Earnings ESP of +14.58% and a Zacks Rank #3.

Cheniere Energy, Inc. (NYSE:LNG) is set to report second-quarter 2019 earnings on Aug 8. The stock has an Earnings ESP of +88.46% and a Zacks Rank #2 (Buy).

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft (NASDAQ:MSFT) stock in the early days of personal computers… or Motorola (NYSE:MSI) after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

NuStar Energy L.P. (NS): Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Cheniere Energy, Inc. (LNG): Free Stock Analysis Report

Marathon Oil Corporation (MRO): Free Stock Analysis Report

Original post

Zacks Investment Research